Pi network struggle with mixed momentum $ 1

The PI (PI) offers stability marks after a turbulent month, and has gained 4.7 % during the past seven days. However, it is still working to recover from an acute correction of 31.5 % over the past thirty days.

While some technical indicators such as DMI indicate a high directional strength, others – such as CMF and EMA – still indicate continuous declining pressure. With buyers and sellers currently in tightening the rope, the next step for PI will depend on whether the main support or resistance levels give way first.

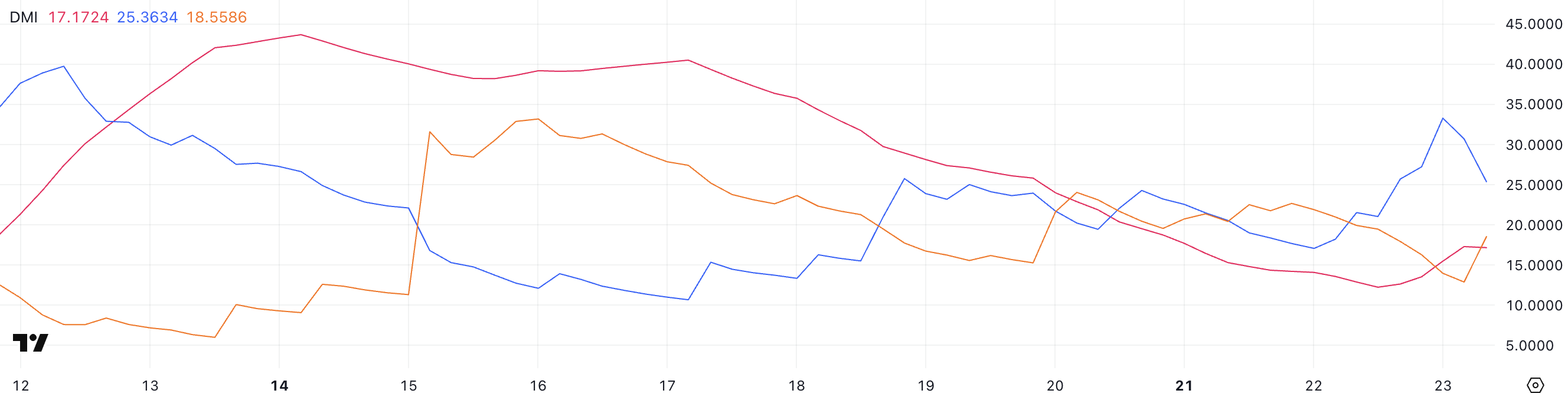

PI DMI shows the growing trend power, but momentum cools

The trend movement index in PI (DMI) explains that ADX (average trend index) rose to 17.17, up from 12.24 only yesterday.

These increased signals that started the direction of the direction began to build, although they are still lower than the 20 -softest threshold used to determine the beginning of a strong direction.

ADX does not show the trend – only the power of the current trend – even the increased ADX, even at lower levels, is usually a sign that the market momentum may pick up.

Looking at the deepest in DMI components, the DI +(the positive trend index) is currently at 25.36, up from 18.22 yesterday, although it was cooled from a height of only 33.2 hours. Meanwhile, the -Di (the negative trend index) is at 18.55, a decrease from 21.89 yesterday but slightly higher than the lowest level of 12.89.

This shift indicates that the upscale pressure is still dominant, but some of the purchasing momentum has recently faded, while sellers try to re -enter. If +Di +Di and ADX persist in height, PI can resume its upward move.

However, if the direction is weakened and the -di climb more, the price may enter a volatile or corrective stage.

Pi Network CMF slips to below zero, which indicates caution

CHAIKIN Money Flow (CMF) of the Pi network is currently at -0.06, after recovering from -0.09 to neutral (0) earlier today and dipped again in the past few hours.

This reflection inside the day may indicate a weak purchase pressure after a short accumulation.

CMF measures the flow of money inside and outside the original over a certain period, and combines price and size data to assess whether buyers or sellers control.

The CMF value suggests above 0 to purchase pressure, while the value is less than 0 points to sell pressure. With CMF PI at -0.06, the current reading tends to a slight landing, indicating that sellers currently have a greater effect than buyers.

The failed pressure may reflect a positive area, followed by a decline, the frequency of the bulls and the possibility of poor price in the short term.

However, if the CMF settles and turns into positively again, it may support the continuation of the upward momentum.

PI EMA lines are still an identity with the emergence of the main support into effect

The PI’s Si -Mobile Mediterranean Lines remain in a declining alignment, as the short -term averages continue to the bottom of the long -term lines.

This setting usually reflects the constant declining pressure and the lack of strong upward momentum. If the support is tested at $ 0.617 and fails to keep it, the PI price may slip to $ 0.59.

If this level is separated from the strength of the declining direction, then the following main support is $ 0.547 – a level that can serve as a deeper floor if the sale continues.

In the upscale direction, it can change the reflection and form a sustainable bullish direction. If PI can get enough strength to test and break the resistance at $ 0.789, the next upward goal will be $ 0.85.

A certain outlook can then open the path about $ 1.04, which represents the first time that the price has been traded over one dollar since March 23.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.