Peter Chef mocks Michael Silor to create the most ridiculous Bitcoin use

Critic Peter Chef Petron acknowledged what he described as the “first real use issue” for Bitcoin. Gold supported digital assets, Peter Chef has repeatedly said that Bitcoin has no benefit.

However, in a recent publication on X, he pointed to a position that includes investment manager Jim Chanus as an example in which Bitcoin may serve a practical role.

Peter Chef criticizes the purchase of Michael Celor Bitcoin

According to X Post, critic Peter Chef Petron Note Bitcoin may finally have use – although Bitcoin’s preachers are not promoted. He referred to the investor Jim Chanus, who recently revealed that he bought Bitcoin to hedge in his short position in Microstrate (MSTR).

The strategy, led by CEO Michael Celor, continued to increase bitcoin holdings. The company now owns approximately 570,000 BTC. This prompted some market monitors to the MSTR width as Bitcoin’s agent with the risks of additional companies. Chef has mocked this strategy, saying that Silor was “accidentally created a real use of Bitcoin”, as BTC investors use themselves to protect themselves from the risks associated with Silor Private Company.

The Chanos Investment Manager is famous for reducing the shares of companies, which he considers careful or poorly weak. Like Peter Chef, he is said to see Mstr outperforms the Bitcoin strategy. By owning Bitcoin during MSTR shortening, Chanos aims to reduce its losses in the event of an increase in Bitcoin.

Chanus is betting against Microstrategy

In X Publishing, Chanos explained that investors pay a lot for every dollar of bitcoin exposure through the strategy. According to his statement, the MSTR shares are traded with a bonus much exceeding the actual value of the Bitco Holdings. Satellite,

“Investors pay $ 3 from the stock price to get $ 1 of bitcoin exposure.”

Chanus hedging strategy indicates that although MSTR stocks may decrease due to its estimate, the bitcoin that carries it can weaken these losses.

The strategy also criticized the borrowing of money to buy bitcoin. The company recently added 13,390 BTC for about $ 1.34 billion. Critic Peter Chef Peter Chef repeated these concerns, saying that the large BTC prices can turn paper profits into real financial pressure for the strategy.

Chef argued that the strategy no longer operates as a software but as an entity from Bitcoin. He asked about the logic behind buying a company that has a major commercial activity, which is to obtain bitcoin, instead of investing directly in Bitcoin or in companies that have actual operating revenues. He said ,

“If you want to buy Bitcoin, buy Bitcoin. If you want to invest in the stock market, buy an actual work company.”

Despite this reverse reaction, the pro -XRP lawyer John Diton Michael Sailor praised his long -term strategy to Bitcoin in the long run with Warren Buffett’s investment approach with Berkchire Hathaway. He stated that Silor may aim to control up to 5 % of the total Bitcoin supply in circulation despite the irony.

Microstrategy stock (MSTR) performance

Microstrategy (MSTR) has gained approximately 40 % in 2025, reflecting the bullish trend of Bitcoin. However, Peter Chef argues that this growth is more associated with the movement of bitcoin than the company’s primary performance. This has led to concerns about sustainability if Bitcoin enters a correction stage.

However, the recent purchases by companies such as metaplanet and the tether -backed company have strengthened Twenty One Shares optimism about the bitcoin price to violate the resistance to the highest new level ever.

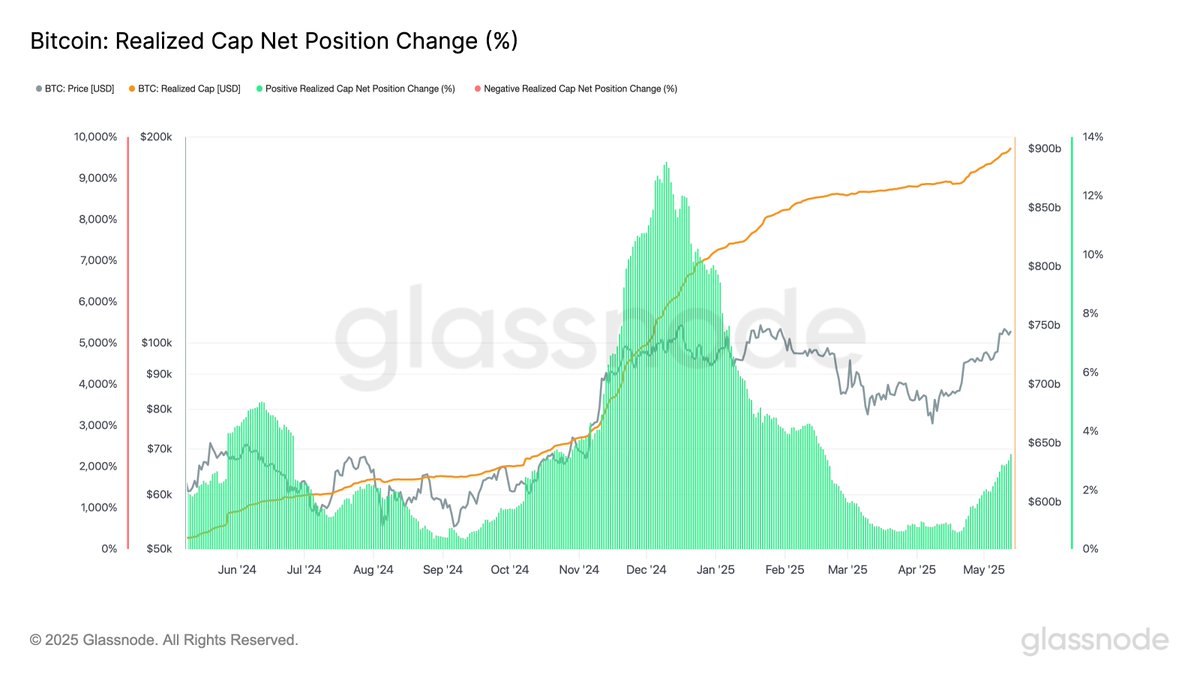

The broader Bitcoin market is currently in the range of price unification between $ 100,678 and $ 105,700. Analysts expect a possible outbreak if the BTC price is higher than the main levels. Glassnode data shows that the maximum Bitcoin has increased by 30 billion dollars since April 20, indicating that the new capital is entering the market and is a prelude to bullish penetration.

Responsibility: Is market research before investing in encrypted currencies? The author or post does not bear any responsibility for your personal financial loss.

partner: