Solana leads Blockchain standards as it build

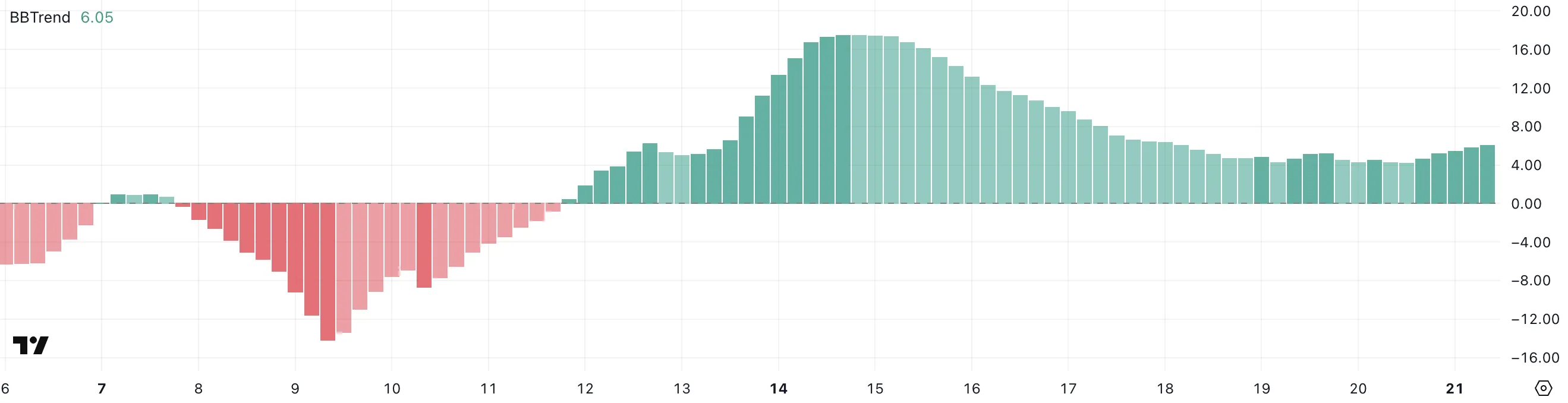

Solana (Sol) continues to show strength on multiple fronts, while maintaining a bullish structure on its Ichimoku cloud plan with the acquisition of momentum in the main market standards. The BBTREND index turned up again, indicating the renewal of the purchase pressure after a brief slowdown.

The activity on the chain is still strong, as Solana leads all Blockchains in the size of DeX and generating dominant fees thanks to the explosive growth of Meme currencies and Launchpad activity. With the trading of Sol now above the main resistance level, the path is open for more bullish trend – although momentum loss may still lead to a re -test of low support.

Solana maintains a bullish structure, but the momentum faces a major test

On the Solana Ichimoku cloud chart, the price is currently higher than Kijun-Sen (the red base line) but it has decreased under the Tenkan-Sen (blue transfer line), indicating poor momentum in the short term.

Tenkan-Sen suggests a potential standardization price or the early stages of withdrawal. However, keeping the price over Kijun-Sen, medium-term support remains intact.

The total Ichimoku structure remains bullish, with a thick cloud, height and a distance much higher distance from B, which leads to a strong strong support.

If Solana finds support in Kijun-Sen and climbing above Tenkan-Sen, the upper trend can restore strength; Otherwise, the top border test may follow.

Meanwhile, the BBTRand size of SolaNa is currently 6 days, extending for nearly ten days in a positive area after its peak at 17.5 on April 14. The last increase from 4.26 to 6 indicates a renewed bullish momentum in the wake of a short slowdown.

BBTREND, or Bollinger Band Trend, tracks the strength of price movement based on the expansion of Bollegerer.

Positive values such as the current point to the active bullish direction, and if BBTRand continues to rise, it may indicate stronger momentum and the possibility of another upward move.

Solana dominates the size of DeX and generating the fees where the Meme coins drive ecological growth

Solana once again ranked first among all chains in the DeX storage, where she recorded 15.15 billion dollars during the past seven days. The total ETHEREUM, BNB, Al Qaeda and Arifi reached $ 22.7 billion.

In the past 24 hours alone, Solana has seen $ 1.67 billion in size, nourishing her largely from her prosperous Mimi’s ecosystem and continuous paid launch battle between Pumpfun and Raydium. In addition to this good momentum, Solana recently exceeded ethereum on the market ceiling.

When it comes to application fees, Solana momentum is quite clear. Four of the top ten fees generation applications over the past week-Pumpfun, JuPITER, Jito and Meteora-focused on Solana.

The package leads the package of about $ 18 million as fees alone.

Solana breaks the main resistance as the upward trend targets higher levels, but the risks remain

Solana has finally broke her main resistance at $ 136, flipping her to a new support level that was successfully tested yesterday.

EMA lines are still aligned in a bullish preparation, indicating that the upper trend is still intact.

If this momentum continues, Sol PRICE may aim to the following resistance areas at $ 147 and $ 152 – at the level, if he violates, open the door to a possible move of about $ 179.

The current structure prefers buyers, with a higher decrease and strong support that enhances the direction.

However, if the momentum fades, it is likely to re -test the support of $ 136.

The collapse of this level may lead to a change in morale, which exposes Solana to a deeper decline of $ 124 and up to $ 112.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.