The following encoded currency of the explosion, February 15 – berachain, Dogwifhat, Superver, WorldCoin

Join us cable A channel to stay in view of the coverage of urgent news

The encrypted currency market tests the changes and developments that make up investment options every day. Since last month, she was in a budget race, even with many symbols that have seen price fluctuations.

The encryption market monitors a worthy increase in the trading signals, which prompted investors to search religiously for the next distinctive symbol. However, discovery The encoded currency following the explosion Amid this abundance requires a comprehensive understanding of the market dynamics. Today’s article determines coins with some capabilities and informs investors and traders for each symbol.

The encoded currency following the explosion

Today’s review highlights the promising cryptocurrencies that investors must monitor. Among this is a new project called Wall Street Baby. Wall Street Baby is a new contrast to the beloved Bibi coin that aims to enable traders through exclusive market visions and advice. The distinctive symbol took the coding scene through the storm, and is preparing to take over the uniswap in just three days.

1. Beratin (Beira)

Braracain has officially launched Mainnet, which is compatible with Ethereum Virtual Machine (EVM), as it brought a new layer of Blockchain to the market. The launch, which occurred on February 6, came with a huge Airdrop of $ 632 million in Bera Tokens. Nearly 80 million symbols have been distributed to qualified users, which raises great attention from the encryption community.

The BERA trading on Binance at 13:00 UTC started on the same day, with trading pairs including BTC, USDT, USDC, BNB, FDUSD and TRW. Other major exchanges such as Bybit, Bitget, Mexc and Kucoin have instantly included the distinctive symbol, which increased its arrival. Since its first appearance, the Birra price has seen fluctuations, with a decrease of 8.85 % during the past week. However, the distinctive symbol showed signs of recovery, gaining 5.25 % in the past 24 hours, which raised renewed optimism among merchants.

One of the main factors behind the rapid height of Barachin is the consensus mechanism to prove liquidity. This innovative approach has attracted strong support for society, as it provides a new experience to secure Blockchain networks. Berarashain indicated that it was launched as a “Q5” – a fake quarter that exceeds the Q4 – the excitement that it nourishes among the supporters. Now that Mainnet has become directly and the symbol is active actively circulating through multiple platforms, berachain takes great steps towards establishing itself in the ecosystem for encryption.

The competition was fierce, but the results in the private sector berachain a race. Researchers invited to the best 3 researchers to the home with more than 315 thousand dollars as bonuses from a total bowl of $ 350,000! 🪐

This is what the absolute commitment to safety.

The best 3 researchers ranked … pic.twitter.com/r4uqdikm7m

Cantinaxyz February 13, 2025

Meanwhile, Staking simply introduced a new network driving panel. This basic system allows users to share BGT codes in the aftermath of the launch of the BGT and a $ 1.1 billion community. Simply put, it now supports more than 50 protocols and holds more than a billion dollars of amazing assets, provides owners of BGT to delegate their symbols to auditors. This system not only enhances the safety of the network, but also enables users to keep their money control through integration with compatible encryption portfolios.

2. Dogwifhat (WIF)

Dogwifhat (WIF) alludes to the reflection of the potential market, as technical indicators indicate a shift in the direction. At the time of this report, WIF is trading at $ 0.6939, with 24 -hour trading volume of $ 707.13 million. Over the past day, its value increased by 50.85 %, although the market ceiling decreased by 3.62 % during the same period.

The distinctive symbol market activity was turbulent. Over the course of last month, WIF recorded a sharp decrease of 59.60 %, with a decrease of 3.62 % in the past 24 hours. Despite this recession, analysts believe that if the bullish momentum gains traction, WIF can challenge the main resistance levels at $ 1.908 and $ 2.436.

The Crypto Ali_charts analyst on Twitter is highlighted that the TD Sequetial indicator has issued a purchase signal on the WiF for 12 hours. This sign usually appears when the downsic trend reaches fatigue, which may lead to a recovery of prices.

However, the risks remain if WiF loses its momentum. If the indiscriminate relative strength indicators decline down, the pressure pressure may increase, which may push the value of the distinctive symbol to less than $ 0.58. In such a scenario, more losses to the range can become 0.40 – 0.50 dollars as possible.

No no.

You do not understand.

It is just a WiF dog hat.

The M. was in Grammys, the first page of CNBC, collaborated with Rubik’s Cube and sent a dog hat into space 🚀🪐

exchange?

It is on Robinhood, Coinbase, Binance, Kaken, Gemini, Etoro, Revolution … pic.twitter.com/lj7kqjvfj4

Soon 🪐 (@1goodplay) February 12, 2025

One of the greatest strengths in Dogwifhat is its extensive presence in return, with lists about Binance, Bybit, OKX and BYDFI, the symbol benefits from strong liquidity and broad access. This comprehensive access to the market makes it easy for traders to interact with WIF via multiple platforms, which increases its capabilities for greater dependence on the long term.

3. Wall Street Baby (Wepe)

Wall Street Baby ($ Wepe) It is preparing to create a bold entrance to the Meme Coin market, with its official launch on UISWAP for only three days from now. On Monday, February 17, pre -investors will be able to claim their symbols at 2 pm UTC. With a lot of excitement buildings, many yearn to see how $ Wepe will perform as soon as the trading start.

Since its launch before noon in December 2024, Wall Street Bibi has constantly challenged market trends. While the broader MeME sector has witnessed a decrease in the total evaluation from $ 137 billion to about 70 billion dollars, the WEPE continued to attract the powerful interest of the investor. The average project has reached more than a million dollars in daily contributions and was able to sell all the distinctive symbols available before the embrace before preparation.

With the stock exchanges ready to insert $ Wepe, expectations are rising for the emergence of the explosive market. The distinctive symbol before it concluded with a final price of $ 0.0003665, and some expectations indicate that it may eventually reach $ 1. If this happens, it represents an amazing increase in value 272,751 %.

A distinctive similar in the space is Pepe Unchained ($ Pepu), which has become the best in the MIM of 2024. The $ Wepe and $ Pepu shares the main similarities – which were launched via Pressales, on Pepe the Frog Meme, attract, attract investments. Great early.

Breaking news: Wepe is inevitable. 🐸⚔ pic.twitter.com/hzhkzbsxcd

Wall Street Pep (WePetoken) February 15, 2025

Pepe Unchained initially the premium code price at $ 0.008. However, later increased to $ 0.06858, which represents an increase of 757 % and a total payment of 8 billion of supply to the market rating of $ 548 million. If $ Wepe follows a similar path, itself may arise quickly as one of the most successful Meme currencies on the market.

Visit the Wepe website

4. Reverse (Super)

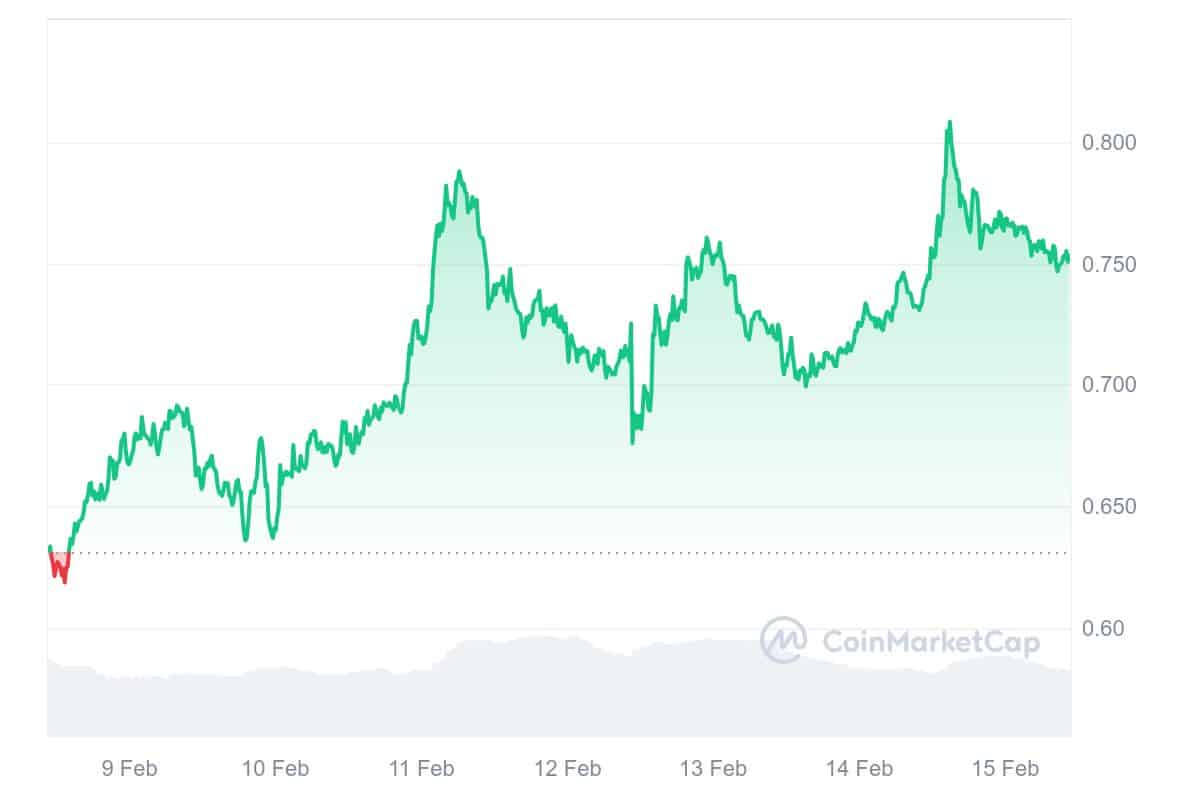

Superverse (Super) has been in ascending direction, with an increase in its price by 1.61 % over the past 24 hours to reach $ 0.7528. This increase is accompanied by 2.31 % in trading volume, which is now $ 20.61 million.

On a wider scale, last week was useful for Super, with the distinctive symbol increased by 20.07 %, reflecting the growing bullish momentum. However, the current price approaches a level that was previously resistant, which could affect a short -term movement.

Technical indicators indicate that the upward trend can continue. Both simple moving averages move for 50 days and 200 days (SMAS) up, which enhances the positive market morale. The price remains much higher than these averages, indicating a strong momentum. The main support level of about $ 0.60 played a decisive role in installing the last boom of Super, creating a solid basis for further possible growth.

At the same time, the RSI is currently at 69.92, indicating neutral conditions. This indicates that although the distinctive symbol has witnessed a strong escalating movement, it may circulate in the short term with the standardization of the market.

Reverse 🤝 Skalenetwork

We are cooperating with Skale, and invisible Blockchain gas -free gas -free, artificial intelligence, social and high -performance DAPPS.

With a prosperous environmental system of 300 projects, Skale will call $ Super With senior creators. pic.twitter.com/cpwtui8zms

– Reverse (Superver) February 11, 2025

On the daily chart, Super maintains an explicit clear structure. The price has succeeded in overcoming the basic averages, while MACD also supports the positive trend. As the relative force index continues in a neutral area, there is a room for a short -term payment in the event of an increase in purchase.

The main levels that must be monitored include the resistance at $ 0.8342 and support at $ 0.60. These price points are expected to play a decisive role in determining the next movement of Super. Traders and investors will closely monitor these levels to measure the next direction of the distinctive symbol.

5. WorldCOIN (WLD)

WorldCOIN (WLD) show signs of strong recovery, benefiting from the recent Bitcoin increase of more than $ 97,000. When Bitcoin acquires momentum, the leading altcoins, including WLD, has returned to a positive area, which prevents optimism between merchants.

Over the past 24 hours, the WorldCOIN price has risen by 1.61 %, raising it to $ 1.26. This increase follows the outbreak of the falling sorry pattern near $ 1.2511, with a distinctive symbol now testing a critical resistance level at $ 1.32. If the WLD succeeds in overcoming this level and confirming the breakthrough by re -testing, it may pave the way for more gains. Analysts have set potential goals at $ 2.51 and $ 3.16, which may represent a significant increase of 150 % over their current value.

Technical indicators add weight to positive expectations. MACD has formed an upper intersection, where the MACD line moves over the signal line. This shift indicates an increase in the purchase interest, which may increase in prices if the trading activity remains strong.

In addition to the price movement, the market value of Worldcoin increased by 1.54 %, reaching $ 1.28 billion and securing its location as the largest encrypted currency in 70 in Coinmarketcap. The interest of the investor also intensified, as the trading volume increased 24 hours by 11.15 % to 169.28 million dollars.

Despite these promising signs, WorldCoin remains at a critical turning point. Resistance levels still constitute challenges, and short -term withdrawal is possible. In order to maintain its upward path, the continuous trading volume, the market of the favorable market, and the total favorable conditions are necessary. If these factors are aligned, the symbol may see great gains in the coming weeks.

Read more

The latest Mimi ICO – Wall Street Baby

- Review by coins

- Pre -early arrival tour

- Alpha Special Trading for WEPE Army $

- Swimming pool – APY high dynamic

Join us cable A channel to stay in view of the coverage of urgent news