Strong technology and institutional confidence that pays the upcoming expectations

on May 22ndBitcoin arrived New at allClosing in 111,390 dollars After touching a peak during the day for a short period 112,000 dollars. Despite this landmark, the market behavior indicates that this may not be the highest of the exhausted top – capitalism is still flowing at unprecedented levels.

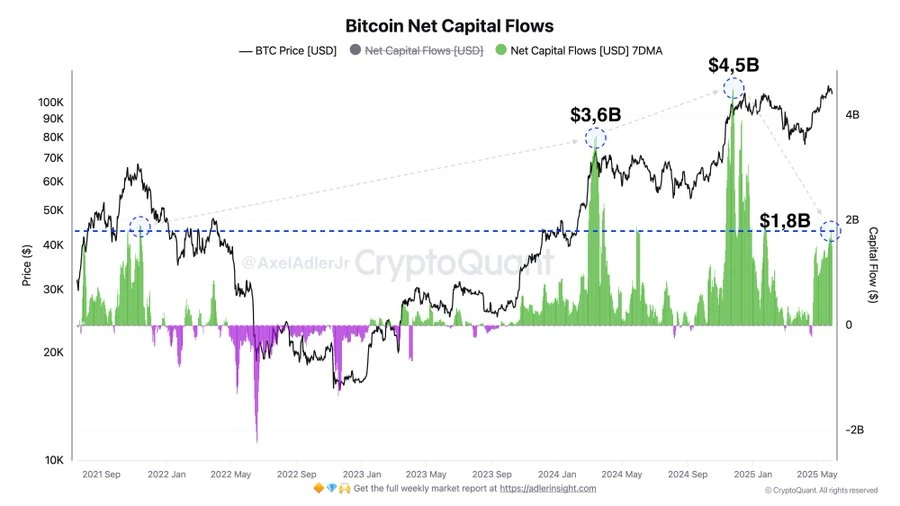

The investor’s confidence is still not vacant: 1.8 billion dollars matching the daily flow of 2021 peaks

According to the analyst on the series Axel Adler JuniorBitcoin is now on average around it $ 1.8 billion in daily net flowsSimilar to the peaks that were last seen in November 2021 The bull market, when BTC reached $ 64,000. Adler, known for his joint data -based vision on platforms such as X (Twitter), confirms that this volume of flow is a strong indicator Continuous investor confidenceEven after setting new levels at all.

Axel Adler Junior on X

“Daily net flows are still historically high – until peak levels 2021 exceeded the current price points.”

The strongest capital flows at high price points – not the decline

It is worth noting that Adler’s data reveals that the capital has risen strongly during the price mutations – not the declines. in $ 73,000Bitcoin saw 3.6 billion dollars In daily flows, while the number jumped to 4.5 billion dollars On a day when BTC was present 92000 dollars.

This is a major transformation from the behavior of the past market where the purchase is usually intensified during the decline. The current session shows an increasing comfort among investors to buy at higher levels, and may reflect Institutional condemnation Instead of short -term speculation.

Market structure: The outbreak of Consolidatio

At the beginning of May, bitcoin hovers around it 94,181 dollarsSide trading in a narrow band. sharp 6.42 % increase in May 8 Breaking this style, with the launch of a new stage of momentum ascending.

from From May 18 to May 22Bitcoin rose 8.3 %Reaching the highest new level. However, follow a short retreat: Since then May 23BTC almost decreased 5.8 %Now trading in 105171.54 dollars. The decline indicates a period of Healthy unification Instead of selling panic, especially given the broader stability of the macroeconomic economy and the continued attention of ETF encryption.

Technical indicators show continuous strength

- RSI (Relative Power Index): Currently in 53.58This indicates the neutral momentum. It has been held between 50 and 70 since late May, indicating monotheism without immediate circumstances at its peak.

- Golden Cross: on May 22ndthe 50 days m I crossed above 200 days– A bullish sign. Moving averages now stand in 97,776.48 dollars and 94,668.91 dollars In a row, with the widening gap, confirming the momentum of the strong direction.

- ADX (average trend index): in 25.88It indicates the strength of the continuous direction. Since late April, ADX has remained above 25, which has increased the current upward upward momentum.

Look forward: beyond ATH

while 5 % weekly decrease It may seem worrying in isolation, revealing the magnification S -profit 30 days by 11.1 %. The volume of capital flows, even at high price levels, emphasizes the transformation of psychology in the market. It seems that the long -term investors are increasingly comfortable in entering the market with higher assessments, and they may see Bitcoin as a Total identification Instead of volatile assets.

Final meals

The highest new level ever in Bitcoin is noticeable-but what matters most is Context Behind him. The historical levels of capital flow, strong technical signals and mature investor base indicate DevelopmentAnd not high temperature.

In the words of the analyst Axel Adler JuniorThis may beThe most structural vocal cycle so far“

Do not miss any rhythm in the world of encryption!

Stay in the foreground with urgent news, expert analysis, actual time updates about the latest trends in Bitcoin, Altcoins, Defi, NFTS and more.

Common questions

According to the prediction of the BTC price in Coinpedia, the price of bitcoin can reach $ 168,000 this year if the upward morale continues.

With the adoption increased, the bitcoin price can reach a height of 901383.47 dollars in 2030.

According to the last BTC price analysis, the bitcoin price can reach the maximum price of 13,532,059.98 dollars

By 2050, the price of one BTC may rise to 377,949,106.84 dollars