How the unstable US dollar makes the Americans rush to bitcoin

Many of the main indicators of the power of the American economy seem to be dull, indicating a new opportunity for American individuals and companies to invest in Bitcoin. Large companies already join the direction.

Nick Pokrin, encryption analyst and founder of the currency office, exclusively shared his observations on this trend with Beincrypto.

Can the American recession benefit from bitcoin?

Recently, it appears that fears of the stagnation of the American economy have been subjected. The Federal Reserve Bank of Atlanta has issued a positive report on GDP, and the threat of definitions dramatically shrinks.

However, two novice in US economic health were pessimistic today, indicating a problem for the dollar and a possible chance for Bitcoin.

Specifically, these two indicators are the economists of the Organization for Economic Cooperation and Development Expectations ADP jobs a report. The last document claims to employ the private sector at its lowest level in more than two years, which prompted President Trump pressure Jerome Powell to reduce interest rates.

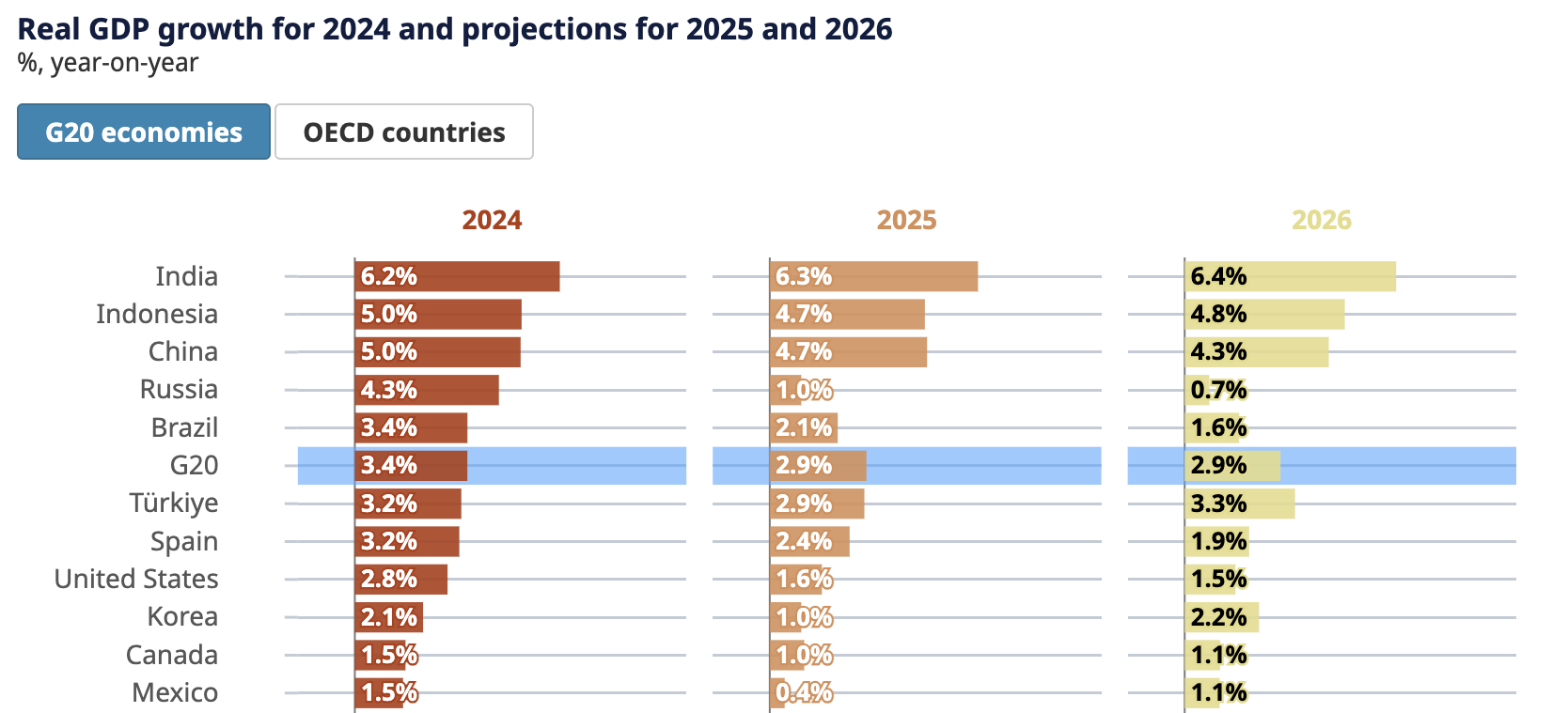

OECD, on the other hand, was more clear. He expected the growth of GDP in the United States to decrease from 2.8 % in 2024 to 1.6 % in 2025 and then decrease in 2026.

The recession is defined by two or more consecutive quarters of the reduced growth, so it may be two disastrous years. Global Global GDP growth rates are low, but the United States is lower. The Organization for Economic Cooperation and Development also predicted an impartially high inflation.

Moreover, a round of the new tariff for the European Union and technical sanctions against China can exacerbate the fermentation crisis more. Nothing is certain, but there is a set of possible recession indicators that affect the market at the present time.

Nic Puckrin described the position of the United States and explains how it can benefit from Bitcoin:

“The Organization for Economic Cooperation and Development in the Organization for Economic Cooperation and Development has set a number in one of the largest investor concerns about the United States – its growth view, which is now expected to be faded at best over the next two years. If the US dollar is still clinging to the recovery hopes before that, the final OECD report appeared finally its wrong devotion.”

Bokerren continued to determine a few other statistics, such as the US dollar index (DXY) decreased by 9.3 % on an annual basis and a decrease. Morgan Stanley predicts another 9 % next year.

Bitcoin has always been a potential hedge of stagnation, and investors outside the United States were already turning to it. However, these trends explain why American companies make the same selection.

More importantly, BTC was less volatile than usual, prompting American companies to make significant investments. Institutional whales such as Microstrategy provides new obligations, and huge ETF flows offer a revealing image.

Earlier today, Jpmorgan to open A new service to facilitate exposure to encryption for institutional customers. These different data points lead to one conclusion.

“Companies decrease themselves in the rush to support cabinet bonds with Bitcoin. As the value of the US dollar continues, we will see this shift happening more and more with investors stampede to protect their assets. With a steady bitcoin, above $ 100,000 for 20 days and becomes fast, the new new safe haven becomes.”

However, as Russia recently showed, Bitcoin’s investments for American companies are not necessarily useful for ordinary users or the Defi ecosystem.

However, this high demand can stimulate the BTC value, ensuring higher gains for current holders. Since the potential recession is waving on the horizon, smart encryption investors have an opportunity to secure stability and long -term growth.

The post shows how the unstable US dollar that makes Americans rush to Bitcoin first appeared on Beincrypto.