SEC agrees to the launch of April 30 for Proshaares’ Stained, Etfs Futures Short XRP

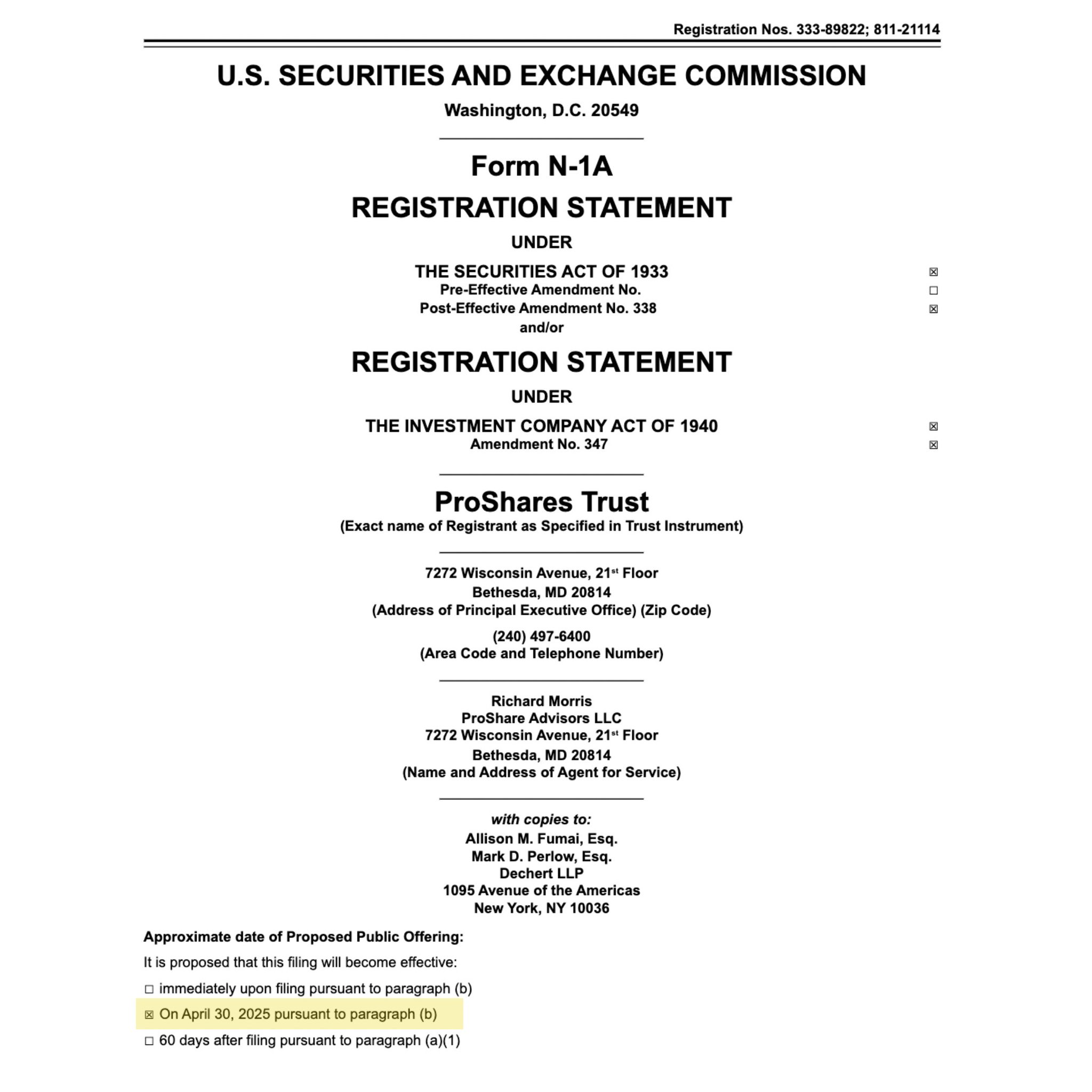

Proshaares will launch three tropical boxes that follow the price of XRP on April 30, according to the submission of a file with the SEC that Cryptopolitan has seen.

The three products are called ETF Ultra XRP, the short ETF XRP, and the very short ETF XRP. Each of them provides different exposure to XRP price movements, as ETF Ultra XRP gives 2x crane, short XRP ETF bars for the price of XRP, and Oltra XRP ETF -2x.

These circulating investment funds were proposed for the first time in January and finally got a green light after SEC refused to object during the review window.

These Three Foxes will become the second, third and fourth traded investment funds that follow XRP available In the United States market. However, Proshares is still waiting for the SEC approval on its XRP ETF application, which stumbles along with other similar proposals from Grayscale, 21shares and Bitwise, according to the block ETF Tracker.

Earlier this month, Teucrium Investment Advisors LLC, a company based in Fairmont, overcame everyone by launching the first ETF Future XRP in the United States. ETF of Teucrium offers exposure to XRP without maintaining the already distinctive symbol.

Eric Balunas, great ETF analyst in Bloomberg, to publish On that, “it is very strange (perhaps first) that the first ETF for the new original is to be used. Spot XRP is still not approved, [although] Our possibilities are very high. “

CME Group for adding XRP futures, where Proshaares launched the Investment Funds

Shortly after news Proshares, the CME group, the largest derivative exchange in the United States, announced plans to add the future of XRP to its shows. CME actually listing BTC, ETH, Sol and XRP futures now join this collection if everything is as planned as planned. This step occurs under an environment, under the leadership of President Donald Trump, organizers such as CFTC and SEC have taken a less aggressive attitude towards the encryption industry.

CME said it will provide two types of future XRP contracts: a small contract linked to 2500 XRP, and with a larger associated with 50,000 XRP. Both will be settled in cash and are calculated using the CME CF XRP-Dollar reference rate, which is updated once a day at 4:00 pm Easter.

The current market data shows XRP trading about $ 2, an increase of about 1 % over the past 24 hours, based on numbers from Coingecko. If the CME continues, XRP will become the fourth cryptocurrency available for future trading on the platform, join BTC, ETH and Sol.

XRP decision is not random. The fourth largest encryption now is a market locksmith of more than $ 127 billion, making it the fourth largest code in the market.

He has its supporter, Ripple, the presence of heavy pressure in Washington, DC, constantly pressure for the regulatory frameworks that prefer to develop Blockchain.

However, the aggressive Ripple pushing XRP adoption has not always sat with the broader encryption community. The so -called XRP army has sometimes launched anti -Blockchain projects to enhance its own cause.

Ripple also photographed the heavy work system in Bitcoin, where XRP was placed as a cleaner and more sustainable option instead.

Cryptopolitan Academy: Do you want to develop your money in 2025? Learn how to do this with Defi on our next electronic performance. Keep your place