Pi Network (PI) rises 11 % – will you continue in the upward trend?

Pi Network (PI) returned to the spotlight after a 11 % price increased due to the withdrawal of more than 86 million symbols of OKX, which sparked a speculation of coordinated supply pressure. This step has been intensified of the upscale morale, especially since technical indicators begin to comply with the price procedure.

Momentum indicators such as DMI and EMA indicate an increased strength, and a potential gold cross -cross hint that a continuous outbreak can be possibility. However, not all signals are fully confirmed-sized-based standards such as CMF width of the frequency, making the next few days decisive to confirm the direction of PI.

Technical indicators support PI amid speculation of shocking show

The PI (PI) increased by 11 % after withdrawing more than 86 million icons from the OKX Stock Exchange, significantly reduced the PIM reserves to only 21 million.

The sudden migration of symbols has sparked speculation of coordinated supply pressure, as some investors explain this step as a strategic effort by adult holders to reduce the circulating offer and may pay the price up.

The voices of society described the event as the “step of strength”, noting the increasing confidence in the future path of the original.

While this pushing the bullish momentum and strengthening the PI to the top of the CONINECKO direction menu, the questions are still standing in terms of their long -term basics, especially their main aspirations, exchange lists, and the development of the wider use status.

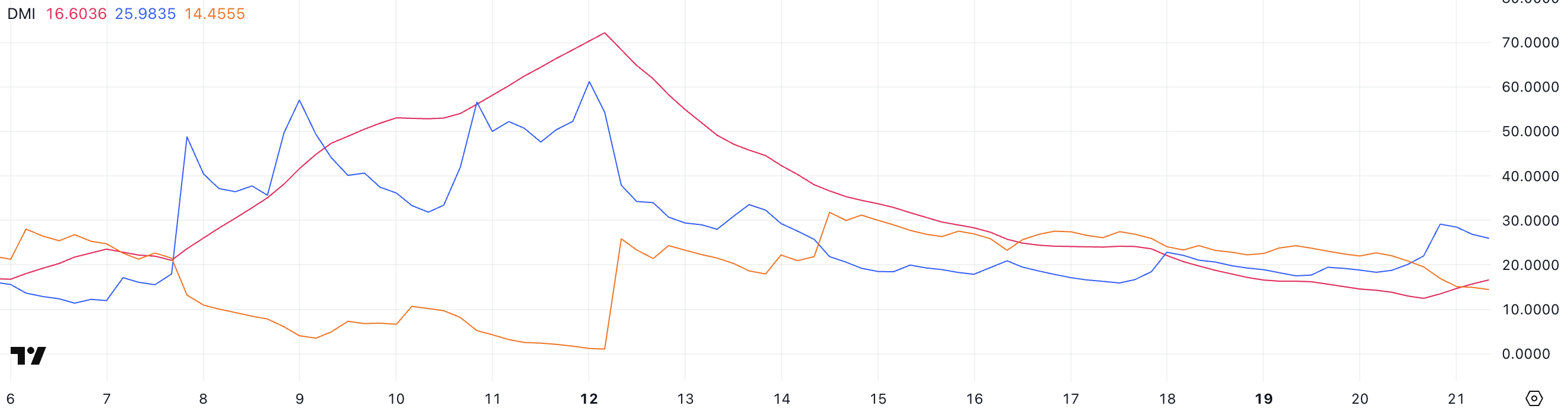

From a technical perspective, the trend movement index of PI (DMI) shows signs of increased strength. ADX – a scale that measures trend strength – rose from 12.46 to 16.6 last day, indicating that the momentum is built. ADX values are usually above 20 to grow, as readings are higher than 25 powerful.

Meanwhile, the Di +line, which tracks the upper pressure, sits on 25.98 – from 20.14 yesterday, although it slightly decreased from its peak earlier today at 29.15. -DI, which represents the declining pressure, dramatically to 14.45 out of 20.84 yesterday.

This difference indicates that the bulls control control and that the sellers are retreating, which supports the narration that the PI network may enter a more decisive upward trend if this momentum continues.

Pi CMF falls after a short height, indicating the removal of the purchase pressure

Despite the last increase, the PI CMF is now at -0.03.

Chaikin Money Flow (CMF), which is an oscillator that depends on the size of purchase and sale over a certain period. CMF values range from -1 to +1, with readings above 0 indicating accumulation (purchase pressure) and less than 0 indicates distribution (sale pressure).

The closer the value is either, the more pressure it reflects.

Currently, CMF is from PI -0.03 -a remarkable improvement from -0.17 two days ago, but a retreat from +09 yesterday.

This shift shows that although the total pressure pressure has declined significantly, the recent decline below the zero line indicates that buyers did not completely control. CMF, which hovers around the neutral area, can refer to the frequency in the market or temporarily stopping after the last gathering.

In order to regain the bulls completely momentum, CMF will perfectly need to return to positive lands and keep them, confirming the continuous capital flows and supporting the issue to continue the upward trend.

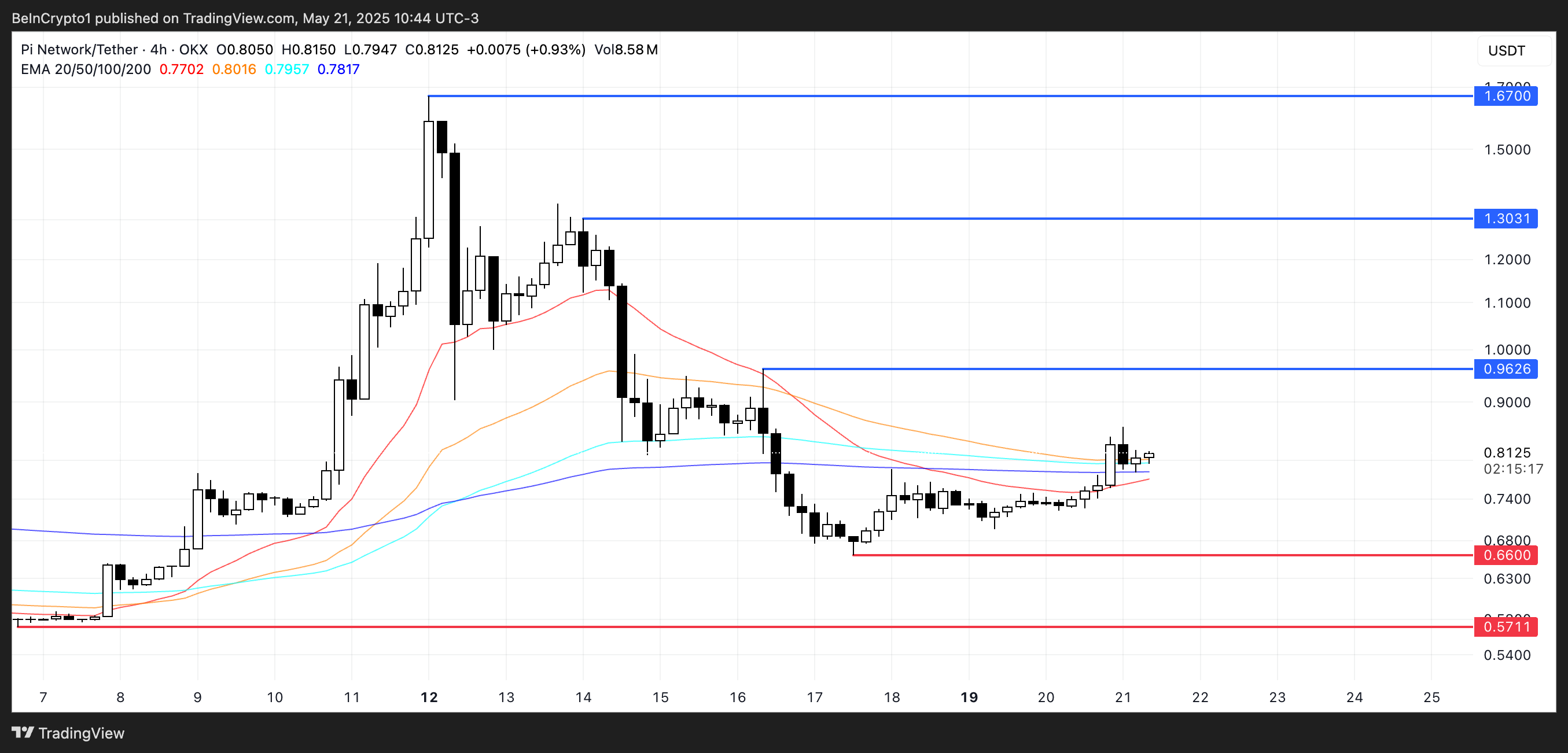

Golden Cross SETUP builds for PI, but the main resistance is still playing

The PI’s EMA lines began to align a bullish preparation, with a potential gold crossing on the horizon. The golden cross occurs when EMA expresses the short term in the long term, indicating the possibility of a continuous upward trend.

If this pattern is confirmed, the PI price may gain enough momentum to challenge the resistance at $ 0.96.

The collapse above this level may open the door for more gains about $ 1.30, and with strong follow-up, the price can reach $ 1.67-levels that have not been seen in the last trading activity.

However, the ascension scenario is not guaranteed. If you lose the current upper steam trend and the purchase pressure weakens, the PI network can be recovered to test the support at $ 0.66.

The collapse below is likely to turn up with this level more down, which exposes the distinctive symbol of more negative aspect of about $ 0.57.

Although technical signals are optimistic at the present time, merchants will closely monitor whether the golden cross is achieved and whether the resistance levels can be convincing.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.