Definitions, whales and volatility

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Bitcoin merchants are preparing for a week full of jam, which is likely to be troubled. From the tariff that rises on the horizon to the BTC activity the size of the whale, there are five main factors that the market participants need to maintain their radar.

#1 The US tariff is preparing to escalate on April 2

The global stage is preparing for what US President Donald Trump called “Liberation Day” on April 2. According to the KobeissileTER message, the management plan with the “mutual tariff” is to be the moment of water gatherings in continuous international commercial disputes.

“President Trump discussed this Wednesday, April 2, for weeks. This is the day he naming“ Liberation Day ”where the wide new definitions will come. He writes Via X.

This customs tariff will be placed on a large number of American duties that extend to steel, aluminum, Canadian goods, Mexican goods and many Chinese imports. Kobeissi’s speech indicates that 25 % of the fees on car imports and countries that buy Venezuelan oil will get this week. With reprisals from Canada, China, the European Union and Mexico in the pipeline, they warn of a “huge trade war”, which increases uncertainty in global markets.

Related reading

Besides commercial details, the coming days can witness an increase in inflation pressure due to the high costs of consumer on imported goods. Quoting a rise in the index of uncertainty in the economy policy, highlighting Kobeissi’s speech: “Uncertainty in politics is higher than any crisis in the history of the modern United States. We are witnessing about 80 % of the uncertainty levels in 2008. As a result, market fluctuations are arched, and we expect a very volatile week.”

Add to President Trump’s latest threats to Iran – where there are “secondary tariffs” and possible fees on Russian oil on the table – and there are several international flash points that may feed market fluctuations.

#2 Bitcoin whale activity

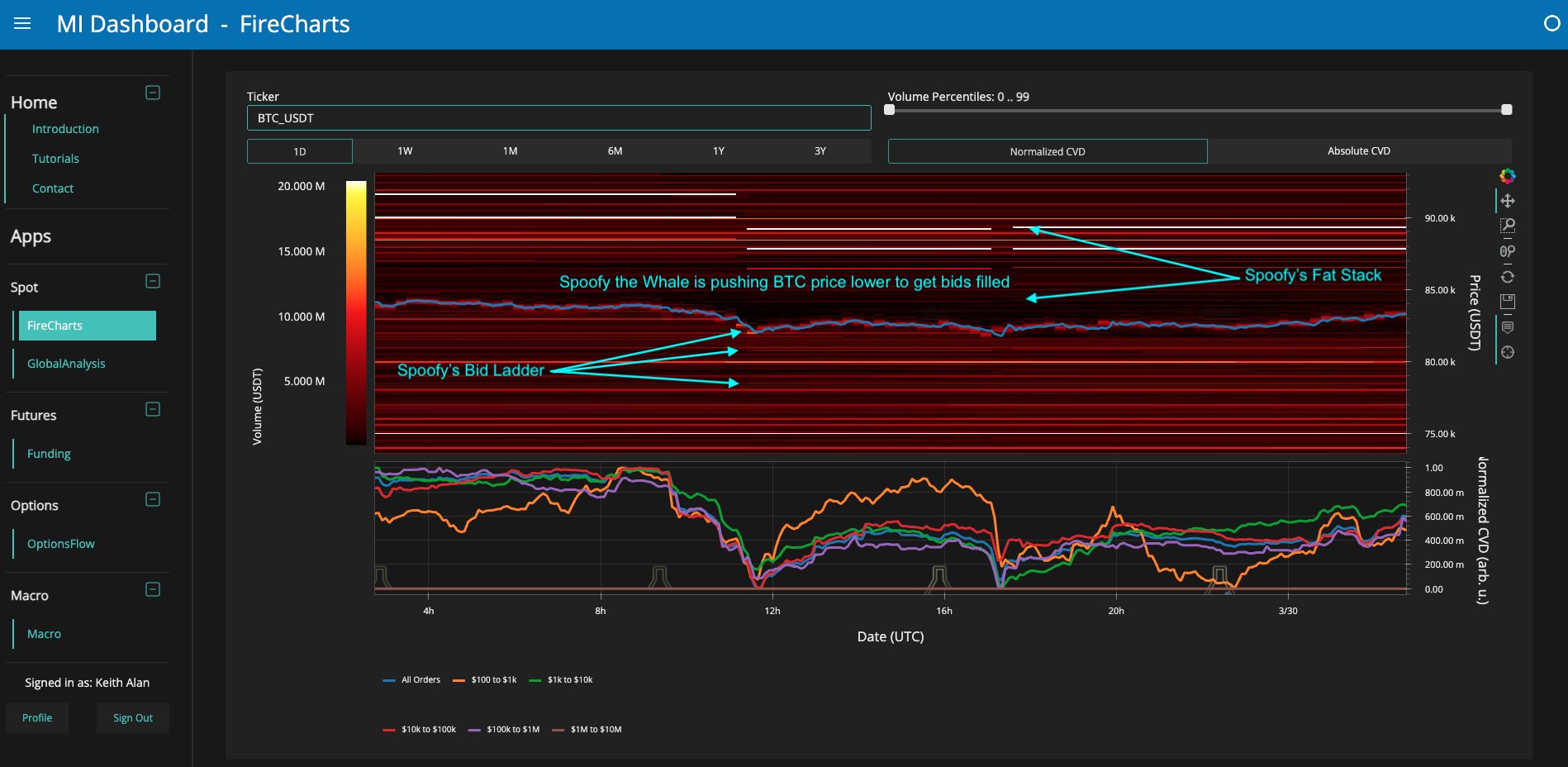

In Bitcoin Square, liquidity maneuvers remain widely a pivotal point. Keith Alan (Kaprduces), co-founder of physical indicators, drew attention to the potential whale strategy at work-was designed on a character described by “Spiofy Pisces”.

“The first evidence that something has happened with a series of small movements that seemed slightly different from adjusting its typical prices for its huge liquidity books Sunday.

He also pointed to the convergence of many news events – a weekly closure on Monday, the monthly closure on Monday, and the implementation of the expected tariff in the middle of the week – which may stimulate additional price fluctuations. Although BTC can still decrease, it has emphasized the whale’s commitment to assemble the current levels: “In the great plan for things, none of this means that the BTC price cannot decrease, but it means that the whale that has suppressed the BTC price for the past three weeks is to use this DCA strategy … and so on am I.”

#3 Bitcoin’s landfill collapse

Technical analyst Kev_Capital_ta is warning Traders who are closely watching on the levels of pivotal support after the collapse of the landfill: “We were following the pattern of the landfill throughout the past week, and since we see that we got a collapse of this weakness. If BTC lost the golden pocket here at a price of 81 thousand dollars, and follows this measuring goal, then 50 thousand dollars – 73 thousand dollars … the“ measured goal ”will be.

However, Kevin is assumed that, given the extensive negative emotions on April 2 (“” Harmjdoun “in some corners of the media), there is a possibility of a contradictory development:” Will the implementation of the tariff on April the second “a rare sale” buy rumors “buy news”? … Everyone thinks that the world will end suddenly. “

Related reading

He also added: “A little long liquidity at a level ranges between 78 thousand dollars and 80 thousand dollars, but a lot of juice is in the range of 87 thousand dollars-89 thousand dollars (dark yellow) for market makers for transactions directly before CNBC announced” on the second of April. “

#4 experienced players accumulate

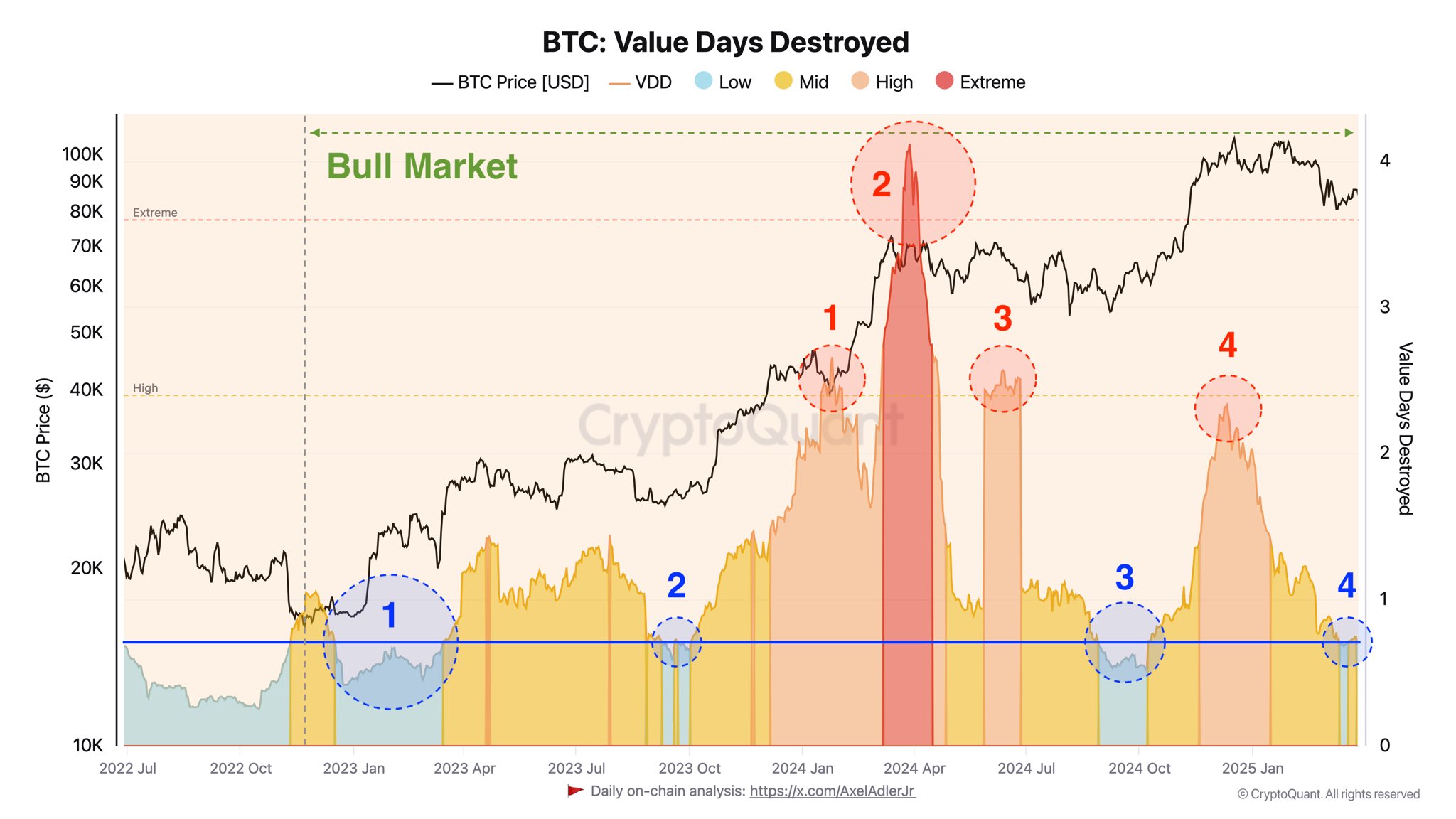

From the perspective of the series, Axel Adler Junior, an analyst at Cryptoquant, comments Experienced market participants move to a new phase. Depending on the destructive value index (VDD), ADLER determines a series of four distinct accumulations since early 2023, which represents the current cycle as a mature of the potential upward aspect of the long term:

“The lack of a large sale in the current stage indicates the confidence of these experienced players that the current BTC prices are not favorable to achieve profits.” Adler emphasizes that historical data shows low VDD periods precedes an increase in prices, which indicates that the upscales are medium-term-provided overall factories, including global economic policy episodes, not hindering morale in the market.

#5 cme gap

Finally, traders need to see the Gap Cme (Chicago Mercantile Exchange) composition, which was a noticeable feature in Bitcoin’s work. Rekt Capital (@rektcapital) High The filling of the last gap ranges between $ 82,000 and 85,000 dollars: “BTC filled the KME area from 82 thousand dollars to 85 thousand dollars. Moreover, Bitcoin is likely to develop a completely new CME gap during the weekend … which can put BTC to move to at least 84 thousand dollars next week.”

GAPS CME often acts as a magnet for prices, and the Rekt Capital analysis indicates a probability of filling newly formed gaps or a continuous step that rises BTC, depending on the extent of the wider market forces this week.

At the time of the press, BTC was traded at $ 82.010.

Distinctive image created with Dall.e, Chart from TradingView.com