Pi network struggle with mixed momentum $ 1

PI (PI) enters May with mixed technical signals. Momentum indicators indicate a strong declining direction, while the flow of money is hinting to potential accumulation. ADX has risen above 50, indicating a strong declining direction.

Meanwhile, the flow of Chaikin (CMF) has become positive for the first time in weeks, indicating early signs of the purchase renewal. However, as Emas continues to go shortly to less than that long -term, PI should carry the main support at $ 0.547 to avoid deep losses.

The PI network enters a strong declining direction, where ADX screws exceed 50

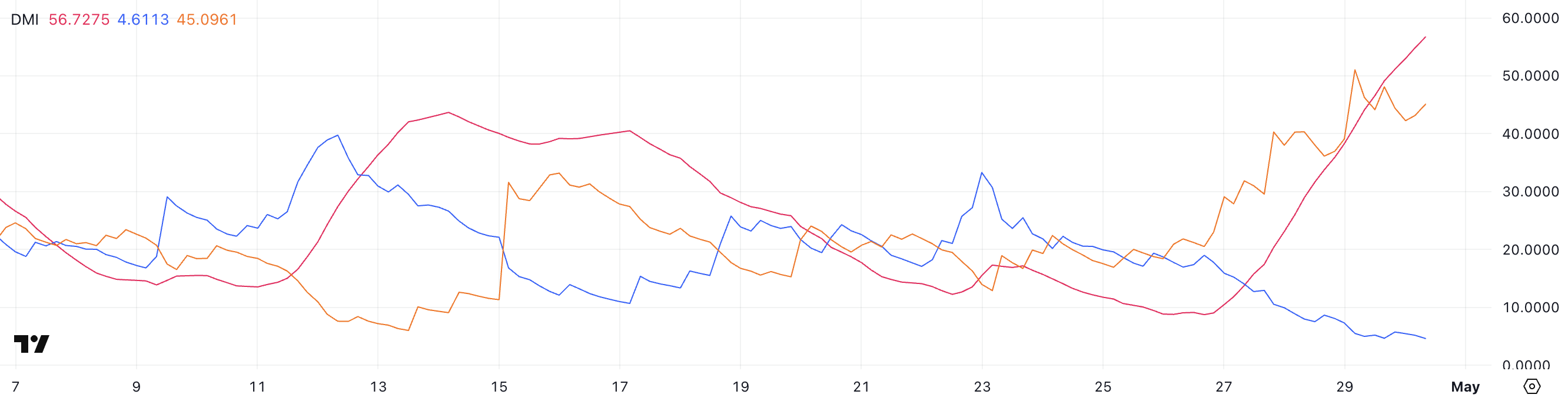

The DMI (direction movement index) of the PI network reveals a major shift in the directional power, with ADX (average trend index) to 56.72 from 10.48 only three days ago.

ADX measures the strength of the direction regardless of its direction, with readings above 25 indicates a strong direction.

The reading that exceeds 50, as we have seen now reflects a very strong trend in playing – which traders often consider them as dominant and continuous in the short term.

At the same time, the collapse of trend indicators indicates that the dominant trend is declining.

+Di, which measures upward movement, sharply decreased from 15.88 to 4.61, while -Di, which tracks the descending movement, dramatically from 23 to 45.

This extensive gap between +Di and -Di enhances the opinion that the PI network is in a strong and accelerating direction. Unless the purchase of pressure revenues soon, technical indicators indicate that the downside may be coming.

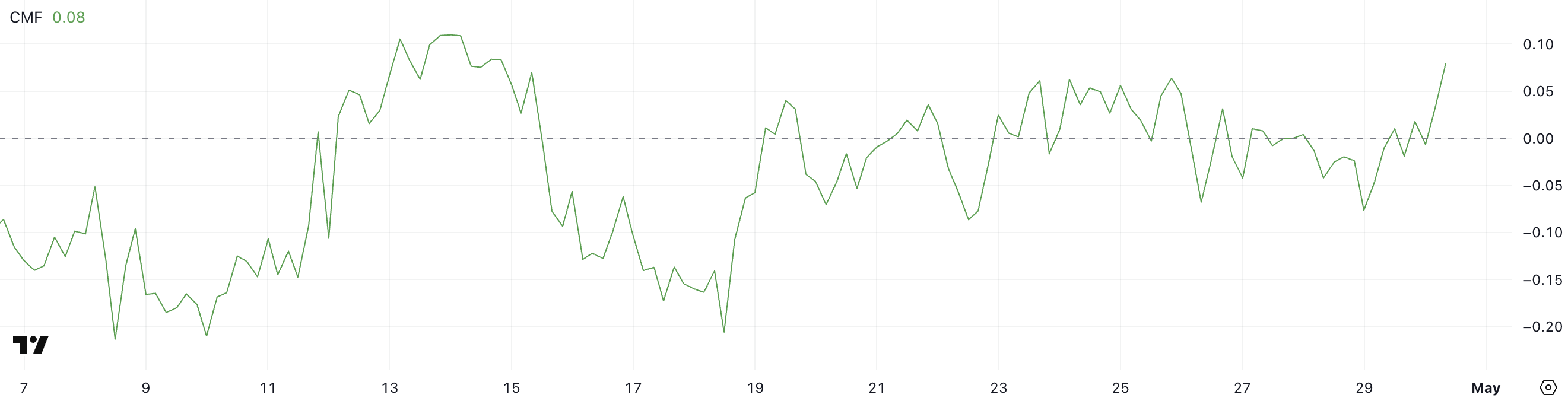

Pi CMF hits the highest level since mid -April

The flow of Chicin money (CMF) has risen to 0.06, from -0.08 just one day ago, which represents its highest level since April 14.

CMF is an indicator based on size that measures the flow of money inside or outside the original over a specified period. It ranges between -1 and +1, with values higher than 0 indicating the purchase pressure (accumulation) and values less than 0 signaling pressure (distribution).

The continuous readings in positive lands often indicate that the market participants have begun to collect the original.

With CMF PI now at 0.06, this shift indicates a possible change in the feeling, indicating that more capital flows into the distinctive symbol after a period of external flows.

Although the level is still relatively low, the transition to a positive and high -end area may indicate that the declining momentum weakens.

If this trend continues and is confirmed by a stronger procedure or size of the price, it may increase the possibility of a short -term restoration or installation of the PI price.

However, more confirmation will be needed before determining a clear upward trend.

PI faces the main support test, where the EMA structure remains a declining

The PI network is currently working in a declining technical preparation, as it sits average short-term mobility (EMAS) at the bottom of the long term-a structure that usually indicates continuous declining momentum.

The distinctive symbol has decreased more than 12 % in the past seven days, reflecting the increase in the pressure pressure. If the correction persists, PI may soon test the level of immediate support at $ 0.547.

The collapse below can open the door for a deeper decline towards a scale of $ 0.40.

However, if the trend reflects and restores buyers, the PI price can re -test the resistance level at $ 0.665.

The collapse above this threshold may lead to more upward trend, which may push the price towards the next main resistance at $ 0.789.

The current EMA alignment still prefers the bears, but the transformation of the momentum-which is certain through the size and prices-can change the short-term look.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the conditions, conditions, privacy policy have been updated and the evacuation of responsibility.