Skyrockets Gold to a height of 4 weeks amid geopolitical tensions, concerns definitions

- Xau/USD climbs with the rise of Russia, Ukraine and Trump, reviving the threats of customs tariffs.

- Trade tensions in the Chinese Chinese, Chinese, provoke a trip to gold.

- Trump rises solid tariffs to 50 % from June 4, adding to global market tensions.

- Waller is left in Fed the door open for price discounts; ISM Manufacturing PMi displays mixed signals before NFP.

Gold prices rose sharply on Monday, reaching the highest levels in more than four weeks, as geopolitical risks escalated on the Russian-Ukraine conflict. Renewable tensions of trade between the United States (the United States) and China have pushed investors to buy yellow metal throughout the day. At the time of this report, Xau/USD is traded at $ 3,377, an increase of 2.70 %.

The sour market feelings turned when the news broke out that Ukraine organized an air attack on Russia, which destroyed a long -term launcher and other aircraft. Meanwhile, US President Donald Trump doubled the definitions of steel and aluminum imports to 50 %, as of June 4, and sent the speech against China a decline in global stocks.

CNBC reported that Trump and China President Xi Jinping can speak this week, but not on Monday.

On the front of the data, the ISM manufacturing manager has revealed in favor of the trade activity. However, there were some improvements in the paid prices, which decreased. Meanwhile, the sub -component of the recruitment index was improved compared to the previous number, and has been positively received by the market participants, who are looking for the non -cultivated salary numbers on Friday.

The prices of alloys increased after the approach of the Federal Governor Christopher Waller, saying that the price cuts are still possible later this year. However, he has warned that policy makers focus mainly on controlling inflation.

Gold Daily Market Motors: Steeling bombers with a decrease in Greenback

- The price of gold is like the US dollar tanks. The US dollar index (DXY), which tracks the value of Greenback against a basket of six currencies, decreases by 0.72 % at 98.71.

- US Treasury’s revenues rise, as the US Treasury Memorandum has achieved for 10 years, approximately six basis points to 4.458 %. The United States has followed the real revenue, and also rises with six basis points to 2.118 %.

- The ISM Manufacturing Index increased by 48.5, a decrease from April 48.7, becoming its lowest reading since November. The price index remained in the expansion area, where it recorded 69.4 percent, while the employment index was in the shrinkage lands, but it improved from 46.5 to 46.8.

- The Global Information Managers Index for the manufacture of S&P remained in an expansion area, but it decreased in May from 52.3 to 52 April.

- After issuing the data, the initial reading of the GDP system in Atlanta, the Federal Reserve of the Economic Growth of the Q2 2025, increased sharply from 3.8 % to 4.6 %.

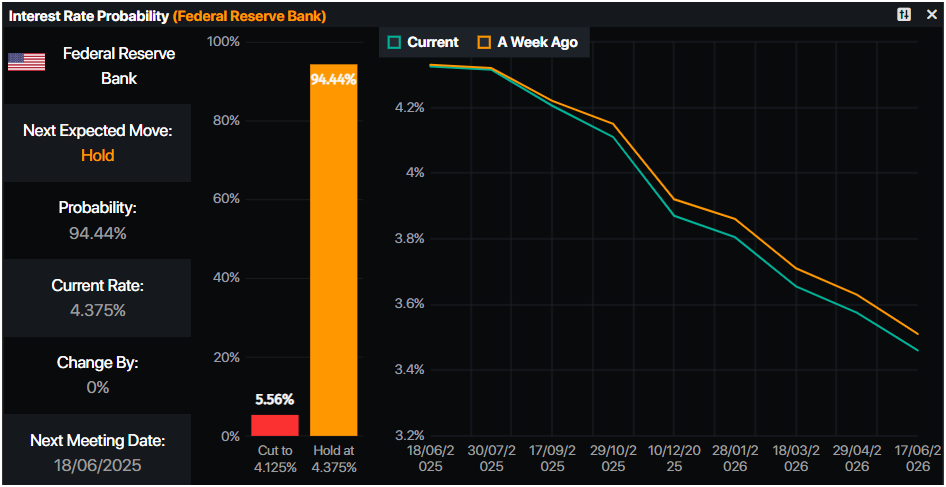

- Money markets indicate that traders are happy at 51 basis points to mitigate at the end of the year, according to the data of the main market station.

source: The main market station

Technical expectations Xau/USD: Gold exceeds $ 3,350 with Bulls targeting $ 3,400

The price of gold is biased up, as buyers raise the price of the Sot Xau/USD above $ 3,370, with a clear look at the level of $ 3400. The RSI Index indicates that buyers gain momentum.

If gold rises above $ 3400, the following resistance will be $ 3,438, which is the peak of May 7, before the record of $ 3500.

To resume the drop, gold must find less than $ 3,300, so that sellers can withdraw prices to $ 3,250. If it is wiped, the next station will be the simple moving average for 50 days (SMA) at $ 3228, followed by high support on April 3 at 3167 dollars.

Common Gold questions

Gold played a major role in human history, as it was widely used as a store for value and exchange. Currently, regardless of its brilliance and use of jewelry, the precious metal is widely seen as a safe asset, which means it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against currency decline because it does not depend on any specific source or government.

Central banks are the largest gold holders. In their goal to support their currencies at troubled times, central banks tend to diversify their reserves and buy gold to improve the powerful power and currency. High gold reserves can be a source of confidence to the dissolved country. Central banks added 1136 tons of gold worth $ 70 billion to their reserves in 2022, according to the data of the Golden Golden Council. This is the highest annual purchase since the start of the records. Central banks of emerging economies such as China, India and Turkey increase their gold reserves.

Gold has a counter -relationship with the US dollar and the United States Treasury, which is one of the main reserves and safe assets. When the dollar decreases, gold tends to rise, allowing investors and central banks to diversify their assets at turbulent times. Gold is inversely associated with the origins of the risk. The assembly in the stock market weakens the price of gold, while sales in the most dangerous markets tend to prefer precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of deep stagnation can escalate the price of gold due to its safe situation. As a lower asset than the return, gold tends to rise with low interest rates, while the high cost of money usually reaches the yellow metal. However, most moves depend on how the US dollar (USD) is behaved as the original is priced in dollars (Xau/USD). The strong dollar tends to maintain the price of gold -controlled gold, while the weakest dollar is likely to increase the price of gold.