PI (PI) decreases by 44 % in 4 days with the growth of descending feelings

Pi Network (PI) is subject to escalating pressure as technical indicators and societal spirits are increasingly declining. Despite the profit of 23 % during the past week, the PI decreased by 44 % in just four days, as it decreased to less than a sign of $ 1 after a violent reaction to the launch of its fund of $ 100 million.

Indicators such as Ichimoku Cloud and BBTREND show a momentum, with no signs of reflection. PI may remain vulnerable to pressure on the additional downside if the main resistance levels are recovered and pressure returns are purchased.

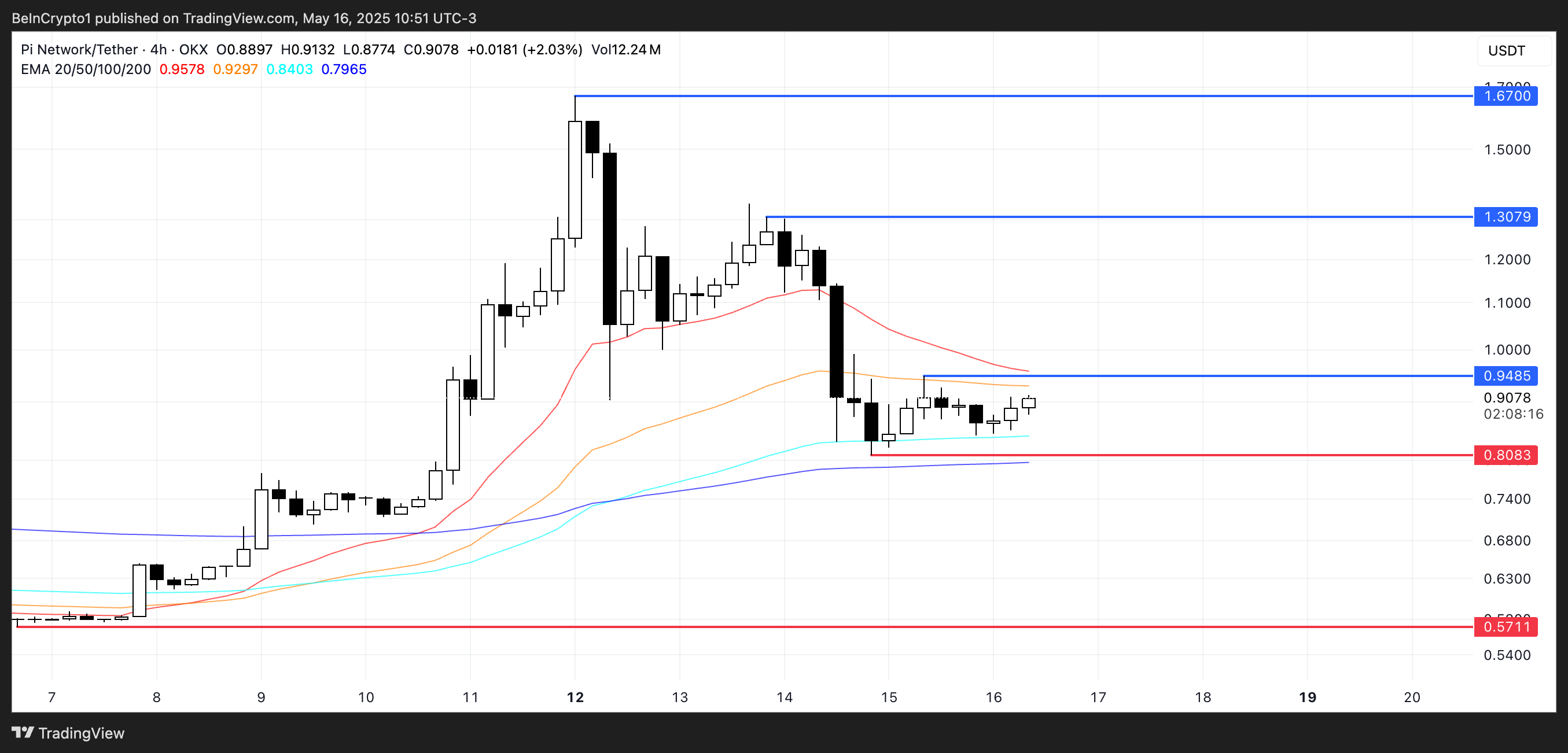

PI fights below the cloud while continuing the landfill

The Ichimoku Cloud scheme of PI (PI) shows signs of constant weakness after a sharp decrease. The price movement is lower than Kijun-Sen (the red line) and close to Tenkan-Sen, indicating that the short-term momentum remains declining.

Modern candles also interact with the lower boundaries of the Kumo cloud (green/red shaded area), indicating the frequency in restoring the rising prep.

Chikou SPAN (green retardation line) is now placed below the price candles, which enhances hippos.

Despite the current monotheism near the edge of the cloud, there is no strong signal after reflection. The pioneering lines that make up the Komo are a slightly flat and double feet, indicating limited upward support in the short term.

In order for the feelings to turn, the PI must be decisively broken over both Kijun-Sen and Cloud, confirming the reflection of the potential direction.

Until then, the graph prefers caution, as the bears still carry the upper hand.

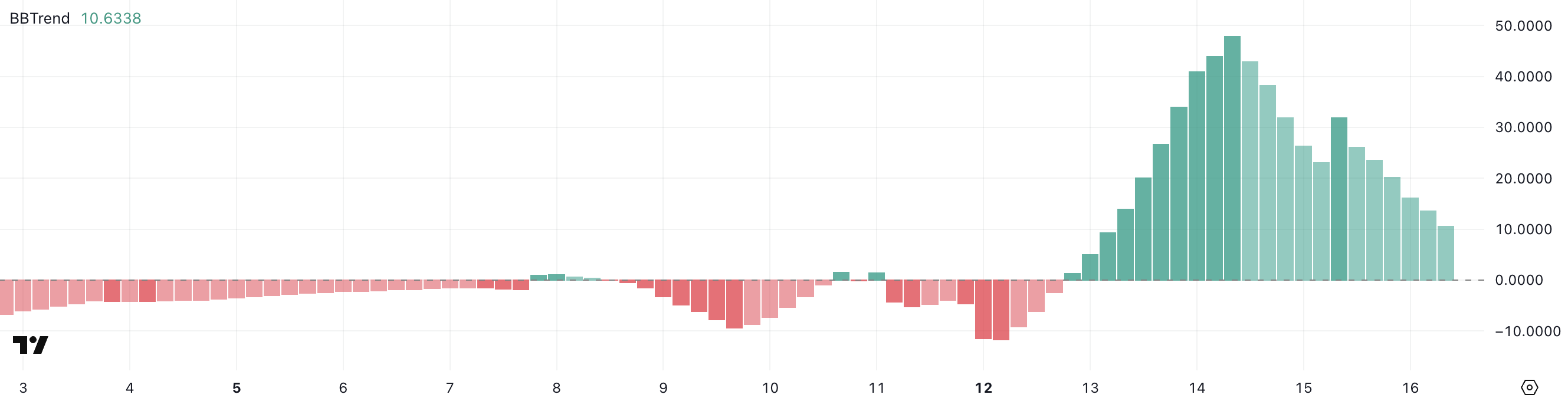

The power of the PI network collapses with Bbtrend drop to 10.63

The PBTREND index of the PI decreased sharply to 10.63, after the peak near 48 days ago and fell to 32 yesterday.

This sharp fall reflects a great weakness in the strength of the trend over a short period, indicating that the last upscale momentum fades quickly.

The rapid loss in the intensity of the direction may indicate a transition towards monotheism or even a possible reflection if a new purchase pressure does not appear.

BBTRIND (Bollinger Band Trend) measures the strength of the price by comparing the Bollinger range to fluctuate prices.

Higher values usually reflect a strong behavior that is directed – either up or downward – while low values indicate side movement or poor momentum.

In 10.63, BBTRand suggests from PI that the original may enter a neutral stage, where the fluctuations and price contracts can range without a clear direction unless the new collapse or collapse develops.

After announcing the $ 100 million PI Network Ventures, Pi Network faces increasing pressure from its community and the market.

Despite the launch of the initiative to enhance the growth of the ecosystem and the adoption of the real world, critics argue that the project has failed to achieve the main promises-such as the launch of 100 DAPS applications, time kyc operations, and referral rewards.

Many pioneers believe that the box is a distraction from the problems that have not been solved, especially since the applications are collected via a simple Google model. The market morale reflected this frustration, as the price of PI decreased to less than one dollar and decreased by 44 % during the past four days.

Technically, the PI indicators support Haboodi expectations. A momentum such as DMI and CMF shows low strength and increased distribution, while EMA lines are tightening and glimpsing the potential death cross.

Although PI has increased by 23 % during the past seven days, the last procedure indicates loss of confidence and the possibility of more from the negative side.

If the distinctive symbol fails to keep the key support level of $ 0.80, this may decrease to $ 0.57 – but if the momentum returns, 0.94 dollars may open the path to $ 1.30 or even $ 1.67.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.