Solana price recovery is likely to repeat the main indicator of date

Solana witnessed a sharp decrease, as it decreased to less than 200 dollars earlier this week. This decrease comes amid wider market fluctuations, which makes investors not sure the next step for Altcoin.

However, the last contraction may represent a bullish opportunity, provided that the market participants change their position and benefit from the decline.

Investors Solana is uncertain

The net profit/loss index (NUPL) decreased in the fear area, where it retracted the optimism area. This shift indicates that investor morale has weakened, which contributes to increasing the pressure pressure. Historically, similar declines in fear of price are often preceded by price repercussions, indicating a possible recovery.

If the previous trends hold, Solana may see a recovery in the coming days. Previous cases, from NUPL decline to these levels, renewed the purchase benefit, and support for price recovery.

The shift in feelings can provide the momentum needed to restore the lost land and re -establish the upscale momentum.

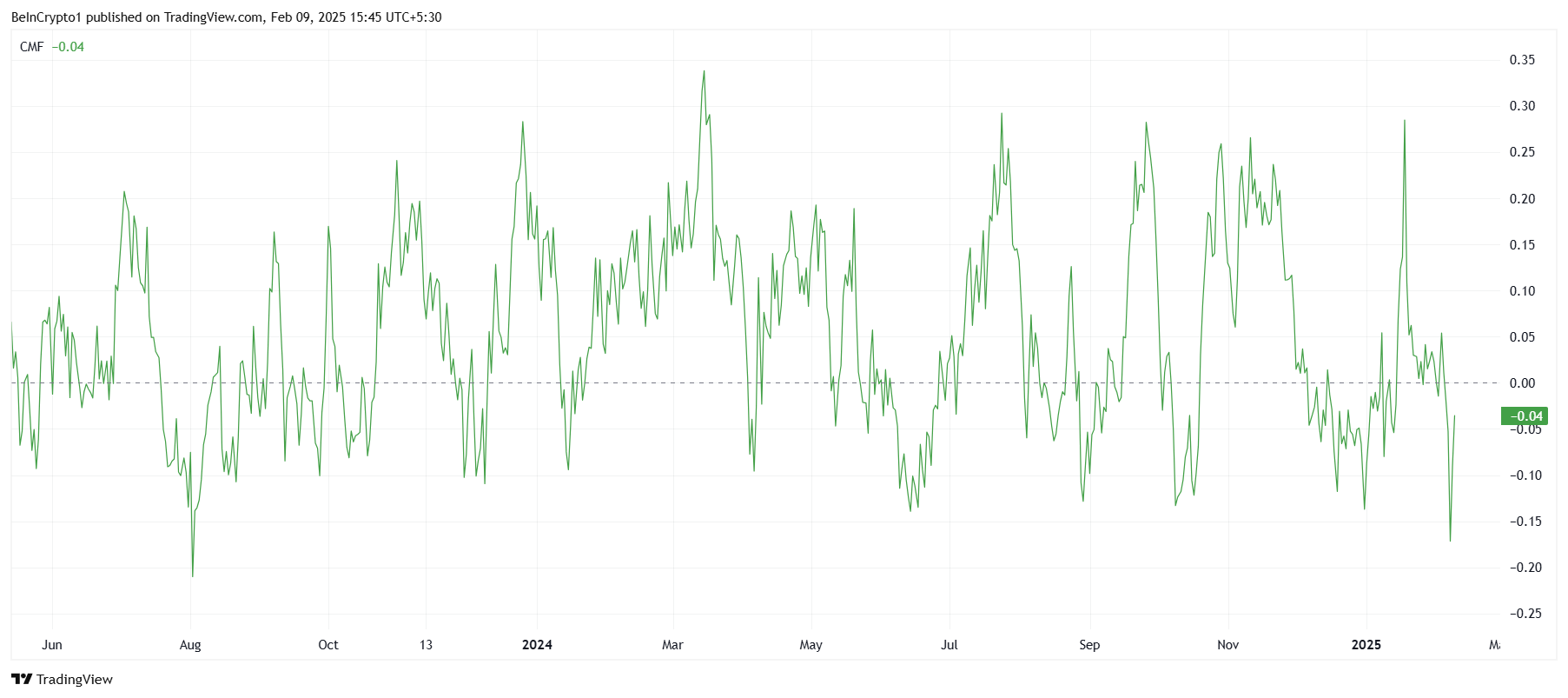

The Solana Chaikin Money Flow (CMF) has decreased to its lowest level in 18 months. This decline reflects an increase in external flows, which represents the most powerful capital of assets since August 2023.

Increased sales activity indicates that investors are still skeptical, which affects Sol’s ability to maintain promotional price movements.

Sustainable external flows usually indicate a declining momentum where merchants move the capital away from the original.

In order for the reflection of the trend, Solana must attract renewable purchase pressure. If investors regain confidence, the price may be stabilized, which paves the way for more bullish capabilities in the short term.

Predicting at the Sol: Height in front of us

Solana’s price has increased by 6 % over the past 48 hours. While this represents a simple recovery, it is still unimportant compared to the 27 % decrease that altcoin has suffered over the past three weeks. More bullish momentum is needed for Sol to create a continuous upward trend.

Currently traded at $ 202, Solana has successfully regained the support level of $ 200. This threshold is crucial in determining the course of the original in the short term.

If Sol is able to exceed $ 221, this will confirm that the recovery has started, which increases the possibility of other gains.

However, if the investor’s doubts persist, Solana may face renewable selling pressure. The decrease below the support level of $ 183 will nullify the upcoming expectations, which leads to extended losses.

The coming days will be very important in determining whether Sol can maintain its recovery or undergo more declines.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.