Solana Futures market where Sol may decrease to less than $ 130

The price of Solana faced great fluctuations during the past week due to the recent market problems. This has led to a sharp decrease in her feeling in the futures market, as it seems that the dodging traders are hesitant in taking bullish positions.

This lack of confidence increases the risk of additional prices, with a decrease to less than $ 130 in the short term.

Solana is struggling with the departure of merchants

SOL’s negative financing rate is an indication of the upgraded bias between futures traders.

According to Coinglass data, Sol Perpetual has maintained a negative financing rate during the past three days, indicating that the open sellers are pushing to keep their locations. At the time of the press, this is by -0.0060 %.

The financing rate is a periodic fee that is exchanged between long and short traders in permanent future contracts to maintain the price of the contract with the immediate market.

As with Sol, when this rate is negative, this means that sellers on the open (those who are betting on a decrease in prices) pay fees for long traders, indicating a declining feeling in the market.

Therefore, more traders are placed in low prices, which enhances the declining pressure on the currency price.

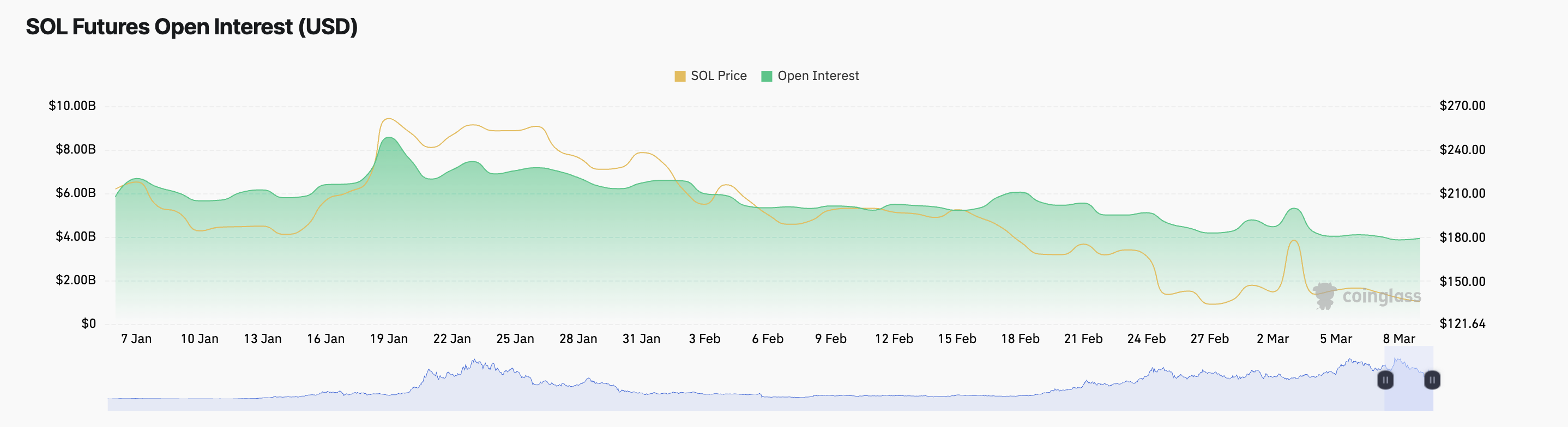

Moreover, the lack of confidence between future traders is reflected in his open attention. At the time of the press, this is $ 3.94 billion, as it decreased by 19 % since the beginning of March.

The open benefit of assets tracks the total number of active future contracts that have not been settled.

When this decreases, especially during the decline in prices, it indicates that traders close sites without opening new posts. This confirms the decrease in condemnation in the short -term Sol prices among futures traders.

Solana bulls weaken – can it prevent a decrease to less than $ 130?

At the time of the press, Sol is trading at $ 137.70, and resting higher than the support hall of $ 136.62. He also pronounces the upscale feelings, this level risks turning to a resistance area.

If this occurs, the Sol price can slip to less than $ 130 to exchange hands at $ 120.72.

On the other hand, if the bullish momentum returns to the Sol Market, this declining projection will be nullified. In this scenario, the new demand can pay the currency price to $ 182.31.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.