Solana (Sol) to $ 77 or what? The bulls and bears are confronting

Solana, the sixth largest encrypted currency in the world, by maximum the market, is gaining great attention from Binance merchants. Recently, data from the Analysis Company on the series Coinglass It revealed that 79 % of the major traders in Binance are walking long on Seoul, despite the morale of the declining market.

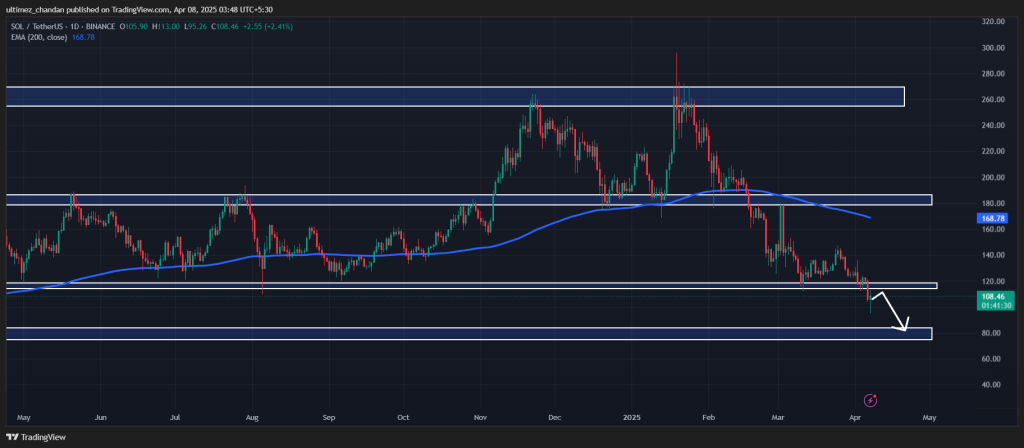

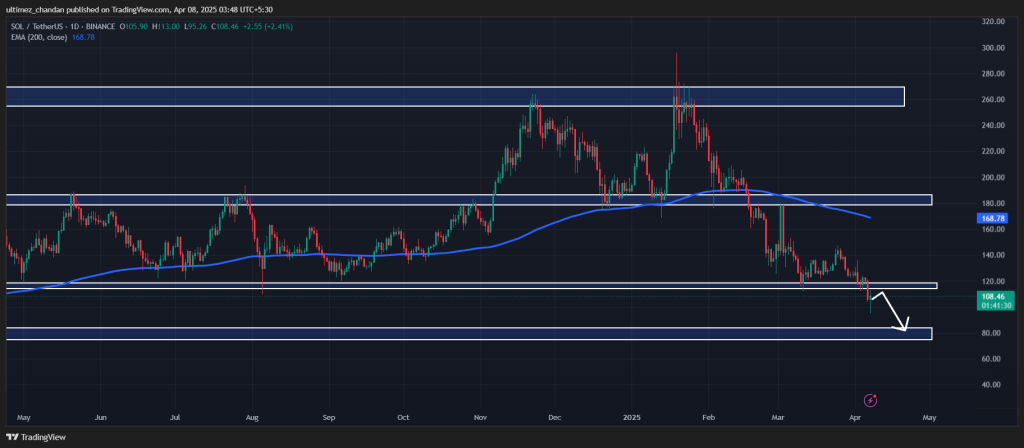

Solana (SOL) has made prices and upcoming levels

According to expert technical analysis, Sol looks down despite continuous price recovery. On April 6, 2025, Sol collapsed from the lengthy major support level of $ 115 and also closed a daily candle than this level, which is its contract since March 2024.

This collapse pushed Seoul to a very declining stage. However, the continuous price recovery appears to be a test of the collapse level.

Based on the last basic procedure and historical momentum, if Sol remains less than a level of $ 115, there is a strong possibility that can decrease by 30 % and up to the level of $ 77 in the near future.

This landfill is strongly supported by momentum indicators such as the RSI Index (RSI) and the 200 -day SIA moving average (EMA) on the daily time frame.

Current price momentum

As of writing this report, Sol was trading near $ 107 and recorded a decrease in prices by more than 1 % over the past 24 hours. Meanwhile, the original showed a strong recovery, as a decrease of $ 95.6 during the Asian market session. In the midst of these important fluctuations in prices and market fluctuations, the trading volume in Sol increased by 185 % during the same period.

$ 140 million of the external flow

While examining the scales on the chain, whales, investors and their long -term holders seem to have the opportunity to assemble Sol at the current price level, according to the Coinglass Series.

The immediate flow/external flow data reveals that the exchanges have witnessed an external flow of about $ 140 million from Sol over the past 24 hours. This large external flow indicates a potential accumulation and can lead to pressure.

However, due to the prevailing landmarks, it may be difficult to achieve a strong bullish gathering.