Outlook Sol Price Outlook: What is the following with a decrease in Solana 99 % transfer volume

Solana struggle is escalating under Mark, $ 140, amid Haboodi’s feelings.

Most encrypted currencies violated reliable support barriers, as the Trump’s encryption party ended with a decrease in Bitcoin to less than 90 thousand dollars.

Solana changes his hands at $ 133, with an invested and rolling activity, indicating more pain before solid reflections.

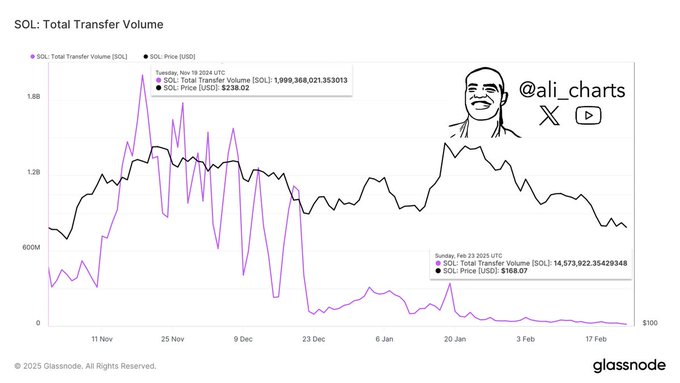

Glassnode data The total transfer volume of Solana decreased from $ 1.99 billion in November last year to its lowest level in this week, amounting to $ 14.57 million.

Billions come out of the Solana environmental system

DIP coincided with more than 99 %, with Sol prices fell from $ 238 to $ 168 in the time frame for three months.

This reflects billions of users who come out of the Solana ecosystem, proving the hopes of stagnation near the period for Altcoin.

Solana once dominated billions of 24 -hour transportation.

However, the trend has shifted, with a sharp diving indicating the diminishing participation and demand for the chain.

Factors such as lower interest from institutional players or the deportation of liquidity to other Blockchains pushing such trends.

These developments have intensified as Solana has faced increasing criticism over the past few months.

Experts and the cryptocurrency community attacked the network to facilitate fraud activities after the scale accident.

Solana’s new amelos, such as Trump Trump and Melania, have raised amazing losses to investors.

Fraud deals have erupted on confidence in the Sol network, explaining the delusional demand.

Will such trends delay the possible Solana recovery after the wide market decline?

Sol Price Outlook

Solana is trading at $ 133 after a decrease of more than 5 % in the previous 24 hours.

The large daily trading volume highlights the dominant sale, threatening more pain for Sol.

The Haboodian technical indicators turned after the huge Solana decreased from mid -January levels of $ 280.

The Si-moving average decreased for 50 days to less than 100 days of EMA, which increased the chances of the death cross-as it decreases 50 days under the EMA for 200 days.

Moreover, the daily relative strength index decreased to the sale area, indicating an increase in the declining momentum.

Meanwhile, the derivative market data brings some hope.

Despite the low prices, the long/short Solana ratio reflects the bulls and equal bears.

Moreover, the likely volume of financing increased to 0.0033 % (Coinglass data).

This indicates the enthusiasm of merchants to pay insurance premiums to implement the phase.

The Solana path in the short term depends on its movements on biological support 130 dollars.

Stability over a foothold can lead to a revival of more than $ 140, which may attract a great activity.

However, weakening the demand indicates more declines before the crucial for Sol.

The analyst Ali Martinez highlights the emerging preparation of the upholstery.

A break under $ 130 is likely to lead to $ 65 – a decrease of approximately 51 % from the current Solana price.

Solana may take longer to recover from the last recession due to the modest activity on the chain, poor demand, and conflicts in the wide market.

Enthusiastic can see how developments such as Solana ExchandE Trocc Fund affect Sol’s performance in the upcoming sessions.

Opert Sol Price Outlook: What is the next with 99 % decrease transmission on Invezz