Cardano (ADA) predicts on February 25

ADA, the original distinguished symbol of Cardano Blockchain, has witnessed a significant decrease in prices during the past 24 hours, as it reached the level of decisive support. As of today, February 25, 2025, ADA has decreased by 13 % and is currently trading near $ 0.67, while trading volume increased by 110 %.

Technical Analysis Cardano (ADA) and the next level

According to expert technical analysis, ADA’s recent decrease in the decisive support level reached a mark of $ 0.65. Historically, this level was a strong price reflection area. In addition, ADA’s daily chart pulled up a bullish sign, as technical indicators show a bullish difference during the same period.

Besides this upscale difference, ADA’s daily chart is a double -priced working pattern on the daily time frame. This upscale view indicates that the ADA price can be recovered soon and experience a prominent bullish momentum.

Based on the modern measures of historical prices and trends, if ADA is higher than the level of $ 0.65, there is a strong possibility that the original will rise by 20 %, and reaches a level of $ 0.84 in the near future.

Mixed metrics by scales on the chain

After noticeable prices and with Ada reaching a decisive support level, the whales and long -term holders were accumulating Ada, according to the analysis company on the series Coinglass. Immediate flow/external flow data reveals that exchanges have witnessed a large flow of $ 22 million of ADA.

This large external flow indicates a possible accumulation, which may create pressure to buy and pay more bullish momentum, a trend that has already started the price in a gradual experience.

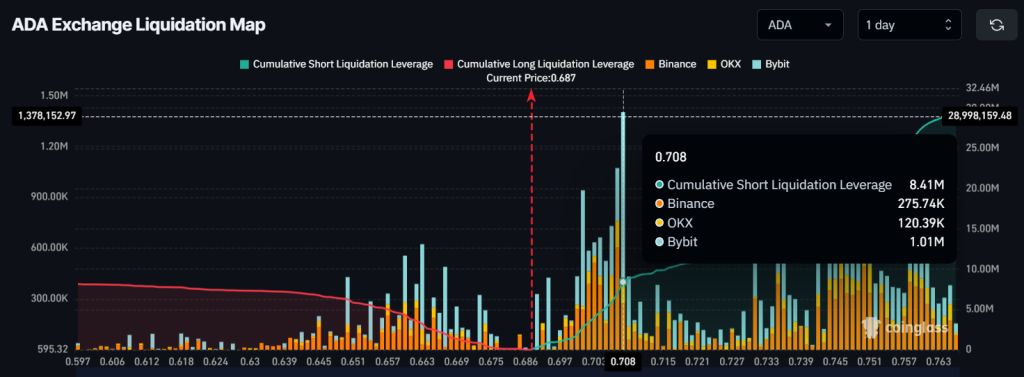

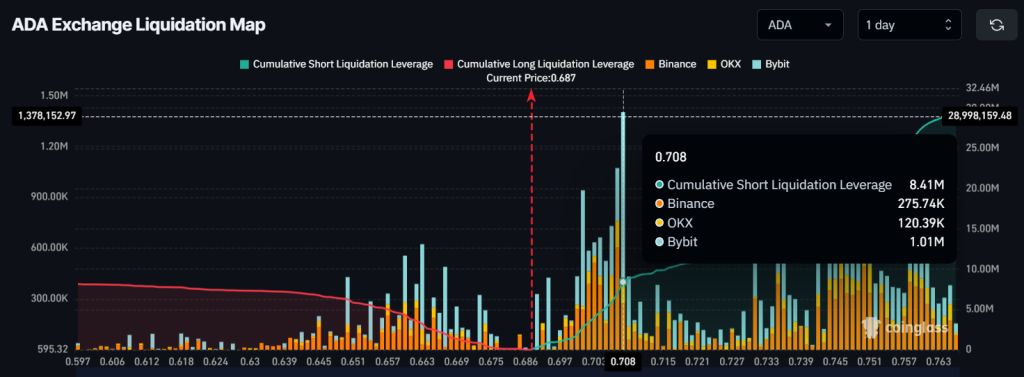

Although the bullish market between the whales and their long -term holders feels that merchants are betting on the short side, expecting the price will continue to decrease in the coming days. At the time of the press, the main liquidation areas are $ 0.663 on the bottom side and $ 0.708 on the upper side, with excessive traders at these levels.

In addition, traders held long positions worth $ 3.25 million and 8.41 million dollars from short positions at these levels. This data indicates that the bears remain active and currently control the original.