The APT price jumps by 15 % as BitWise files for Aptos ETF

Curricula shows mixed shows as Altcoins appears to be out of bitcoin.

BTC decreased to 82 thousand dollars, and the Habudiya feelings grew with the Trump tariff that stretches the global financial space.

However, some altcoins have registered the large bouncing cells during the past day, indicating the upcoming altcoin selective season.

APT increased nearly 15 % of the daily bottoms from $ 5.5411 to $ 6,3695.

While Altcoins is looking to lead the market recovery amid BTC conflicts, BitWise Supercharged Aptos’.

The company took the initial step towards entering the APTOS Spot trading box through the Dilayer box.

BitWise becomes the first company to follow a tall box linked to APTOS.

BitWise’s preliminary step towards introducing Spot Aptos Etf

Deposit is the first step before the company registered with the United States again.

Thus, this step does not guarantee the launch of imminent funds or the approval of the regulator.

After that, the asset manager will send an official request to SEC.

The application will define the securities regulator details about ETF structure, appropriate tracking and investment strategy.

SEC will evaluate the ETF application and issue a ruling, either request amendments, rejection, or approval, in the coming months.

Filling price predictions

APTOS recorded great recovers as ETF Move from BitWise ignited the interest of the investor.

Alt increased nearly 9 % on the daily price scheme to trade at $ 6.13.

Increasing the impressive daily trading volume confirms the remarkable bi -up activity within the APTOS ecosystem.

Technical indicators and the chain support changing feelings to ascend.

Chaikin money flow from -0.18 was recovered on February 24 to +0.03 at the time of the press.

This highlights the increase in the money that enters the APTOS ecosystem during the past 72 hours.

Large decisive flows for the continuous height.

Moving 4H moving average divergence indicates a noticeable bull.

The visible bullish difference with the signal line shows the buyer control.

Such trends are a suitable position to make extended gains before the potential landing.

Feelings in the entire encryption space and the SEC response will be determined in the coming weeks and months.

Meanwhile, the BitWise app comes at a time when the money circulated in the exchange of Altcoin traction is gained.

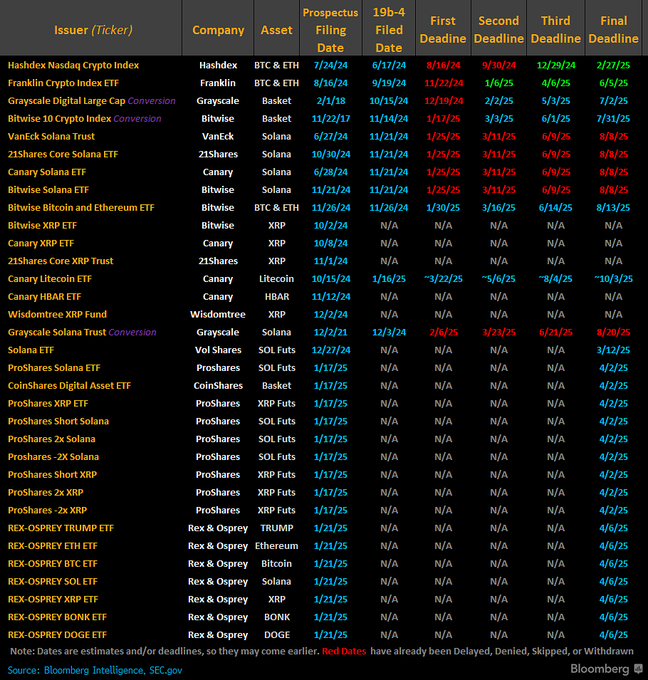

Multiple asset managers continue to invest in Crypto outside BTC and ETH, explore Solana, Exp, Cardano, Litecoin, Hedra and Dogecoin.

More from Etfs Altcoin – the new Crypto qualifiers are planned outside Solana, XRP and Litecoin. Canceles are now focused on polkadot (dot), Cardano (Ada) and Hedra (HBAR). Nasdaq 19B-4 provided Grayscale’s polkadot etf. 21 Shares also submitted a similar proposal. Dot has $ 7 billion …

Moreover, the Aptos’ Etf’s interest comes at a time when SEC adopts a more friendly position on the regulation of encryption.

The Supervisory Authority has dropped multiple lawsuits against encryption entities recently, including cases against UISWAP, Robinhood and Coinbase.

The ETCOIN is likely to open for institutional adoption, such as retirement traders, pension funds and hedge boxes exposed to Aptos without relying on the exchange of cryptocurrencies.

The trading box for exchange improves price stability and increased liquidity while improving the prevailing APTOS call.

The post -APT rate jumps by 15 % as BitWise files for Aptos ETF, which seeks to obtain early SEC approval first on Invezz

Only in: BitWise recorded to get Aptos Etf in Dilayer, indicating a possible Aptos ETF spot file soon! Could this be the next big step in ETF?

Only in: BitWise recorded to get Aptos Etf in Dilayer, indicating a possible Aptos ETF spot file soon! Could this be the next big step in ETF?