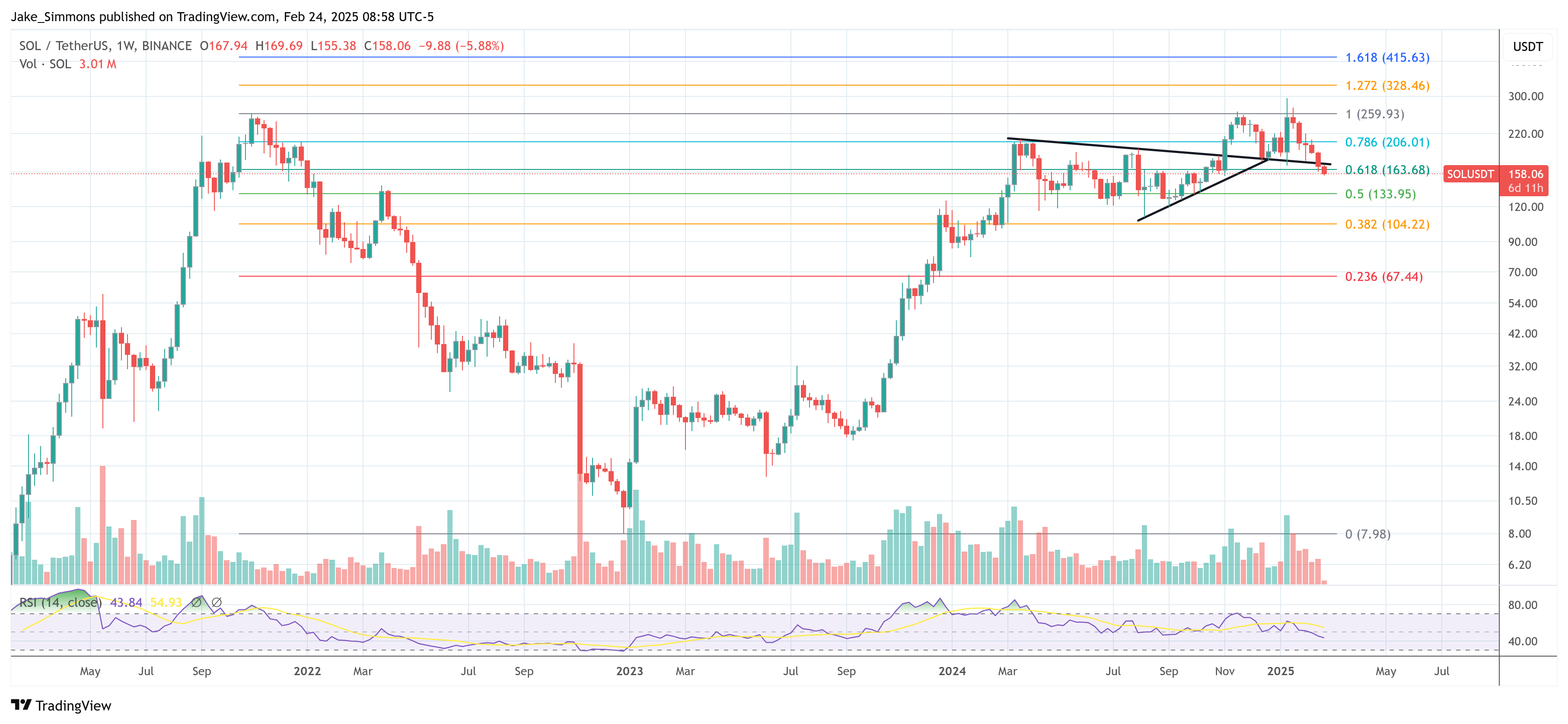

Solana faces the moment of making or breaking with the opening of $ 1.77 billion

Este artículo también está disponible en estñol.

In a joint technical scheme today, Kourath Khaneghah, founder of Trading Zero Complexity, emphasizes the ongoing lower Solana tensions, highlighting the levels of support and axial resistance on the daily Sol/USDT (Binance). According to the graph, Solana has lost many major areas currently hovering near the $ 157 region – what Khaneghah calls as “the last major support level.”

Solana’s rupture argument

“The declining direction continues as Sol is rejected by another S/R heart and moves to the level of $ 150. Feelings are at the lowest level ever. Suppose a continuation until it is proven otherwise,” khaneghah He writes Via X.

A prominent feature of analysis is support/resistance support (S/R) about $ 180.58. Earlier in February, Solana tried to restore this level but met with strong sale pressure. The failure to secure a daily closure above $ 180.58 – and is now resistance – has been renewed renewable momentum on the negative side.

After the decrease, Solana settled a little $ 157, the graph was marked as “the last main support level”. Prices briefly decreased under this area, indicating fragility in the current market position. Failure to maintain $ 157 on the daily closure increases the possibility of a further decline towards the next important horizontal line about $ 127.05 – visible at the bottom end of the scheme.

Related reading

Koroush’s comments also indicate that the transit above $ 180.58 will turn the market bias from landing to “neutral”. Until this happens, the analyst warns that the sellers seem to control, with a negative feeling around the coins that enhance the continuous landfill.

The upcoming argument for Soul

Meanwhile, at Runnerxbt (runnerxbt) subscriber Arrangement analysis from Solana (SOL) (SOL) (Sam) (timeline for two hours on Binance) today. The graph emphasizes the noticeable price points, references and changes in location before the opening of next March 1 – when 11.2 million are determined (at a value of approximately $ 1.77 billion) for the release.

In the explanatory graph, the price reached its peak in mid -January, to reach $ 295, before the steady decline that witnessed the recently hovering in the range of $ 150. The graph shows that from early to late January, there was a significant decrease in open interest (OI) along with a price slice, with the cumulative size of the Delta (CVD), indicating that it was driven primarily by closing long situations. This Runnerxbt’s notes are attributed to the Slance of Weakness, which moves largely to a tandem (1: 1) with Bitcoin.

By late January, after a more clear step down, the price and OI settled at lower levels. OI has briefly recovered in early February, although the graph indicates that the first long positioning may soon follow it short coverage as axis to make profit or close short centers. Despite this activity, the Sol price was unable to install the continuous upward trend, which enhances a broader feeling of frequency among merchants.

Related reading

Acts in mid-February (16-18 February) and again on February 24, the planned highlighting the stages of “aggressive negligence and immediate sale”, which contributed to the constant pressure on the price. Although there are short coverage cases (especially on February 21, when CVD rose a little), the total momentum remained interested, with few signs on a new long accumulation.

On the right side of the scheme, Runnerxbt placed a red line vertically ranked first on March 1 as the date of what he calls “the largest known opening for humanity”. It seems that many market participants “run” the event by selling in anticipation of a flood of new symbols that strike the market. This has the ability to increase fluctuations.

However, in his position, Runnerxbt warns of Sol’s default at the current levels, explaining that he initially began to monitor this position when the distinctive symbol is traded slightly less than $ 200 and is now seeking to get the scalp for a long time after the lock is canceled. It indicates that attempts to capture every 5-10 % of the daily decrease is dangerous and that traders who do this risk repeated or liquidated.

“I don’t think it is a new” new “wise -5 % hunt to -10 % of the falling daily knives. […] TLDR: Longing for Longs (not 5 days before opening). No short pants. If people cannot read, I cannot help you. ”He writes via X.

At the time of the press, Sol was traded at $ 158.

Distinctive photo of Shutterstock, Chart from TradingView.com