S & P 500, Nasdaq 100 Trackors Spy and QQQ Less than average 200 days with the continuing concerns of tariffs in the problem markets – Invesco QQQ TRUST, Series 1 (NASDAQ: QQQ), SPDR S & P 500 (Arca: Spy)

The money traded on the stock exchange that follows the S& P 500 index has decreased again, while tracking on the Nasdaq 100 is still less than an average of 200 days as its president Donald TrumpCustoms tariffs continue to obtain newspaper headlines.

What happened: Technical analysis of SPDR S & P 500 ETF TRUST spy and Investco QQQ TRUST, Series 1 QQq He explains that both of them were trading less than average in the long run amid the constant market fluctuations.

spy

according to Benzinga ProThe price of SPY was less than 20, 50 and 200 days in moving averages, as of the closure of Wednesday.

Regarding its average for 200 days in the long run, SPY was putting pressure for 10 days trading after sliding without this level on March 10. However, he recovered on Monday this week and traded this level on Tuesday, after decreasing again on Wednesday.

Although the relative power index was neutral at 44.86, the MACD line was negative at -6.37, but it was approaching the signal line with a positive arrest scale of 1.78, as it displayed a bullish mark in a declining direction.

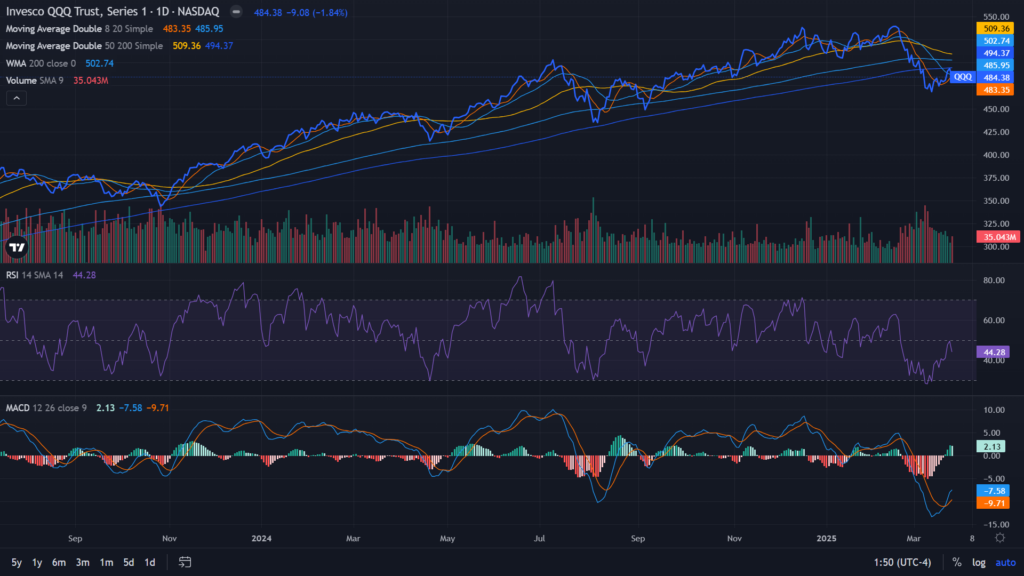

QQq

The price of QQQ was also less than its simple average 20, 50 and 200 days, as of near Wednesday.

However, it has been less than its average in the long run since March 5. While approaching an average of 200 days on March 25, it fell more on Wednesday. This represents 16 sessions of the box price less than average in the long run.

RSI was in 44.28 neutral, while, similar to SPY, the MacD index was negative at -7.58 with a positive graph value of 2.13, indicating a thunderbolt mark in a declining direction.

See also: Gamestop Cash Pile expands 3.4 % in the fourth quarter amid Bitcoin’s purchase report: The analyst says stock can decrease if the BTC cabinet value is like Michael Saylor’s Mstr.

Why do it matter: After saying that some countries may be exempted from the “mutual definitions” received on April 2, Trump made a 25 % tariff on car imports on Wednesday. “This will continue to stimulate growth,” Trump said.

While the definitions bear the expected economic costs, their negative effects can be diligently through the company’s and consumer procedures, according to Scott WayneThe major global market strategists in Wales Fargo.

“Let’s be clear: We expect the definitions to have some economic cost,” WRN, noting that some American companies have already raised prices due to the effects of customs tariffs, although they are often less than the full tariff rate. And note that high companies profit margins provide “some space to accommodate part of the price increases.”

The mitigation efforts are already ongoing. “Keep in mind that some companies have been working to diversify supply chains from the first days of the epidemic or even before,” Wren.

Consumers also adapt. “Consumers can also be some of the impact of possible definitions … for many products, there are alternative possibilities,” Wren added, pointing to examples such as choosing local alternatives if imports become very expensive. He believes that “these reactions will be treated and relieved a lot of the effect of negative tariff.”

Price work: The spy decreased by 1.19 % to $ 568.59, and QQQ decreased by 1.84 % to $ 484.38, he said Benzinga Pro Data on Wednesday.

On Thursday, Dow Jones futures increased by 0.27 %, while S&P 500 and NASDAQ offer 0.21 % and 0.06 %, respectively.

Read the following:

Compliment image: Shutterstock

batch69.17

growth–

quality–

value–

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.