Ripple What is 355 million dollars to Binance, the price of XRP is further?

The treatment of a large ripple whale drew attention through the encryption market. Early reports confirm that 200,000,000 XRP, at a value of $ 355.6 million, was transferred from an unknown portfolio to Binance. This movement raised concerns about the volatility of potential prices in the short term.

The price of XRP decreased as a result of the ripple whale to about $ 1.61, which raised fears of the decrease.

The main whale ripple is sparks of transaction

According to the whale alert, a Top whale move 200 million XRP to Binance. The total value of this transfer is 355,576,574 dollars based on the current XRP price. These major movements often indicate the upcoming trading activity that can affect price behavior. Moreover, some optimism that was made by NYSE Arca’s approval is built to include and register ETF Daily Daily Daily Daily from Teucrium.

After conducting a whale ripple, analysts on social media Common viewing views On this development. “There is no change in the monthly XRP frame. $ 1.8815 is held.” Dark Defender commented.

While the origin of the ripple whale is still unknown, historical data shows that similar movements have preceded corrections or temporary price declines. Meanwhile, Ali Charts expected that the price of XRP would explode from the head and shoulder pattern, which paves the way to a Possible transfer to $ 1.30. This interpretation adds a short -term XRP perspective if the pattern confirms fewer levels before a possible recovery.

Will the price of XRP collect $ 8 in April?

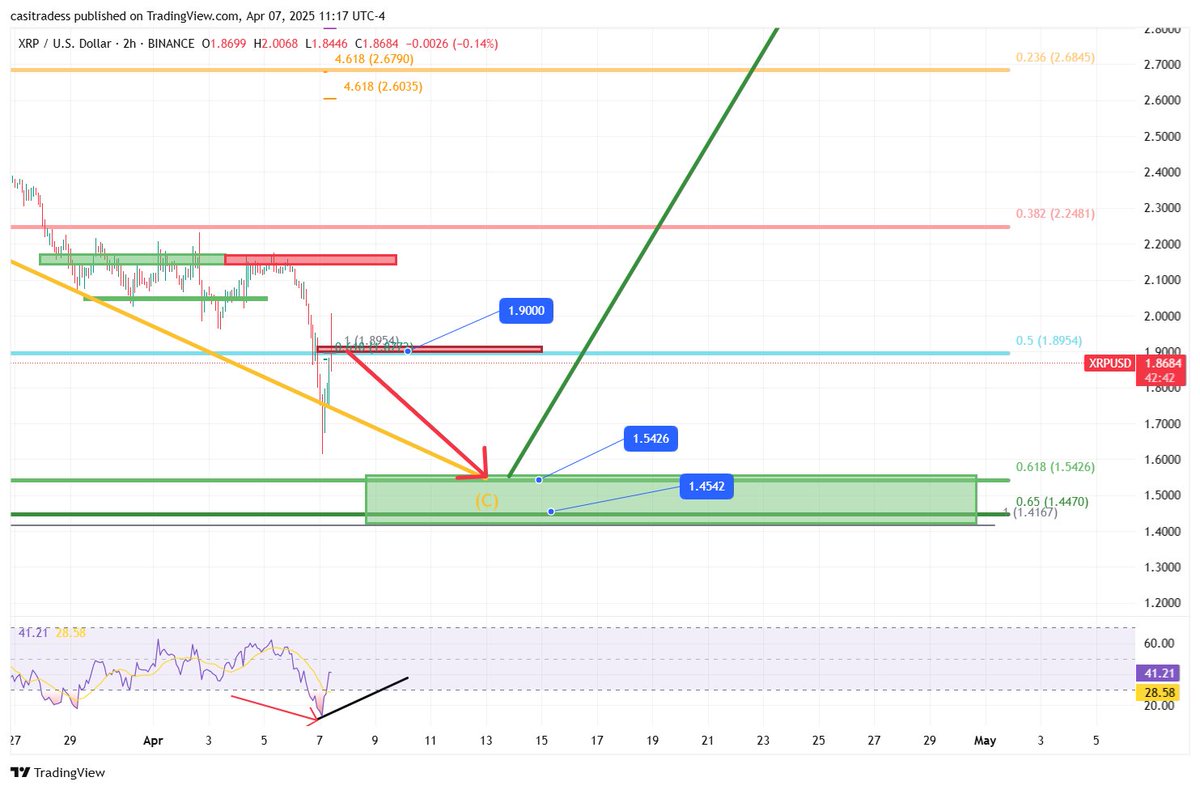

Co -whale coincided, CASI stated that the support level of $ 1.90 has collapsed, and turned it into a XRP resistance point. “This low is made of maximum new degrees on the relative strength index,” they stated, referring to the decrease in prices at the market level that reached XRP to $ 1.61.

Note Cassi as well Next support at $ 1.55Which corresponds to the level of alternative re -618 fibonacci. This is a decisive field where many merchants prepare alerts. According to the trader, “If we blocked less than $ 1.55, it actually enhances the upscale issue of the Greater April goals – still 8 to $ 13.”

Crediblecrypto echoed similar ideas, noting this XRP finally move Less than the scope that has been held for more than a month. They referred to a major request area ranging from $ 1.61 and $ 1.79, indicating that it provides possible preparation for apostasy. However, they also noticed that “perfectly, we offer/the range here to form a bit base before a complete reflection.”

As of now, despite the ripple whale, the XRP price is merged directly above this area.

The analyst determines a major resistance to the violation of the Taurus Rally

Technical analysts have continued to monitor Elliott wave structure, indicating that the price of XRP may complete the wave 2 of a larger direction. This theory suggests that a strong wave 3 can start soon, which usually represents a strong upward movement.

The local resistance levels that must be seen include $ 1.97 and $ 2.17. The collapse above these points may move towards higher targets such as $ 2.72 and possibly the highest level ever at $ 3.70. However, failure to keep more than $ 1.61 can convert to a deeper correction.

According to EGRAG, a potential or counter -aperture is formed, which can support a bullish reflection if confirmed. This pattern is formed inside the demand area, which some traders are seen as a long -term setting for XRP.

Historical market courses and long -term offer

Egrag Crypto SLong -term silkA drawing from the previous market courses. They compared the current XRP price movement with patterns of 2017 and 2021. According to EGRAG, during both sessions, the XRP price or less than 200 mA (moving average) has been touched before achieving significant gains.

“In 2017, XRP decreased by 73 % and then pumped 2700 %. In 2021, 78 % decreased and then pumped 1000 %,” EGRAG edited. He emphasized that as long as 50 mAh has not crossed less than 200 mA, the upper trend is still valid.

EGRAG pointed out that short -term price declines are part of the largest patterns. “You buy blood, even if it is your matter,” he wrote, referring to the purchase during the market’s fear.

Responsibility: Is market research before investing in encrypted currencies? The author or post does not bear any responsibility for your personal financial loss.

partner: