Solana (Sol) jumps 24 % per week – $ 200 before progress?

Solana (SOL) has increased by 17 % in the past seven days and shows a strong technical momentum across multiple indicators. The Ichimoku Cloud scheme is still firmly superior, as the price of the price is made over the cloud and the main support lines.

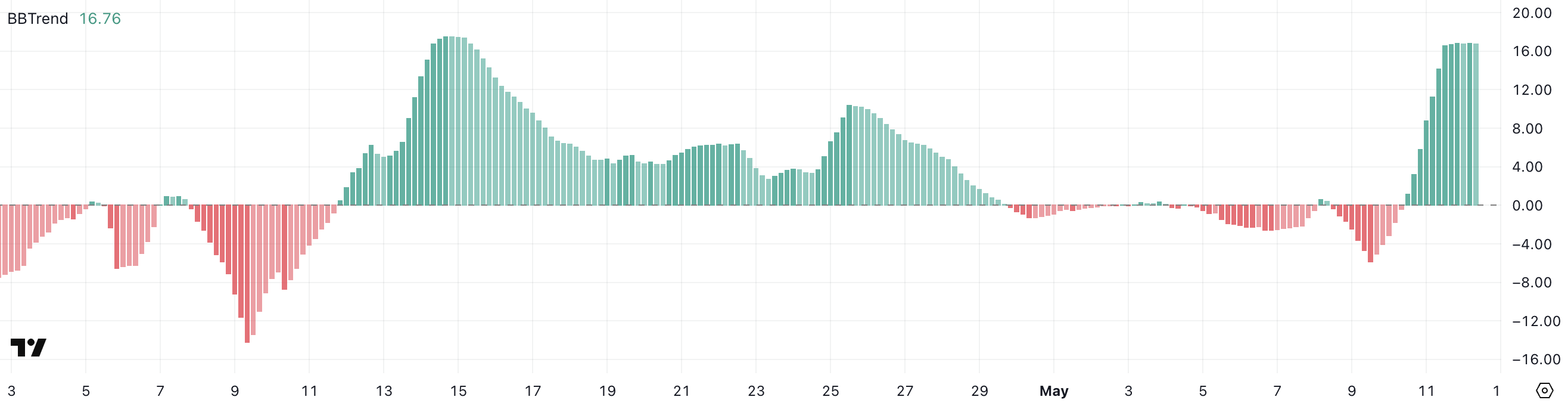

The BBTREND index also emphasizes the strength of the trend, as it jumps from negative lands to 16.7 and proves constant. As Sol approaches a large resistance area, the penetration can open the door for a step above 200 dollars for the first time since February.

Solana maintains

The Solana Ichimoku Cloud scheme currently displays a bullish structure. The price is traded much higher than Kumo (Cloud), which turned green – signing that momentum prefers bulls.

The leading period A (green cloud border) is higher than the leading period B (the boundaries of the red cloud), which confirms the positive direction.

In addition, the price remains constantly higher than Tinkan-Sen (blue line) and Kijun-Sen, indicating that short-term and medium-term support levels remain sound.

The late range (green line) is placed on top of both the price and the cloud, which confirms the bullish bias more.

The wide gap between the current price and the cloud suggests a strong upward momentum with minimal resistance in the short term.

As long as the price remains over the cloud support lines and the main support lines, the trend remains clearly up. Despite the good momentum, large transportation and eradication of the main portfolios, including FTX/Alameda and Pump.fun, have sparked fears of a possible sale after the rapid prices of Sol.

Sol bbtrend holds about 16.7, confirming the strong budget momentum

The Solana’s BBTRIND (Bollinger Band Trend) increased sharply from -0.41 to 16.76 in just two days, indicating a strong shift from the stage of unification or Habboudia to a clear upscale area.

BBTRand measures the distance between the price and the Bolleinger Band Centerline, which helps to determine the strength of the direction. The above values indicate the upscale conditions, while negative values indicate potential bends or side movement.

A sharp step such signs that entered Sol in a stage of medium fluctuations with ascending momentum.

Bbtrend has settled around the level of 16.7 over the past few hours, indicating that the strong upscale motivation may be united now.

This may mean possible scenarios: ongoing upward movement if the momentum is built again, or a cooling period where traders evaluate modern gains.

The ongoing high bbtrend value reflects a strong directional strength, and unless there is a sharp reflection, it is possible that the Sol price procedures are favorable in the short term.

Sol eyes are broken by more than $ 200 as EMA lines signal power

Solana Price is trading slightly lower than the main resistance level at $ 180.54, a region that crowned its upward movement in the last sessions.

EMA lines show a clear upscale structure, as short -term averages are much higher than long -term lines and maintain a healthy separation, indicating a strong and sustainable upward trend.

If Sol penetrates this resistance and maintains momentum, it may climb about $ 205, which represents a first step above 200 dollars since February 10.

The continuous outbreak after that may reach $ 220, which is a possible increase of 24 % of the current levels.

On the negative side, merchants must see $ 160.78 support. The collapse below this level would indicate the weakness of momentum and pay Sol to 147.6 dollars.

If the declining pressure intensifies and fails the support, the next main level sits at $ 140.4.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.