Predging of the PI network price: Is it safe to buy a decline in PI?

The price of the PI network has collapsed this month with a dilution of demand and noise surrounding the currency. After rise to the highest level at 3 dollars last month, it decreased by more than 60 % to the current $ 1.1630. So, what is the next PI coin in the next few years, and will it become a Bitcoin capable competitor?

Why the price of the PI network crashed

Pi Network is an encrypted currency project in the past seven years. It was in its development stage for most of this period. In this, more than 60 million pioneers actively extracted them, with the aim of converting their profits into the Fiat currencies such as the US dollar.

Pi Mainnet launched In February, which makes it possible to sell pioneers. It was also widespreadand The PI fell immediately after being included in many exchanges such as OKX and Mexc. This incident occurred as these pioneers sold symbols.

Then he wore the price of the PI network immediately after that and reached its highest level ever. This recovery occurred when the noise surrounding PI jumped.

However, recently, Pi Coin has been destroyed, and she is now homing near its lowest level since February 22.

There are some reasons why the value of PI has been shattered in the past few weeks. First, the noise surrounding the distinctive symbol decreased, prompting more pregnant women to sell distinctive symbols.

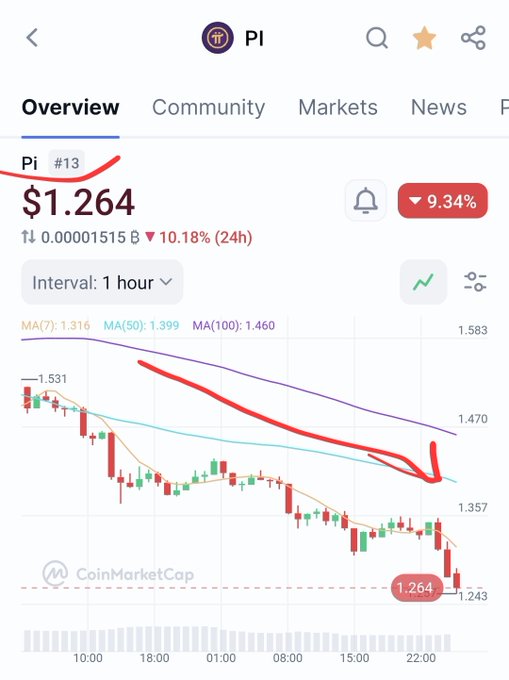

PI decreased to the number 13 in the CMC classification, where its price decreased to less than $ 1.3. The low prices are associated with general feelings. The failure to obtain the list on Binance, despite 86 % of the community vote in favor, raises serious concerns about the public’s confidence in the project. this…

Second, the long -awaited Binance list has not yet occurred. Binance conducted a survey on whether to tell the PI network. Although most of the users who voted in favor of the inclusion, the company has not yet confirmed the date of its occurrence.

Read more: Pi -2025 – 2030 network predictions after Mainnet launch

Third, there are concerns about the future mitigation of the PI network. Data by Coinmarketcap It shows that the PI network has the maximum supply of 100 billion symbols, and one from 6.8 billion. This means that the network will open more than 93 billion symbols over time.

Some of these symbols or about 1.4 billion symbols will be opened, and other billions in the next few years. Unless the PI network provides a burning mechanism, there are opportunities for the supply to become more than demand, which will affect the price.

Piots of PI

There are a few stimuli that may help to pay the price of the PI coin in the long run. First, there are signs in the recession In the United States where Donald Trump implements a major tariff on goods imported from countries such as China, Canada and Mexico. The recession will be good for cryptocurrencies like PI because it will lead to interest rate cuts.

Secondly, the PI network has become a large encrypted currency of more than $ 12 billion. It is also one of the most coins that are traded on the market. As such, it is just a matter of time before the list of major companies like Coinbase, Apbit and Binance. They will include them to take advantage of the fees you generate for other exchanges.

Third, Pi Network is a USA coin made in a rating of more than $ 12 billion. It is also a work evidence for work that contains higher sizes of other coins such as Litecoin, Hedra Hashgraph, SUI and Polkadot, which received ETF applications. This means that there are possibilities for one or more companies to apply for the PI ETF spot, a step that will lead to more demand.

Pi currency rate analysis

Technologies indicate that the price of the PI network has more the downside to go. Less than the average transfer of 50 and 25 points has decreased, a sign of control of bears at the present time.

The PI network has also moved to the bottom of the rising trend line that connects the lowest fluctuations since February 25. This price was the underside of the head and shoulders in the graph style, which is a famous continuity sign.

Therefore, the short -term expectations of the price of PI currency are declining, with the next goal to watch at $ 0.61, which is the slightest swing on February 25. In the long run, the price of the PI network is probably bounced and the resistance is re -testing at $ 5 as the stimuli above happens.

Piots of the post -PI network: Is it safe to buy a decline in the PI? First appeared on Invezz