Low Ethereum Exchang supplies to record the lowest level of 4.9 %

The data on the series shows that the ETHEREUM supplies on the stock exchanges have decreased to the lowest new level ever with investors continuing to withdraw ETH.

Ethereum supplies on the stock exchanges continued the primary trend recently

In new mail In X, the analysis company discussed the Santiment series about the last direction in the exhibition on the exchanges of ETHEREM. The “display on the stock exchanges” indicates an indicator, as its name already suggests, the percentage of the total ETH supply, which is currently sitting in the portfolio associated with central exchanges.

When the value of this scale rises, this means that investors deposit a net number of symbols on these platforms. As one of the main reasons why holders of transporting their metal currencies to exchanges are for the purposes of selling them, this type of direction can have a decreased impact on the currency price.

On the other hand, the descent indicator means that the width leaves the stock exchanges. In general, investors withdraw their metal currencies to self -portfolio when they plan to keep them in the long run, so this trend can be optimistic about the encrypted currency.

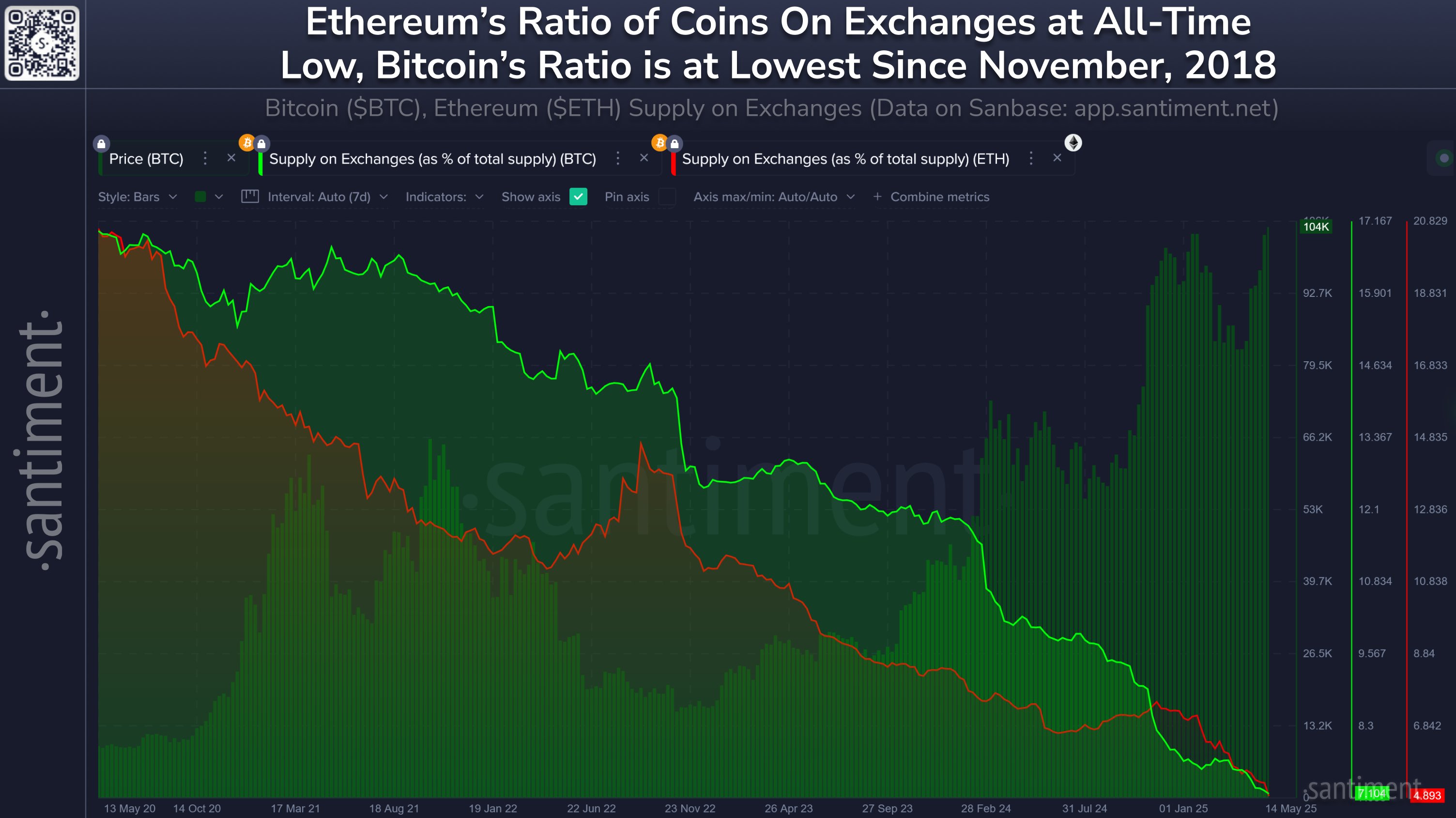

Now, here is the chart that the analysis company that shows the trend in displaying the exchanges of ETHEREUM in the past few years:

The value of the metric appears to have been following a downward trajectory for a while now | Source: Santiment on X

As shown in the graph above, Ethereum supplies on exchanges show a long -term direction, but there were periods of temporary deviation.

One of these stages came soon from running at the end of 2024, and it is a possible sign that some investors decided to get out of ETH during the profitable opportunity.

In the months that have passed since the peak, though, the index returned to the landline, indicating that holders have resumed their accumulation. Today, the scale sits by 4.9 %, which is the least registered value ever.

In the same graph, Santiment also connected the display data on the Bitcoin exchange. It seems that the number one cryptocurrency has also seen a trend of clear flows over the past few years and unlike ETH, there have been no remarkable deviation cases.

During the past five years, investors have withdrawn 1.7 million BTC from stock exchanges. This decrease reached the value of the scale to 7.1 %, which is the lowest level since November 2018. In the same period, ETH holders got 15.3 million symbols of assets from these platforms.

Something to take into account is that although the exchanges played a major role in the market for years, this is no longer the case. The appearance of the boxes circulating on the stock exchange (ETFS) means that there is now another major gate in the sector, so it may not carry the external flows of exchange as the same effect as before.

ETH price

At the time of this report, Ethereum floats around $ 2,500, a decrease of more than 2 % last week.

Looks like the price of the coin hasn't moved much recently | Source: ETHUSDT on TradingView

Distinctive image from Dall-E, Santiment.net, Chart from TradingView.com

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.