Pi Price Rallly inch 7 %, however bulls against control

The price of PI has increased by 7 % during the past seven days, indicating modest ascending momentum. He is currently trading at $ 0.65.

However, technical readings reveal that the assembly largely lacks the condemnation of the upscale merchants, indicating that price growth reflects the general market growth from the demand for PI.

PI climbs, but momentum stalls

A main indicator that supports this view is the RSI index, which has been largely fixed despite the high prices. This indicates a balance between PI’s pressure and sale of PI, rather than an increase in the upscale feelings that usually accompany sustainable gatherings.

The RSI index measures the conditions of the asset assets market and increase. It ranges between 0 and 100. Values that exceed 70 indicate that the original may be excessive at the peak of prices, while values that are less than 30 indicate that the original has increased and may witness a recovery.

When it is flat like this, there is a balance between buying and selling pressure, without any clear momentum in either direction. These signals are equivalent to the market or monotheism, instead of a strong direction, although the prices of PI.

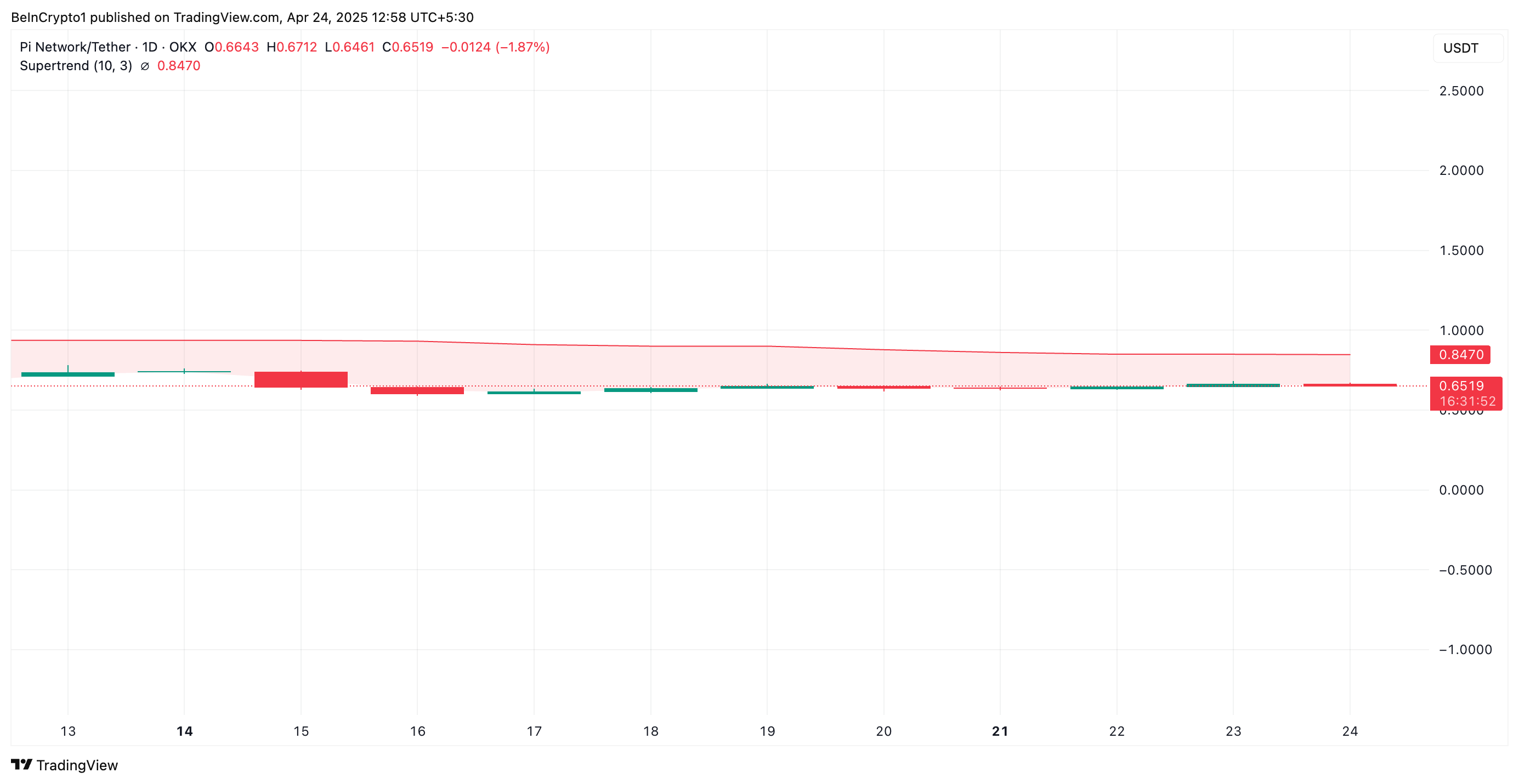

Moreover, the PI, which still serves as a higher dynamic resistance than the distinctive symbol, adds to cautious expectations. This is currently at $ 0.85

The indicator helps to determine the direction of the market by setting a higher line or less than the price scheme based on asset fluctuation.

As with PI, when the price of the original is traded without the super -direction line, it indicates a declining direction, which indicates that the market is at the bottom and the pressure pressure is the dominant.

Since the PI is struggling to break this level, the trend line promotes a declining feeling and suggests that the payment of the original in the short term is difficult.

PI risks decrease to $ 0.40 without renewing demand

Pi is currently trading at $ 0.65, and resting less than 20 days of SIA moving average (EMA). This indicator measures the average price of the original over the past twenty days, which gives more weight to the last prices.

When EMA is placed above the current price of the original, it indicates a short -term decline, indicating that the last prices are less than the past twenty days. If the demand is fading more, PI can extend its losses and reconsider its lowest level ever at $ 0.40.

On the other hand, if the bulls regain the dominance of the market, they can pay the value of the PI over the EMA for 20 days and a direction of $ 1.01.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.