Cheniere Energy: Cheniere Energy (Nyse: Lng)

Investors who have a lot of money to spend have taken a position up Cheneree Energy LNG.

Retailing traders should be known.

We have noticed this day when trading appeared on the history of the options available to the audience that we follow here in Benzinga.

Whether these are institutions or just rich individuals, we do not know. But when something big happens with liquefied natural gas, this often means that someone knows that something is about to happen.

How do we know what these investors have just done?

Today, monitor the Benzinga 10 options scanner is unfamiliar options trading for Cheniere Energy.

This is not normal.

The overall feelings of these great merchants are divided between 40 % of ascension and 40 %, landing.

Of all the special options we discovered, 4 are placed, with a total amount of $ 136,000 and 6 calls, with a total amount of $ 421,310.

The expected price range

After evaluating the trading volumes and open benefits, it is clear that the main market engine is focusing on a price scale between $ 180.0 and $ 250.0 for Cheniere Energy, and has extended the past three months.

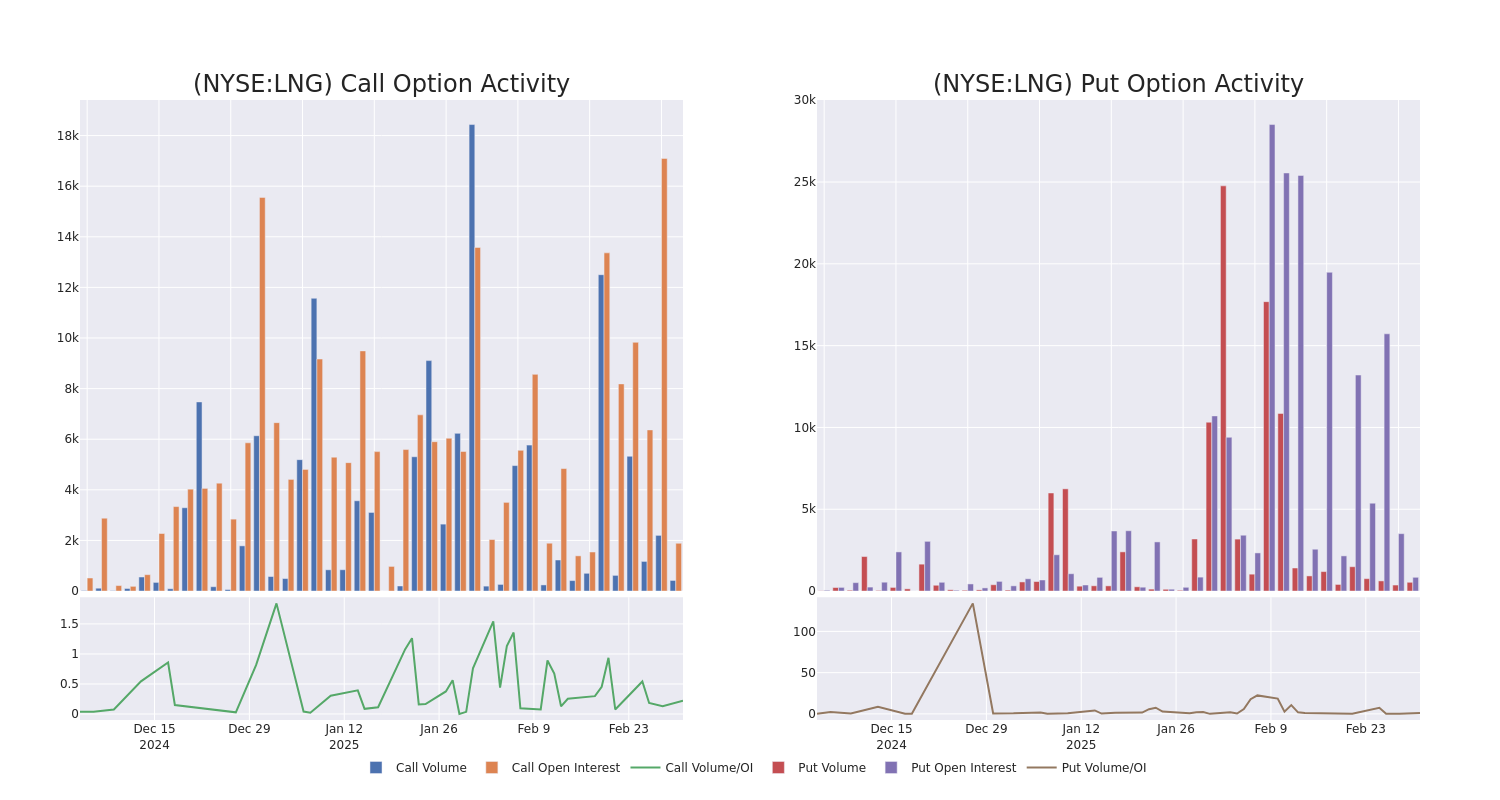

Size trends and open benefits

In the context of trading today, the average open attention to the Cheniere Energy options is 454.5, with a total size of up to 954.00. The accompanying graph determines the development of Call and Put Option Volume and the open interest of high value trades in Cheniere Energy, located in the strike price corridor from $ 180.0 to $ 250.0, over the past thirty days.

Cheniere Energer 30 days option size and benefits

The largest monitoring options:

| code | Set/call | Trade type | Feelings | Earn. date | Asking | tender | price | Strike price | Total trade price | Open attention | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LNG | Call | commerce | Climb | 01/16/26 | $ 17.9 | $ 17.1 | $ 17.9 | $ 250.00 | 178.9 thousand dollars | 315 | 102 |

| LNG | Call | Sweep | bearish | 01/16/26 | $ 56.8 | $ 54.0 | $ 54.0 | 185.00 dollars | $ 64.8K | 124 | 12 |

| LNG | Call | Sweep | bearish | 01/16/26 | $ 43.7 | $ 42.7 | $ 42.7 | 200.00 dollars | 64.0 thousand dollars | 698 | 15 |

| LNG | Put | commerce | bearish | 01/16/26 | $ 25.1 | $ 24.9 | $ 25.1 | 230.00 dollars | 50.2 thousand dollars | 274 | 32 |

| LNG | Call | commerce | Climb | 01/16/26 | $ 17.9 | 16.8 dollars | $ 17.5 | $ 250.00 | 43.7 thousand dollars | 315 | 127 |

About Cheneree Energy

Cheniere Energy is a liquid natural gas, or liquefied natural gas, produced with two attached to Corpus Christi, Texas, SABINE PASS, Louisiana. It generates most of its revenues through long -term contracts with customers on the structure of fixed and changing fee payments. It also generates revenues by selling non -corresponding liquefied natural gas on a short basis or once. Cheniere Energy Partners has a SABINE PASS facility and trades as a limited major partnership.

In light of the history of the modern options for Cheniere Energy, it is now appropriate to focus on the company itself. We aim to explore its current performance.

Present in the market from Chenere Energy

- With a volume of 1,191,392, the LNG price decreased by -2.47 % at $ 222.91.

- RSI indicators indicate that basic stocks are currently neutral between peak peak and increase.

- The following profits are expected to be released in 60 days.

Opinions of experts about Chenere Energy

It gave a total of 1 professional analysts this stock in the last 30 days, setting its average target price of $ 255.0.

Transfer 1000 dollars to $ 1270 in only 20 days?

TRADER Pro Options for 20 years reveal the technique of one line that shows the time of purchase and sale. Copy his deals, which amounted to 27 % profit every 20 days. Click here to arrive. * In accordance with their evaluation, a STIFEL analyst maintains a purchase on Cheniere Energy at a targeted price of $ 255.

Trading options offer higher risks and possible rewards. Smart traders manage these risks by constantly educating themselves, adapting their strategies, monitoring multiple indicators, and closely monitoring market movements. Keep aware of the latest energy options in Cheniere with alerts in the actual time from Benzinga Pro.

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.