Stablecoin Pressce on 2025 January to June

Stablecoins has strengthened its role in the digital financing revolution as one of the stable forces in the encryption market. It is linked to stable reserves such as Fiat currencies, for example, the US dollar, which helps reduce price fluctuations.

Welcome to the Coinpedia’s H1 2025 report. This analysis contains a comprehensive examination of the Stablecoin sector of original sources.

This report displays the necessary information to the market participants and its lovers to make informed decisions and set opportunities.

Continue reading to learn more.

Cap Market Stablecoin ATH: The prediction rises to $ 2 trillion

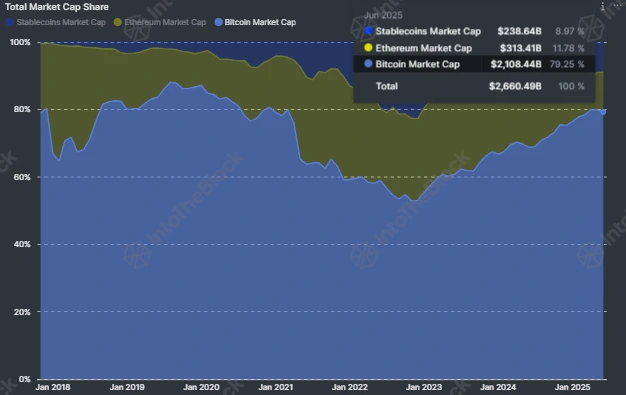

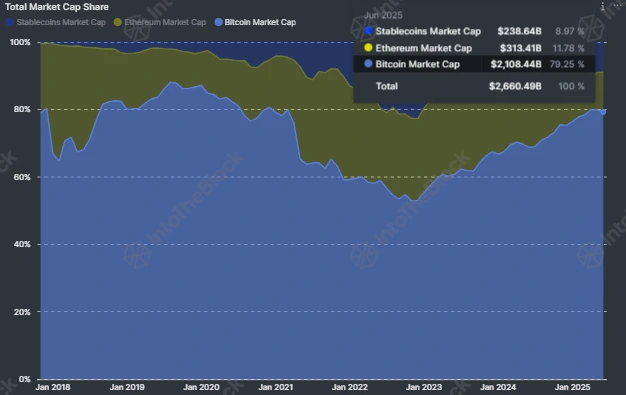

The first half of 2025 represents a historical moment, with the total Stablecoin market roof reaches the highest level ever From 251.55 billion dollars, an increase of $ 204 billion on January 2. This growth pushed Stablecoins share of the total maximum Crypto market from 7.9 % to 8.9 %, reflecting the increase in investor confidence and use.

Despite the maximum ATH market, optimism did not calm down one bit; In fact, it has turned significantly with US Treasury Secretary Scott Besent’s expectations of stirring $ 2 trillion by the end of 2028.

Under the most advanced prediction, Citigroup analysts also estimated that the maximum market may reach $ 3.7 trillion by 2030. This indicates high expectations for growth and shows the extent of the opportunism of this sector, supported by an analysis of major financial institutions.

The formation of the market and hegemony

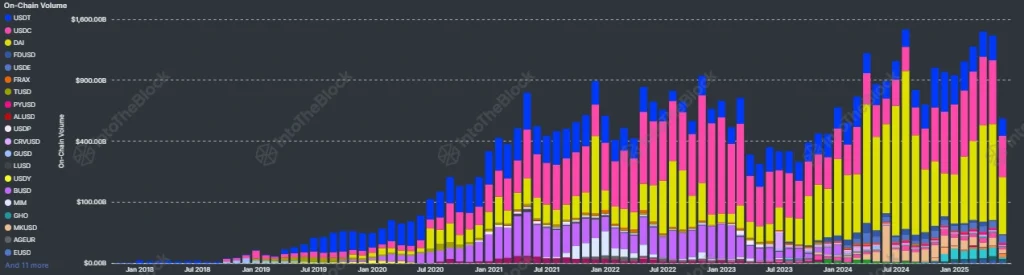

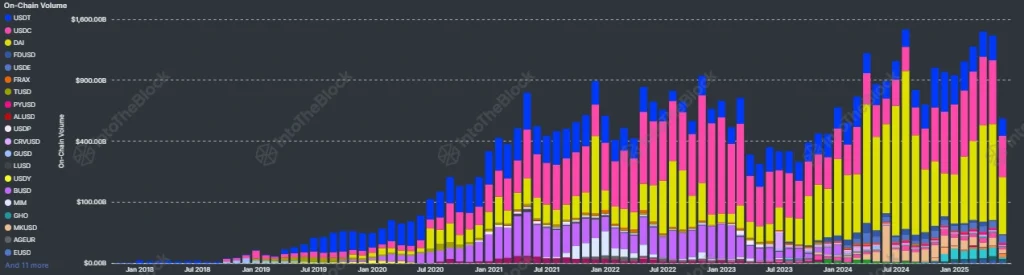

according to DeviliaThere is now 264 stablecoinsFrom it 162 Get the ceiling of the market above Million dollars. Tether (USDT) continues to control the market, with USDC as a strong second.

| Stablecoin | December 2024 Cover ($ B) | June 2025 Cover ($ B) | December 2024 hegemony ( %) | June 2025 Hegemony ( %) |

| USDT | 138 | 154 | 71.06 | 65.64 |

| USDC | 41 | 61 | 21.52 | 26.02 |

| USDE | 5.5 | 5.78 | 2.87 | 2.46 |

| Dai | 3.4 | 3.65 | 1.77 | 1.55 |

| Fdusd | 1.9 | 1.57 | 0.99 | 0.67 |

| Frax | 0.64 | 0.31 | 0.33 | 0.13 |

| Tusd | 0.497 | 0.494 | 0.26 | 0.21 |

| pyusd | 0.51 | 0.975 | 0.26 | 0.42 |

| rlusd | 0.03 | 0.366 | 0.02 | 0.16 |

It is worth noting that the USDT dominance has decreased slightly, while the USDC share has grown steadily. Pyusd and RLUSD showed a positive movement, indicating the increasing interest of the investor in the latest stables.

Exchanging activity and signals on the series

Exchange flows He remained high Throughout the first half of 2025, clear flows were consistent, indicating a strong demand. The size of the series also increased sharply, from 982 billion dollars to 1.394 trillion dollars By May. In addition, the stablecoin wallet addresses have witnessed a sharp rise, indicating a fixed flow of users.

Blockchain preferences by stablecoin

Looking at the series’s dominance reveals strong preferences between the leading stablecoins:

| Stablecoin | The upper chain ( %) | break (%) |

| USDT | See (50.11 %) | Ethereum (40.44 %) |

| USDC | Ethereum (61.58 %) | Solana (13.29 %) |

| USDE | Ethereum (96.92 %) | I am free |

| Dai | Ethereum (87.62 %) | I am free |

| Fdusd | Ethereum (80.38 %) | Solana (8.28 %) |

| rlusd | Ethereum (83.76 %) | XRPL (16.24 %) |

| Frax | Ethereum (48.77 %) | Fraxtal (32.85 %) |

Ethereum is clearly the central axis of Stablecoins, where TON and Solana gains a remarkable activity.

Adoption of institutions and companies

Meanwhile, the organizational environment has become an incentive. The genius law, UP to vote in the Senate on June 17, can reshape the Stablecoin scene. It requires Stablecoins its support in US dollars or very liquid assets and imposes annual audits of those over the age of $ 50 billion in market value.

President Trump’s voice support for the draft law is expected to enhance the strength of the dollar in digital financing. It is clear that the Trump administration is organized based on a long -term strategy planned in advance, to maintain the sovereignty of the dollar amid geopolitical challenges.

Likewise, this draft law would clearly change Stablecoin, as Stablecoins will not be an exclusive luxury that is limited to financial technology companies such as Circle and Tether. But Santander and Société générale I entered, raised the noise with a new generation of stablecoins issued by the bank.

At the same time, traditional institutions joined the race. Bank Of America tracks its Stablecoin project quickly, waiting for the organizational green light.

On the corporate front, Circle, the company that stands behind USDC Stablecoin, enjoyed the growing Stablecoin market with its latest step in H1 2025 as it was published. Her shares jumped by 235 % on the first day, which clearly indicates strong adoption.

Moreover, companies like Amazon, Walmart and Expedia are said to explore Blockchains and the encryption sector to launch their Stablecoins, and perhaps to reduce cards processing fees and simplify payments.

You see the new arrivals

Regardless of the ETHEREUM giant, Tron is still the main Blockchain for Stablecoins. In a major teacher, Justin Sun recently confirmed this World Liberty Financial Inc. (WLFI) It was promoted on Stablecoin Stablecoin USD1 on Tron. These releases emphasize the increasing shift towards the original financial tools in Blockchain.

Moreover, exporters like Tether also sees financial bonuses. newly, Tether recorded more than a billion dollars in Q1 2025 profitsLargely, the US Treasury revenue is linked to the reservation of assets.

Note the end: Stablecoin reigns

The first half of 2025 showed a new stage of the development of Stablecoin. One of the increasing folders and dominance transformations to broader institutional use and legislative support. Now, Stablecoins is clear on the way to become essential elements of the global financial system.

As the year continues, the results of the law of genius and more moves can be determined for the following jumping companies for the digital dollar.

Moreover, in building a dominance perspective, Tether (USDT) and Circle (USDC) communicate control of the market, where ETHEREUM remains the main axis of Major Stablecoins, while Tron and Solana are also increasing with the launch of Stablecoin.

Do not miss any rhythm in the world of encryption!

Stay in the foreground with urgent news, expert analysis, actual time updates about the latest trends in Bitcoin, Altcoins, Defi, NFTS and more.

Common questions

The total maximum of the Stablecoin market reached its highest level of $ 251.55 billion in H1 2025, an increase of $ 204 billion on January 2, increasing its share of the total encryption market to 8.9 %.

The genius law, in favor of the Senate vote on June 17, requires that Stablecoins be supported by US dollars or very liquid assets and annual mandate for those worth more than $ 50 billion, with the aim of organizational clarity.

Yes, traditional institutions such as Santander and Société Générale are released by the bank supported by the bank, and the Bank of America quickly tracks its project, indicating the adoption of the increasing institutions.