The PI network reaches an increase at all with an increase in trading volume

Pi Network has increased by more than 70 % in the past 24 hours, and the market value has paid to $ 16 billion and its size to more than $ 2.3 billion in the past 24 hours.

Despite reaching the highest new levels ever near 3 dollars, this technical difference indicates the presence of a volatile path forward for the PI. Traders are closely monitoring while the distinctive symbol moves between the upscale momentum that can be paid by about 4 dollars and the warning signs that may lead to withdrawal to support low levels of $ 1.7 or even $ 0.79.

The PI DMI network shows that the upward trend is very strong

The trend movement index of PI (DMI) shows a great momentum, with average average trend index (ADX) to 57.7 out of 12.3 only a day ago.

ADX is a major technical indicator that measures the strength of the direction regardless of its direction. Readings that are less than 20 generally indicate a weak direction, 20-40 indicates a moderate direction, and values of more than 40 indicates a strong direction.

This ADX dramatic increase of PI from weak lands is very strong to great intensification in the strength of the primary direction.

To complete this ADX increase, the PI (+DI) index rose sharply to 40.9 from 14.6 days ago, while the negative trend index (-DI) decreased to 1.1 out of 19.4 in the same period.

When +Di is much higher than -Di, as currently with PI, it confirms a strong upward trend. The combination of a high ADX value with a wide spread between Di and -Di +indicates that the PI network is witnessing a strong strong trend with the minimum sale pressure.

If these technical signals maintain their current formation, they may indicate a continuous escalating price movement for PI in the short term, as it seems that the market is under the control of strong purchase with the minimum resistance.

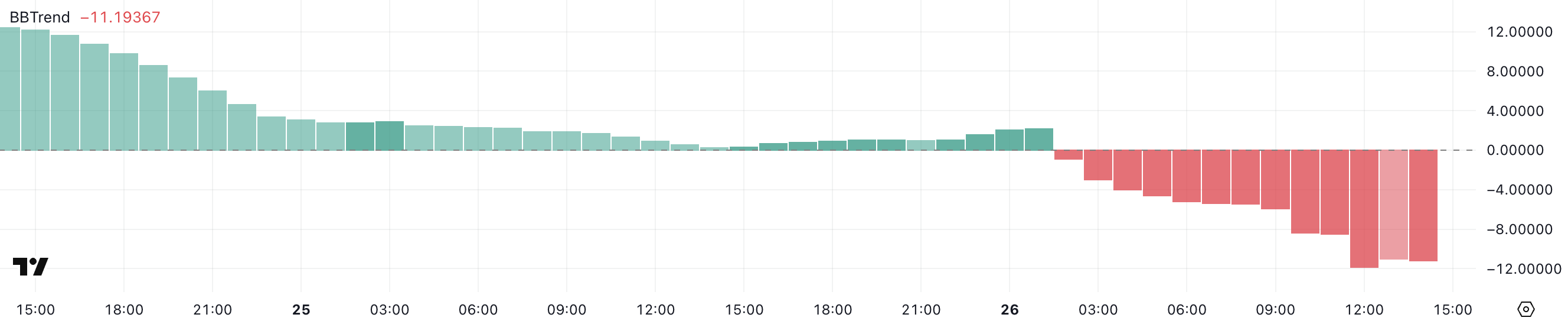

PI BBTRand is negative despite the price increase

Despite the increase in the continuous prices, the Bollegerer Bands (BBTREND) trend decreased to -11, which represents a significant decrease from its reading of 51.2 just three days ago, after it hovered between 1 and 3 yesterday.

The BBTREND is a specialized technical tool that measures price movement for Bollinger. It mainly determines how the price is within these volatile channels.

Positive readings refer to the progressive price movement for gangs, while negative values indicate the dominant movement or the reflux towards the middle range.

This sharp decline can indicate to -11 in BBTREND in PI that the current upward trend has become excessive and perhaps vulnerable to correction or monotheism.

When BBTRand turns significantly negative after increasing the price, it often indicates that the original may move very quickly and is now circulating with levels that may be unsustainable in the short term.

This technical warning brand indicates that PI may face a decline towards the middle Bollenger Band, or a side unification period, or at least, slowing down its rising momentum.

Can PI reach $ 4 in March?

The price of the PI network has reached its highest level ever just hours, when its price approached 3 dollars for the first time.

With this bullish powerful momentum, PI can continue to ascend, penetrating the psychological barrier of $ 3 and testing higher resistance levels at $ 3.5 or even 4 dollars in the near term.

This impressive gathering shows the increasing interest of the market and the purchase pressure that can maintain more upward trend if positive feelings continue.

However, as shown in the negative BBTRand reading, this gathering may be excessive and at risk of reflection. If the firm technical signal is achieved in prices, PI may suffer from a large correction, initially in the support test at $ 1.7.

If this level fails to keep, then an additional decrease to $ 1.42 becomes likely to intensify the pressure pressure.

In the scenario where the strong landmark wanders, the PI price may have a more dramatic decline to $ 0.79, which represents its lowest level in five days and a significant decline in the current levels.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.