Tesla slices, Robinhood declines, ingredient power and Place Buck Trend

Futures in the United States flashed in red before the bell, led by Tesla, which decreased by approximately 14 % last Thursday, eradicating more than $ 150 billion in the market value after a hot year conflicts between Elon Musk and President Trump.

Since Tesla tests the main support levels this morning, the other names listed on the Nasdaq Stock Exchange, Robinhood, the delivery power, and the place of children, are noticeable movements in the pre -market trade. Here’s the full, complete, as it combines technical levels and market stimuli.

Tesla (TSLA): 3 % decrease before the market, as Trump attacks were wiped $ 150 billion from the market roof

Tesla shares are again pressure, as it decreased by approximately 3 % before the bell and traded by about 287 dollars. This comes after historic sale of $ 150 billion, which witnessed the stock in the worst loss for one day in more than a year. The slide came after Donald Trump, who was carrying firmly to return to the White House, came as a direct goal to Elon Musk, accusing him of “drafting taxpayers” through EV benefits.

Persian rhetoric Wall Street. With Trump’s leadership in many major opinion polls, the markets suddenly restore the safety of the government -backed business model. PRICE has now cut multiple main support levels, and with the next main floor at $ 271, the bulls have their appearance against the wall. The momentum indicators show a clear exhaustion, and what Musk does not pass as a control gathering, this trend may get worse before it improves.

RobinHood (Cover Cover): 5 % banks after they were included from S&P 500

Robinhood is acutely traded in the early session, a decrease of about 5 % to hovering near 71 dollars. This decrease comes after leaving the famous trading application from the last S&P 500 budget, and scary speculators who were placed in a sudden insert.

Miss not only delays the potential negative flows of index boxes, but also rejuvenates doubts about the quality of the company’s profits and the profitability path. Technical traders look forward to $ 66.85 as a level of making or breaking. If this fails to keep, another correction cannot be excluded towards $ 60. The sound level has already been raised on pre -market orders, indicating that the reaction may accelerate as soon as the bell rings.

Plug Power: Apartment at $ 0.97 while investors are waiting for clarity

PLug Power shares remain silent before open, and a apartment trades at $ 0.97. The stock was stuck in the scope of tight monotheism for weeks, unable to maintain the upward trend despite attention at the level of the sector with clean energy and storage of hydrogen.

Investors seem to wait for a new round of updates, perhaps around new fuel cell contracts or production features. Currently, technical expectations are neutral. RSI is a file near 50 and a flat MACD, indicating the frequency. If the bulls want to restore momentum, they will need punching by resisting $ 1.03 with a strong size. Otherwise, the re -test of the demand area may be $ 0.92 after that.

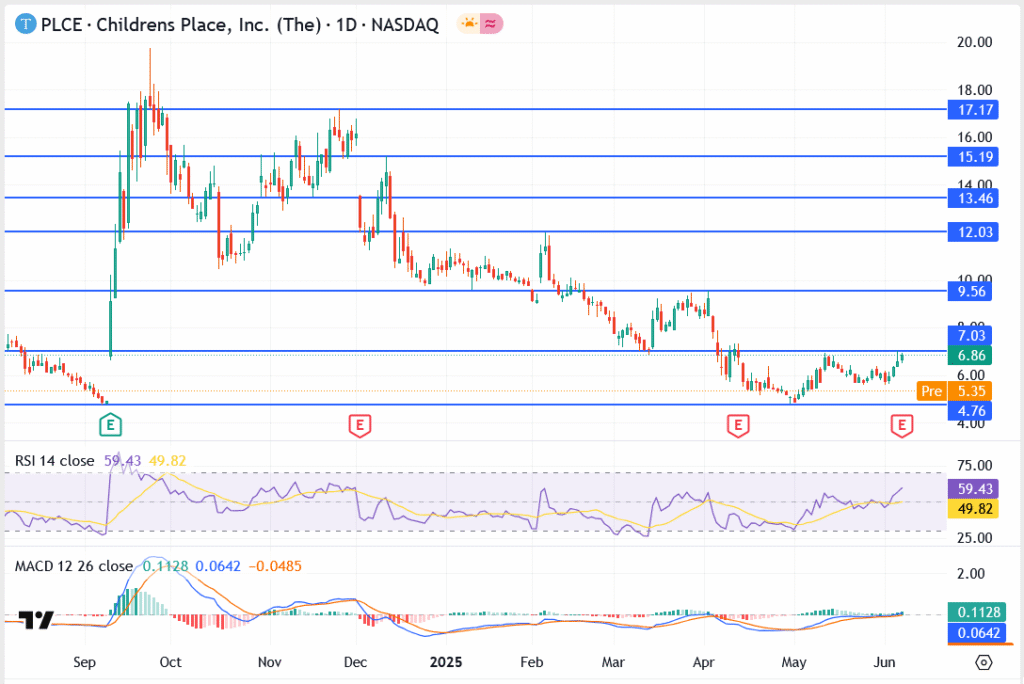

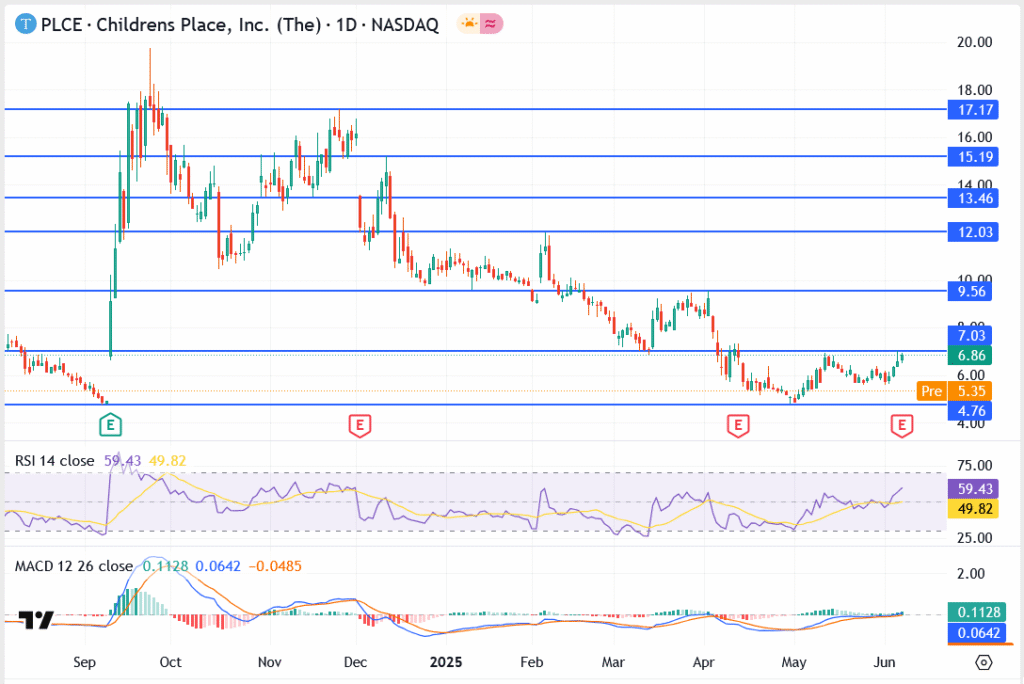

Place of children (PLCE): 6 % after the collapse 22 % on Friday

The retail place witnesses a sharp recovery this morning, an increase of more than 6 % in early trade near $ 6.86. This comes after the arrow collapsed by 22 % on Friday, which led to the stopping of losses and wave after selling the wave of panic in the aftermath of Miss, the first quarter of the quarter.

The reversion appears to be defined in short. While the basics remain shaky, some merchants are looking to play a technical recovery of about $ 9.50, which is the last large axis before collapse. The preparation is fragile though. If the purchase of drought is in the middle of the session, the gathering may fade at the speed that appeared in it.

Blogs are over.