Will the interest rate decision revive the demand for purchase?

Last week, Bitcoin (BTC) witnessed great fluctuations. The conflicting market signals created a declining pressure, preventing merchants from placing a clear directional direction. As a result, the main altcoins such as Ethereum and XRP decreased to the decisive price points. However, after hints from CPI and American PPI data that may be inflation, the market has risen, controlling the stage for a possible upper week.

The interest rate decision can refresh the encryption

Amid a 2 % decrease last week, Bitcoin continues to face huge risks on the downside due to multiple macroeconomic pressure.

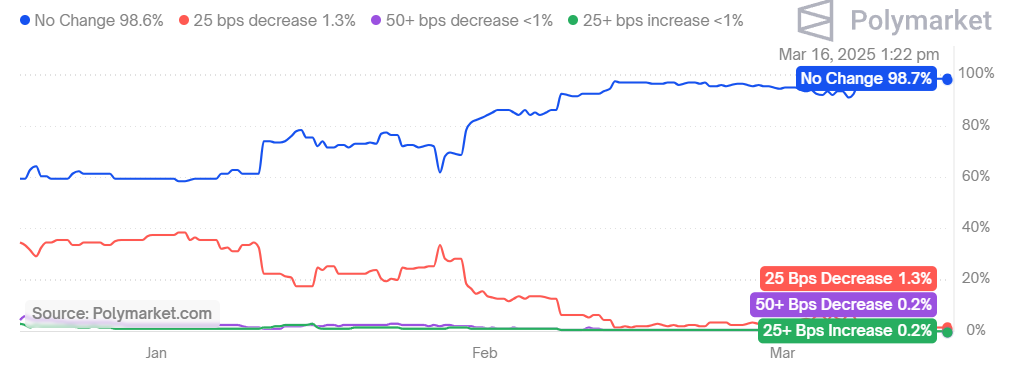

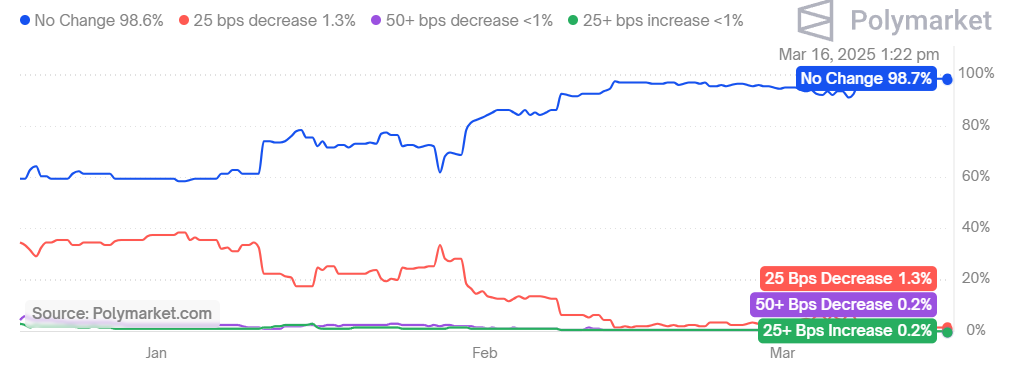

In a brighter note, analysts in encryption markets, such as polymarket, are optimistic about a potential stop at the high federal reserve rate next week. In addition, there is an increasing hope that geopolitical tensions between Russia and Ukraine may reduce.

Polymarks betting on 99 % of temporarily high stops in the Federal Reserve in March, with Russia Ukraine’s possibilities stopped to approximately 80 %. In the event of these developments, an increase in the appetite of risk can lead to an increase in investments in bitcoin and other encrypted currencies, which may lead to more upscale momentum next week.

Bitcoin prediction

Bitcoin Bulls is trying to recover, although it is likely to face a large resistance between the EMA20 direction line and 86.7 thousand dollars. Currently, the BTC price is 84,262 dollars, as it has increased by 0.09 % over the past 24 hours.

If the price remains higher than EMA for 20 days, this may indicate that the last decline to less than $ 84,000 was just a bear trap. Under these circumstances, the BTC/USDT pair may rise to the decisive level of $ 86.7 thousand and extends to $ 93,000.

On the other hand, if the price decreases sharply from this resistance area, it indicates that the bears have the upper hand. This can increase the possibility of a decrease to the level of decisive support at 79,974 dollars.

Predicting ETHEREUM price

The ether faces increased volatility around the descending resistance line, indicating an increase in the hegemony between buyers and sellers. The price of the ETH was unified without a mark of $ 2,000. As of writing this report, the ETH price is trading at $ 1923, with more than 0.2 % in the past 24 hours.

The RSI has begun to show early signs on the positive difference. If the price is violated, the EMA50 trend line, the ETH/USDT pair may rise to the level of collapse of $ 2,109. At this level, bears may intensify their sale efforts; However, if the bulls can keep their momentum, the couple may advance towards SMA for 50 days at $ 2530.

This positive view will be nullified if the price fails to keep $ 2,109, then less than $ 1772. Such a step indicates a declining domination.

XRP prediction price

XRP bounced out of the support level $ 2 and broke over the EMA20 direction line on the graph for one hour. Bears try to stop recovery in this EMA, but the continued purchase of pressure from the bulls indicates a possible outbreak over it.

If successful, the XRP/USDT pair can reach $ 2.65. Over this level may lead to the reinforcement stage to $ 2.97.

On the contrary, the sharp decline in the current level indicates that the feelings remain declining. In such a case, the husband may restore critical support 2 dollars.