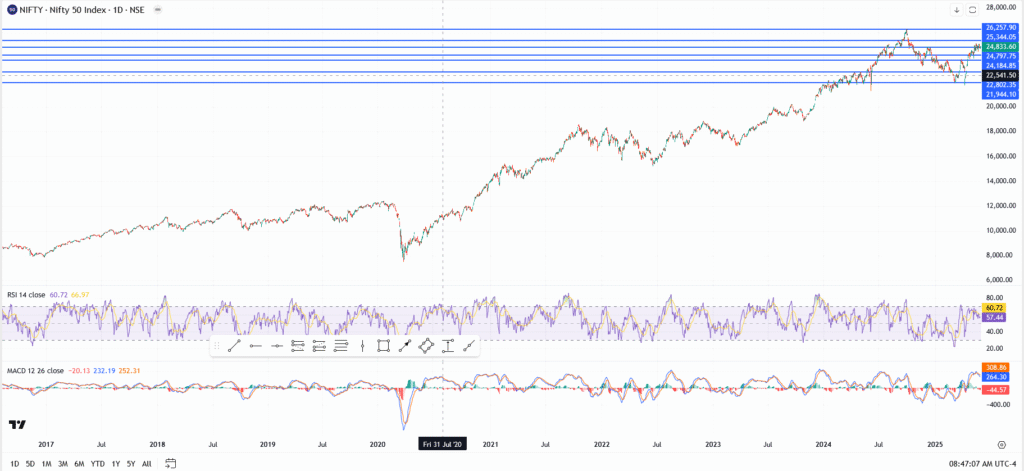

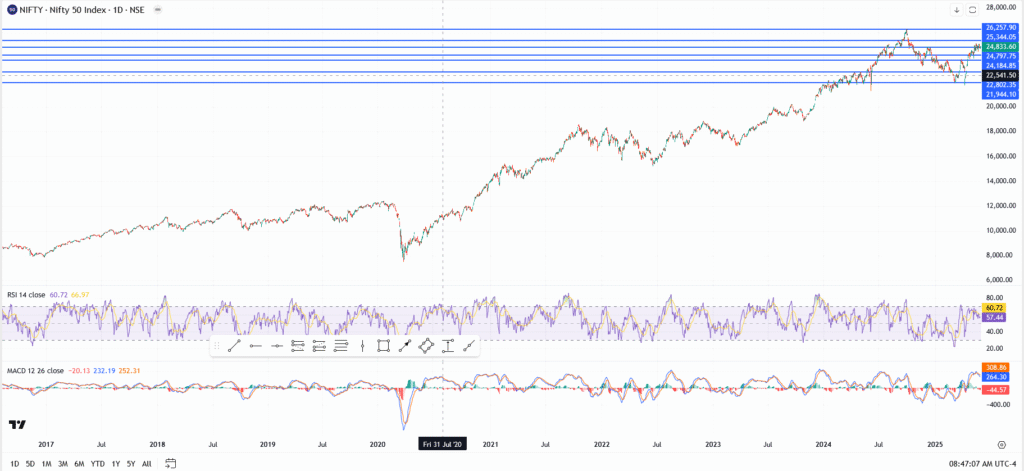

NIFTY 50 ends after a two -day decrease, but the bulls are struggling to break 25,000

The NIFTY 50 index bounced on Wednesday, closed two days after the sale. But despite the broader market superiority, the measurement index still strikes resistance, and the level of 25,000 began to feel like a wall.

The index ended just less than 24,900, and spread a moderate recovery led by banking and cars. Midcaps and small Caps also witnessed renewable strength, indicating inherent optimism. But the big big momentum is still intermittent, and without driving from the heavyweight sectors like it, the gathering feels incomplete.

NIFTY 50 Technical Expectations: The resistance still presses 25344

The elegant is discovered in the range. Bulls has restored in the short term in 24,797, but they have not yet exceeded 25344, a resistance level that a company has held through multiple tests.

- The immediate resistance is 25344, followed by 26257 if it is broken

- The main support areas sit at 24,797, 24384 and 24,144

- RSI in 60.72, the upcoming control appears, but lost the slope up

- MACD is still positive, although the graph has been settled, signs of cooling momentum

There is no reflection here, but there is no outbreak either. NIFTy in the phase of waiting and vision, and wrap directly below the main psychological level.

NIFTY 50 expectations: Bulls need a higher broken stimulus

The short -term expectations are still side to classify, but fuel is needed. With the updates of Indian elections on the horizon and changing the appetite of global risks, the next step may depend on macro data or a surprise in the profits of heavy index.

See too

If NIFTY 25,344 is scanned with size, expecting about 26000 to 26,250. Until then, it seems likely to be the work related to communication between 24,400 and 25300.

Merchants should stay smart. The structure still prefers buyers, but the momentum relieves, and failure in a higher fracture can call for the call to achieve rapid profits before the total calendar next week.