Solana is facing the level at $ 120 – will the date be repeated?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Solana continues to face the escalating sale pressure because it is struggling to restore the level of $ 150, with the largest uncertainty in the market significantly on the price of price. A 60 % decrease from its highest level ever, Solana reflects the weakness seen in the encryption sector, as fear and volatility has returned to control investor morale. With the continued instability of the macroeconomic and risk behavior, the bulls were unable to restore control, and confidence is still fragile.

Related reading

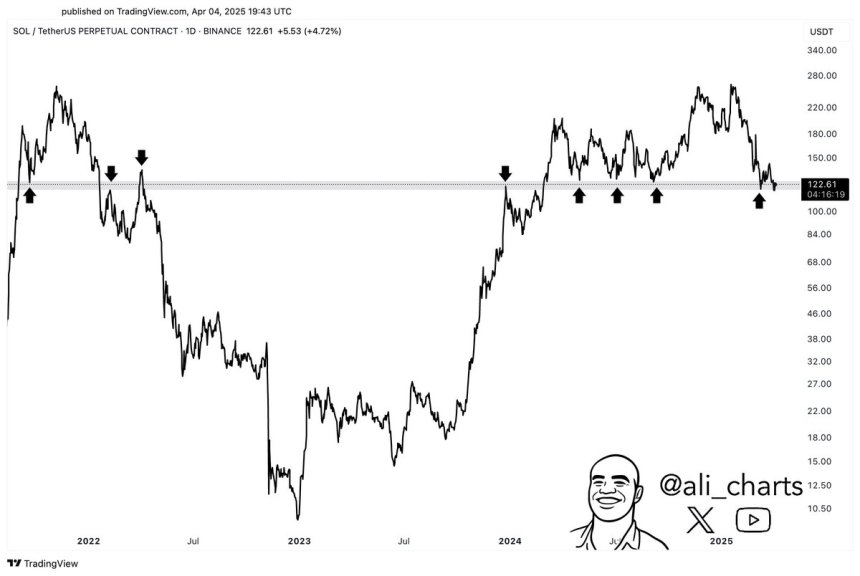

Ali Martinez, the recently higher encryption analyst, participated in an important technical analysis, setting $ 120 as a vital area or separation for Solana. According to Martinez, this level has historically defined major transformations in the Sol price track, and often served as a turning point between recovery and decline. As Solana now hovers close to this threshold, merchants are closely watching to see if he can carry or break.

If $ 120 fails to work as support, this may lead to a deeper correction. On the other hand, this Bulls level contract may provide a base to install a possible return – especially if market conditions stabilize. Currently, Solana remains in a weak position, and how he behaves around this main level may determine his direction in the coming weeks.

Solana holds the decisive demand with the growth of world trade war tensions

Solana is traded in a decisive demand area where the pressure pressure is intensified through the encryption market, driven by the escalation of global tensions and fears of the trade war. On liberation day, US President Donald Trump announced the sweeping of a new tariff, which sparked strong responses from major economies such as China. Fallout has rocked the investor’s confidence in all markets, including encryption, as the risk assets feel increased uncertainty and reduce appetite.

Solana (SOL) was particularly weak, as the price movement slipped towards the main support levels. Analysts warn that if the current demand fails to keep it, the downward trend may accelerate. The next few days will be crucial, as the continuous weakness in the next week can confirm a tremendous collapse. Many merchants are already preparing for more negative aspect if the market does not settle soon.

Martinez recently The importance of the current support area. According to his analysis, a level of $ 120 is a decisive point or a break of Solana. This region has historically identified the repercussions of the main direction and transformations in the momentum. Failure to adhere to it may lead to a deeper correction, while the reversal of this level may lead to recovery.

As Sol already decreased by 60 % of its highest level ever, the bulls are in defense. If they can defend $ 120, there is still hope for reflection – but its loss may indicate that the broader landing trend is still intact. In the coming days, all eyes will be on the ability of Solana to keep the line while continuing the macro pressure to form the trend of the encryption market.

Related reading

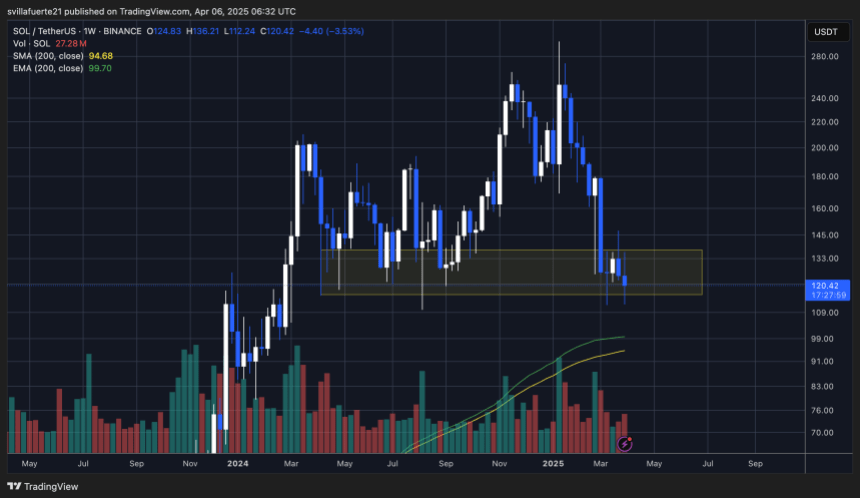

The main weekly support faces the risk of collapse

Solana is currently trading at $ 120, on the right track to register the lowest weekly closure since February 2024. After weeks of pressure and repeated rejection below $ 150, bulls run out of time to defend the main support. The inability to restore $ 150 – a major resistance zone – Sol kept trapped in a declining structure, with momentum in favor of bears.

For any hope that the recovery rally will form, Solana must restore $ 150 in the coming days. This level remains the gateway to the higher demand areas and turns in the short -term direction. However, if the price procedures persist in weakness and 120 dollars fail to keep it, the following logical goal is much less-about 200 days MA and EMA, both of which are close to $ 95.

Related reading

This would represent a decisive collapse and may lead to additional pressure on the negative side, especially if the conditions of the broader market remain fragile. With total economic uncertainty and the heavily visible warfare tensions, Solana’s position appears increasingly weak. Unless the bulls enter soon, Sol can face a deeper decline because it tests the long -term support areas that have not been seen since late 2023.

Distinctive image from Dall-E, the tradingView graph