Solana (Sol) is less than $ 184, but Bulls targets $ 200

Solana increased by 28.4 % over the past month, but its momentum slowed down. After touching $ 184 for a short period, only 0.78 % gained in the past seven days. Nevertheless, Solana continues to control DeX standards, as it led all chains at $ 27.9 billion in weekly size.

The broader ecosystem remains active, with multiple applications based on Solana among the highest fees. However, technical indicators such as RSI, Ichimoku Cloud and EMA indicate that the gathering may lose steam, indicating a possible period of monotheism or correction forward.

Solana leads the DEX market with a weekly size 27.9 billion dollars and the increasing application activity

Solana continues to confirm her dominance in the decentralized stock exchange system (DeX), leading to the leadership of all chains in the trading volume for the fourth week in a row.

Over the past seven days alone, Solana has registered $ 27.9 billion in the size of DeX – tearing the BNB series, ethereum, base, and definition.

Solana’s weekly DEX, 45.78 %, indicates a strong return in the series after reducing the activity between March and April.

This height is an increase and part of a wider direction, while storing units remained constantly over the mark of $ 20 billion during the past month.

In addition to its momentum, Solana is home to four out of ten applications and chains for fees. This includes familiar platforms and new arrivals, which indicates a healthy diversity in the ecosystem.

Believe App, a newly launched Launchpad program in Solana, stands out in the last increase. During the past 24 hours alone, it achieved $ 3.68 million in fees-firm platforms such as Pancakeswap, Uniswap and Tron.

The momentum for Sol cools as indicators turn into neutral

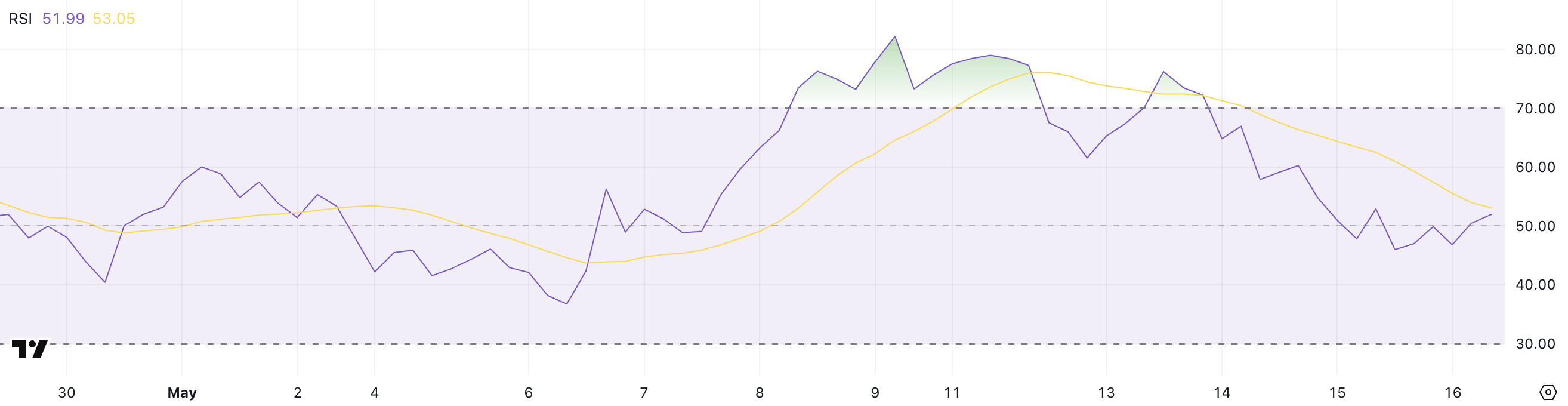

The Solana Relative Power Index (RSI) decreased to 51.99, a decrease from 66.5 just three days ago, indicating a clear loss of bullish momentum.

Over the past few days, the relative power index has been hovering between 44 and 50, which reflects the market morale of the market more neutral after it approached the excessive conditions in the peak.

This shift indicates that traders are more cautious, and modern gains may have cool.

RSI is the momentum index of 0 to 100, with values higher than 70 indicates excessive conditions purchased and less than 30 signal area. At 51.99, Solana sits in the neutral area, which usually indicates a period of monotheism or frequency.

If the relative strength index rises above 60 again, it may indicate the regeneration of upward strength; If it decreases less than 45, the additional pressure may follow.

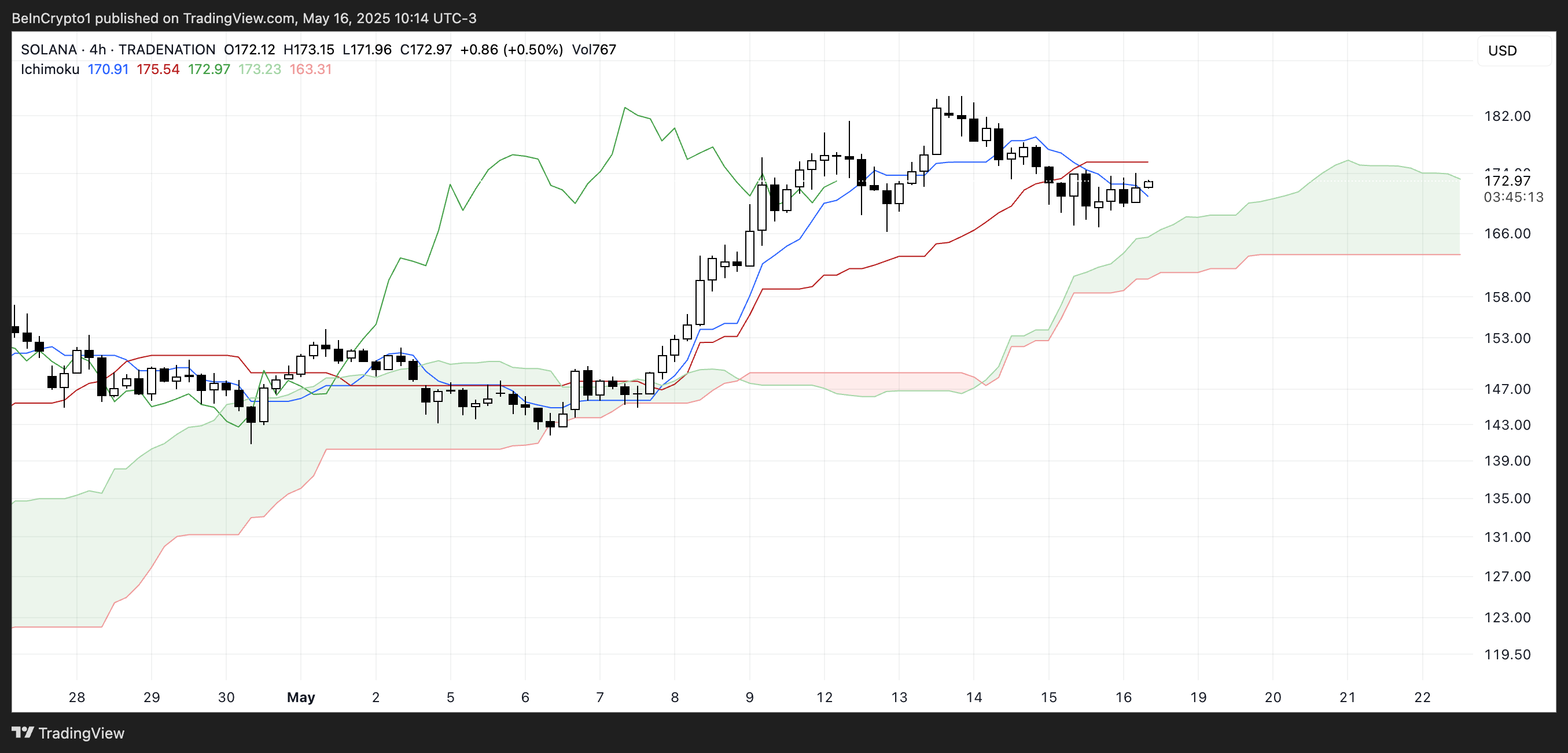

The Solana’s Ichimoku cloud chart shows a period of monotheism after a strong upward trend, with major signals indicating the frequency.

The price is hovering near the Kijun-Sen (Red Line) and Tenkan-Sen (blue line), both of which began to settle-the slowdown in the momentum.

Chico Span (the green delay line) remains above the candles, indicating that the broader direction still has a bullish bias. However, the lack of the distance between it and the current price of the price reflects the strength of weakness.

The Kumo cloud (green and shaded red region) is still upward, as the lines of the leading period are spreading, providing support under the current price.

However, with candles now interacting now closely with Kijun-Sen and failed to fracture Tinkan-Sen, the feeling seems short-term.

If the price can be decisively paid over the blue line, the momentum may return, but any erosion in the cloud can indicate the start of a longer unification phase or the reflection of the possible direction.

EMA structure faces the climb from Solana, slowing down the momentum

Solana EMA lines are optimistic, as the short -term moving averages are placed over the long -term lines. However, the gap between these lines is narrowing, indicating that upward momentum weakens.

Solana Price recently failed to overcome the main resistance level, and although re -test can open the path towards restoring the $ 200 region, the lack of strong follow -up raises questions about the strength of the trend.

To complete this cautious outlook, Ichimoku Cloud and RSI indicators indicate a possible slowdown. Solana was recently held above an important support level but still weak – if this support, can follow the negative side.

The broader structure still tends to climb, but the market appears to be at a crossroads. The next step is likely to depend on whether buyers can restore the initiative or that sellers pay lower levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.