Ruby slides before RBI decision

The Indian rupee returned under pressure today, with the US dollar/INR climbing about 85.77 as a request for renewal of the US dollar and the flow of foreign stocks on the local currency. The couple extended his recovery after 85.00, as it was now circulated slightly less than the main resistance area before the decision of the Reserve Bank on Friday (RBI).

The weakness comes in INR despite the best economic growth data expected in the last quarter. Traders focus on the capital journey, high demand for the US dollar, and relaxation abroad, all of which tend to have short -term flows in favor of Greenback.

Foreign external flows and GPS NDF vibrate inr

According to market sources, many foreign institutions were relaxed from long rupees through the NDF, before the RBI policy meeting on Friday, where the point rate of 25 points is widely expected.

Meanwhile, the external flows of shares continue with the return of global funds to the United States, where the return expectations remain high. This added another layer of pressure on the rupee, which led to the weakness of most of its Asian peers this year.

Trump’s tariff policy and the United States’ deficit related to survival

While the US dollar is still strong in the short term, it can turn feelings. Donald Trump’s aggressive definition and the growing financial deficit in the United States can undermine the house to reduce full taxes, trust in dollars if macro cracks begin to appear.

See too

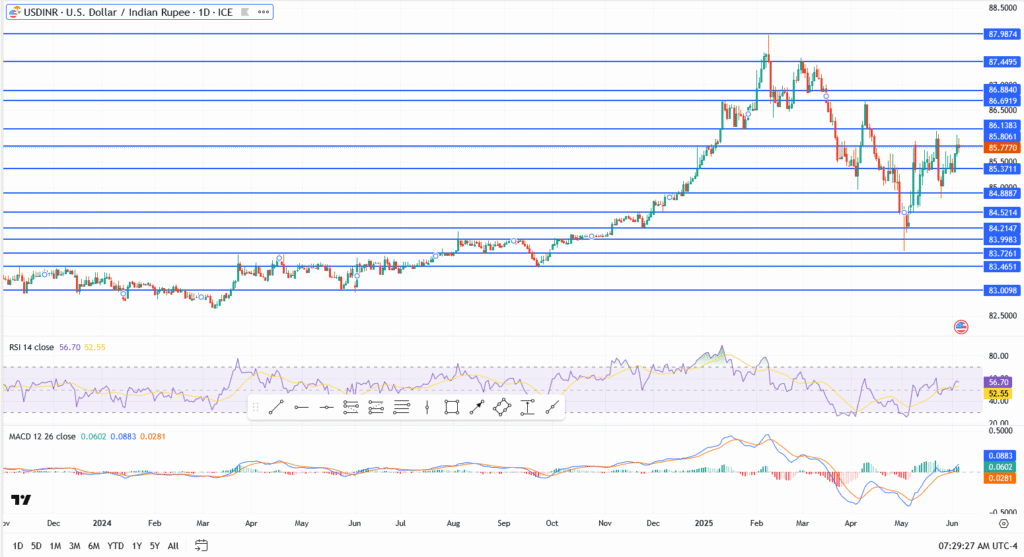

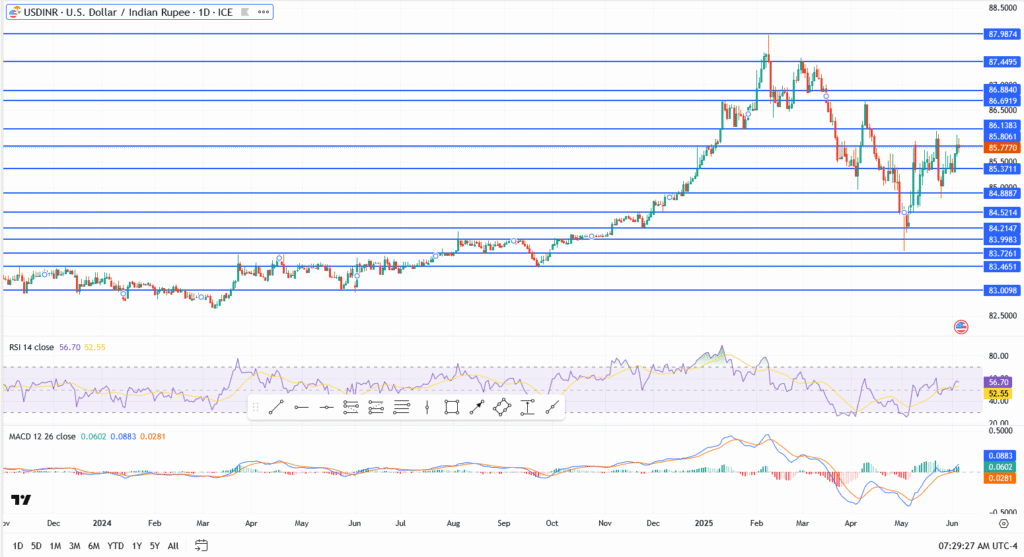

USD/Inr Technical Analysis: Bulls Retest

- Recovered EMA for 100 days and is currently testing the resistance range 85.80-86.13

- Fracture above 86.13 opens the door to 86.50, then 86.88

- Immediate support lies in 85.30, followed by 85.04 and 84.61

- RSI suggests at 56.70 that the upscale momentum is built, but it has not yet extended

- Macd Crossover is active, with the current positive chart extending

The preparation is constantly preferring to climb to the upward trend unless RBI is surprised with Hawkish Hold or US data. Otherwise, the momentum appears to be tested 86.71 in April.