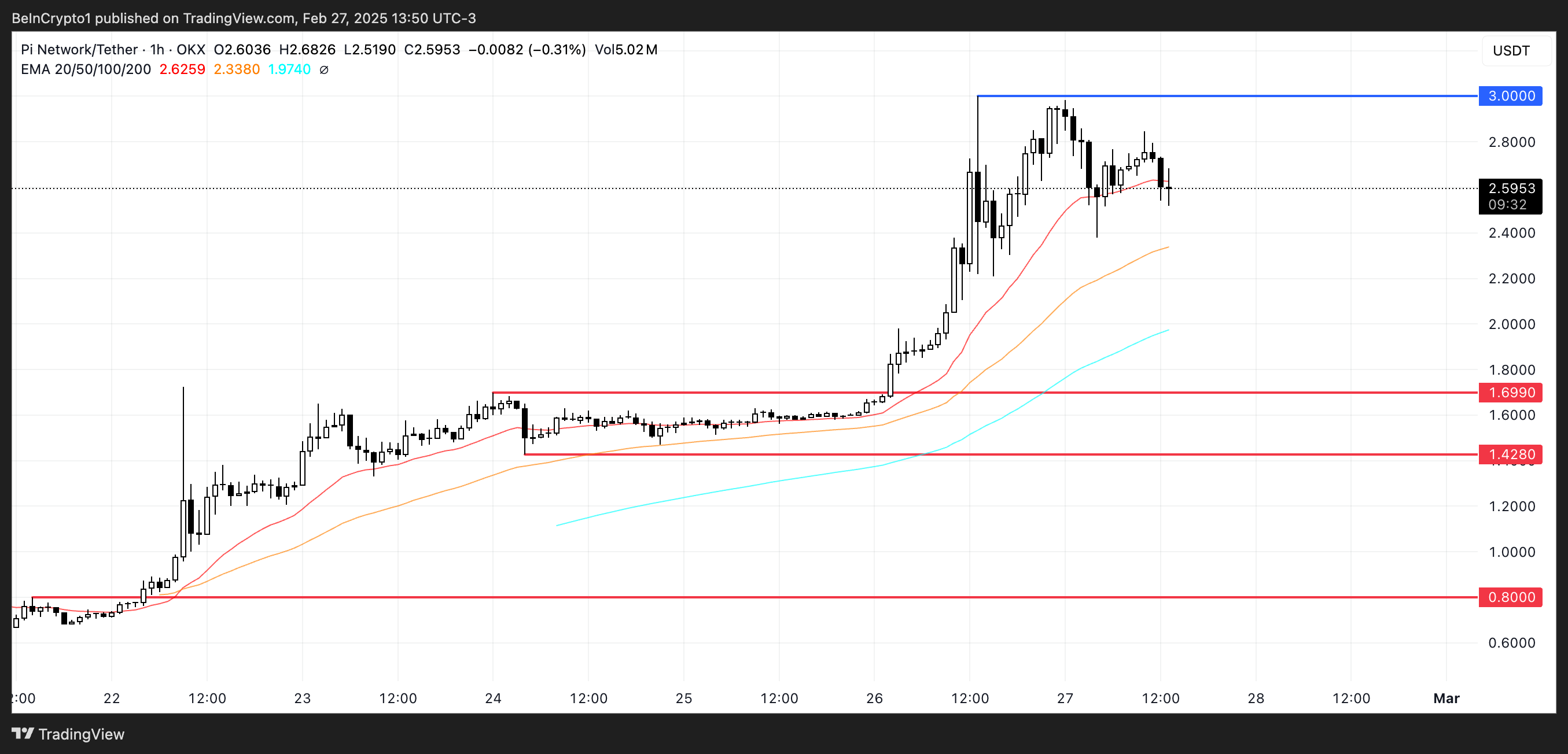

PI (PI) may see a major price correction soon

Pi (PI) may be the most vibrant dictators in 2025. The price has increased by more than 200 % in the past seven days, with approximately $ 3 in the past few days. Despite this impressive gathering, technical indicators indicate that the upward trend may lose momentum.

DMI explains that buyers are still in control, but the narrow gap between +Di and -Di signs weaken bullish pressure. Meanwhile, RSI cools from PI from extreme peak levels, and EMA font to reflect the potential direction, endangered his upward view of danger.

PI DMI shows that buyers are still controlling, but this may change soon

The DMI chart explains that ADX is currently in 37.6, after its height from 9 to 62.7 between yesterday and today. The average trend (ADX) measures the strength of the trend without indicating its direction.

It ranges from 0 to 100, with values higher than 25 indicates a strong direction and values less than 20, which indicates a weak or uninterrupted market.

PI’s +Di at 23.6, a decrease from 57 yesterday, indicating poor oud pressure. -DI rose to 20 of 1, which indicates an increase in a declining feeling.

Despite this transformation, +Di +remains higher than -Di, which confirms that the PI is still in the direction of ascending. However, the narrow gap between the directional indicators indicates that the upward trend loses strength. If +Di continues to decrease and cross down -di, it may indicate the beginning of the reflection of the direction.

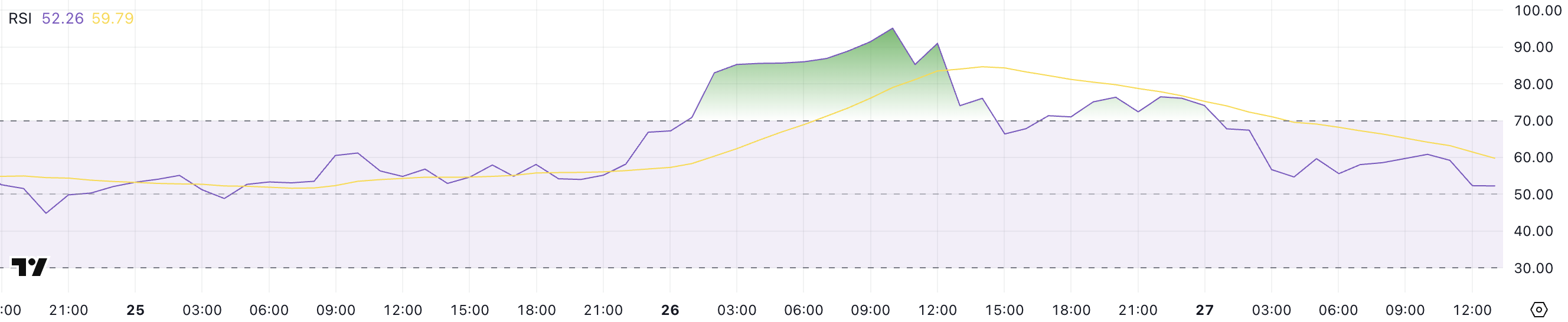

RSI PI network returns

RSI PI’s is currently 52.2, after it reached a significant rise from 95 yesterday and staying over 70 for several hours on February 26. RSI is a momentum that measures the speed and change of price movements, ranging from 0 to 100.

Values that exceed 70 indicate excessive conditions, indicating that the original may be exaggerated and the reason for its decline, while values that are less than 30 excessive conditions indicate, indicating the possibility of a recovery of the price.

The relative strength index is between 30 and 70 generally neutral, with no strong directional bias.

RSI decreased from PI to 52.2 after staying over 70 and climax in 95 indicates that intense purchase pressure has been cooled. This decline reflects the loss of bullish momentum and may indicate that PI enters the stage of unification.

The acute withdrawal of extreme peak levels indicates that achieving profits occurs, which increases the possibility of temporary prices.

However, since the RSI is now in the neutral area, the next price movement will depend on whether purchase of interest resumes or continues to increase the pressure pressure.

The PI can be corrected by 68 % soon

The EMA EMA lines remain optimistic, with short -term lines higher than long -term lines, indicating that the upward trend is still intact. However, the last movement indicates that this upward trend may lose momentum, as confirmed by the latest DMI and RSI values.

PI remains one of the most coins in the market, and made Newspapers repeatedly. Recently, the CEO of Moonrock Capital Simon Denitic Wash Trading in the PI network. Before that, the currency rose after the Florida companies started accepting PI currencies.

Poor purchase pressure and height of the Haboodi feelings indicate a possible transformation in the positive market morale in recent days. If EMA continues to be rapprochement, it may indicate the imminent direction, which puts the ups of the bi -ups.

If PI can restore the strength of the upward trend, it may rise to test levels above $ 3 for the first time, and may reach $ 3.5.

However, if the trend is reflected, the PI price can test support at $ 1.69. If this level is lost, it may continue to decrease to $ 1.42. If this support fails, the PI network may decrease to $ 0.8, which represents a large correction of 68 %.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.