Tether’s Sparks IPO – Will Usdt be the public?

Tether Paolo Ardoino CEO has rejected talks on Stablecoin Spect. His position comes despite the company’s evaluation.

These discussions come after Circle, launched Tether’s Market Peer and its opponent, the public subscription (first public offering) and went directly on the New York Stock Exchange.

Paolo Ardoino cancels subscription conversations

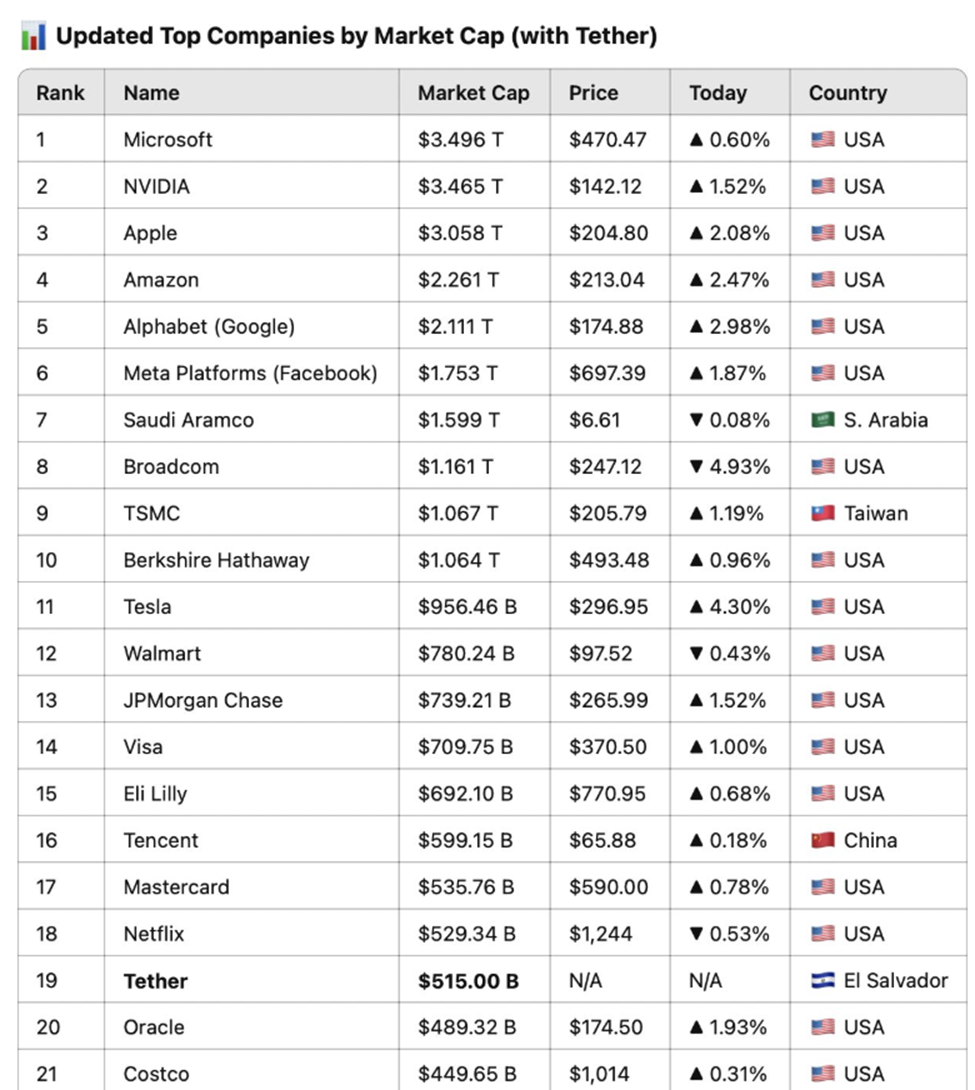

The market analysis is estimated at the Stablecoin giant at $ 515 billion. According to John, who is creating on Artemis, this is sufficient to make Tether the most valuable companies in the world. Specifically, he will put a rope on heavy weights like Costco and Coca-Cola.

“If Tether is announced today, Tether will be the world’s largest company in the world for $ 515 billion. This is progressing on Costco and Coca Cola,” books M.

John Maqda was extracted on the net net profit of $ 13 billion in 2024, when Ebitda amounted to $ 7.4 billion for 2025, the company can have a value of $ 515 billion if it is public.

“The rope assessment of $ 515 billion is a beautiful number. There may be a little bit for Bitco + Bitcoin + Gold Treasury, but I am also very excited about the next stage of our company’s growth,” Ardoino books.

Despite the bullish projection, Ardoino explained that Tether has no intention for the public. In a follow -up post, he briefly stated, “There is no need for the public.” This indicates confidence in the private structure and the current path of the company.

For the first time in the Wall Street circle highlights the stablecoin assessments

The conversation gained traction after Circle, and the nearest Tether competitor in the Stablecoin sector, was officially announced in the historical public subscription.

Trading under $ CRCL, Circle offers 34 million shares at $ 31, each of which is $ 8.1 billion. This is the first time that Stablecoin source on the New York Stock Exchange (New York Stock Exchange).

The MA model applies the noble Circle 69.3x Ebitda to the expected profits in Tether 2025, which assumes a continuous increase in USDT supplies and a stable FED rate of about 4.2 %.

His publication explained that the model excluded unrealized gains from Bitcoin and Gold, which represents about $ 5 billion of Tether 2024 profits.

Some commentators, such as Anthony Boxbrano, pushed the evaluation envelope so further. “1 trillion dollars in the end,” is Propagate. Jacques Malars from the capital Repeat Feelings with a more optimistic estimate “trillion dollars”.

However, along with the noise, doubts are waving on the horizon. One user Indicate This go to the audience will open the rope for more scrutiny and scrutiny.

Against the background of this background, users remain skeptical that Tether can be announced, indicating the continuous transparency fears that have been stolen for years.

Erdino’s position enhances this view. Although it is likely to be more than many S&P 500 giants, Tether seems to be satisfied with continuing to expand in particular without the additional organizational glow in Wall Street.

The primary product for Tether, USDT Stablecoin, is still the most traded coding assets by size. Nevertheless, the company also diversified its public budget significantly.

Modern certification reports indicate that Tether carries billions in treasury, gold and bitcoin bonds, which are increasingly supported by its financial strength and credibility.

Since Stablecoin space enters a new stage of institutional audit and exposure to the public market, Tether seems to be committed to growth on its terms.

Will this strategy maintain it on public competitors such as Circle? Erdino is betting that special survival is strength, not a setback.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.