Solana’s death raises 28 % collapse. Recovery is difficult

Solana faced a sharp decrease, as it decreased to the lowest level in a few vulnerabilities in the market wider. The continuous trend of altcoin, which is aggravated by modern technical indicators, made the recovery uncertain.

The procedure in the future prices of Solana depends largely on the performance of Bitcoin, as a potential BTC recovery can support Sol’s transformation.

Solana investors need to pay

The net profit/unrealized loss in Solana has entered the long term (LTH NUPL) to the fear area, indicating an increase in the market distress. This indicator currently sits at its lowest level in 16 months, and reflects the impact of the broader market shrinkage on Sol investors. Since long -term holders suffer from increased losses, the possibility of increasing the large sale pressure, which is a risk of more declines.

Feelings between these investors can extend to retail traders if fear escalates. Collective sales can lead to hypotension, which makes it difficult to recover. Unless Bitcoin stabilizes and improves market conditions, the investor’s confidence in Solana will remain weak in the short term.

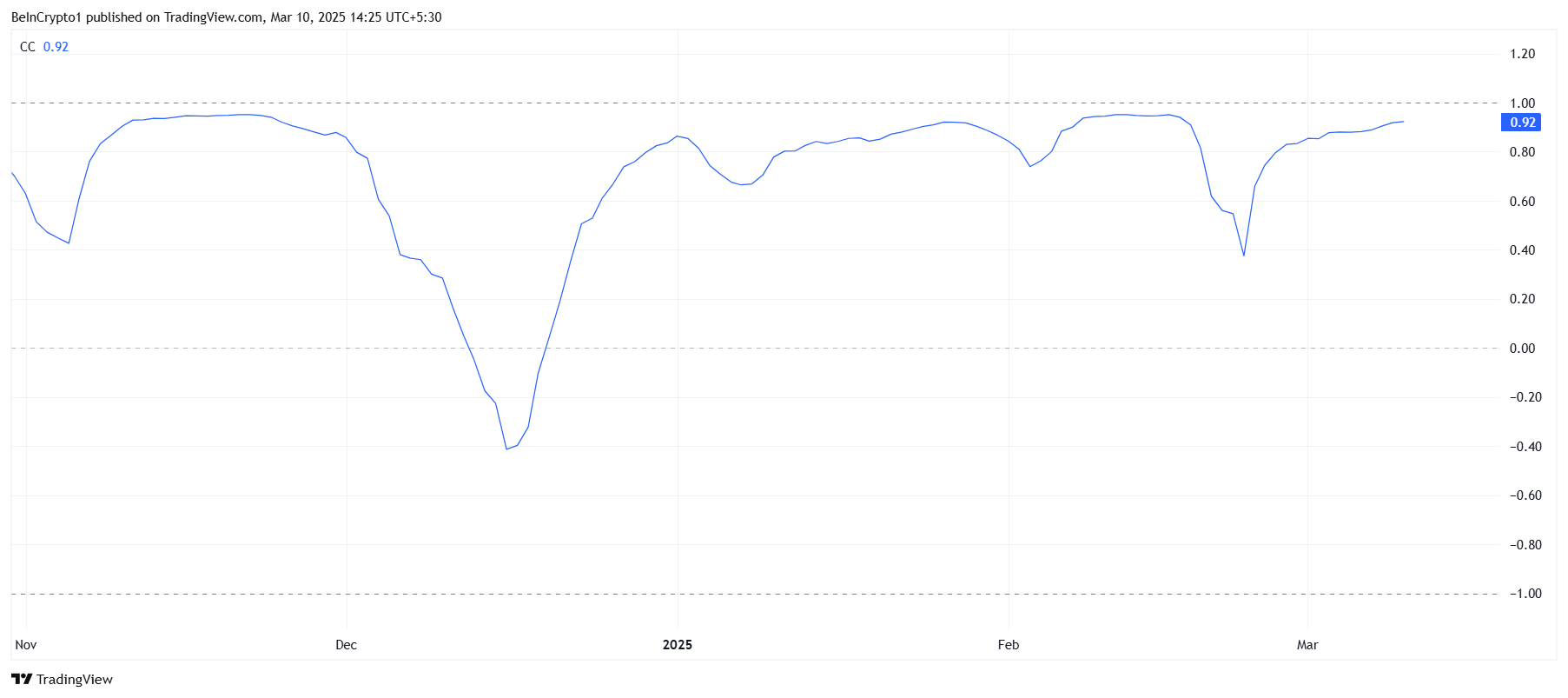

Solana maintains a strong association with Bitcoin, currently at 0.92. While high association usually indicates an upward alignment, it is in the case of Sol, it is a declining indication. Bitcoin is struggling to get more than $ 80,000, which means that any weakness in BTC can withdraw Solana as well.

If Bitcoin fails to restore momentum, the Solana price may face additional losses. Altcoin’s dependence on BTC stability adds to its weakness. Until Bitcoin recovers the main support levels, the Sol’s Macro momentum is likely to fall down, which prolongs its declining direction.

Sol Price takes a blow

Solana’s price has decreased by 28 % over the past 24 hours, as it was traded at $ 128. The decline stems from the public market landing and the formation of Death Cross on the Sol scheme last week. This technical style indicates the continuation of the negative side unless the strong purchase pressure appears.

Currently, Sol holds more than $ 120, in an attempt to settle. However, if the wider market conditions are not improved, Altcoin risk dividing the main support at $ 128. Failure to maintain this level may speed up losses, which leads to deeper corrections.

On the other hand, if investors benefit from low price and accumulation, Sol can restore $ 137 as support. The successful collapse behind this level would open the door to a possible gathering of about 155 dollars, which effectively nullifying the homogeneous expectations. The feelings of the market and the Bitcoin track are still very important to restore Solana.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.