ONYXCOIN (XCN) offers signs of reflection after a 200 % footnote

Onyxcoin (XCN) has decreased by approximately 10 % over the past seven days, as it cools after a 200 % acute crowd between April 9 and April 11. The momentum indicators indicate that the bullish trend may lose its strength, as both RSI and ADX show signs of faded condemnation.

While Xcn’s EMA lines remain in an upward formation, early signs of a possible reflection appear with the start of the short term in the slope down. The coming days will be a key to determining whether ONYXCOIN can settle and resume climbing – or if the correction is the deepest horizon.

Onyxcoin shows early installation signs, but the momentum is still uncertain

Onyxcoin (RSI) is currently sitting at 43 years. Readings that exceed 70 usually indicate that the original may be excessive and may be due to withdrawal, while readings that are less than 30 indicate.

The levels are between 30 and 70 neutral, and often reflects monotheism or frequency in the market.

RSI from Xcn indicates a neutral condition but shows signs of gradual recovery. Although it did not serve as a clear bullish sign, the bullish step yesterday indicates that the declining momentum may be abandoned.

However, the fact that RSI failed to reach above 50 reflects the constant uncertainty and the lack of constant purchase pressure.

At the present time, it appears that Xcn is in the phase of waiting and vision, where the continuous rise in RSI can refer to a shift towards the renewed upward trend, but any other weakness may keep the price besieged in the scope of unification.

Xcn Uptrend weakens the ADX signals fade

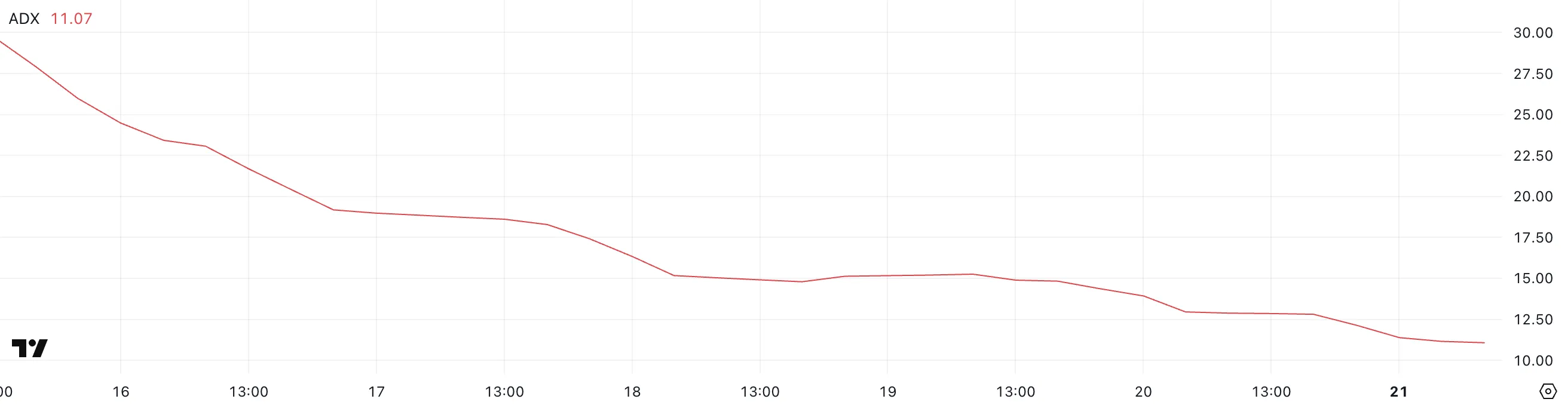

The average trend index in ONYXCOIN (ADX) decreased to 11, a decrease from 13.92 yesterday and 15.26 two days ago. This decline reflects a steady weakness in the strength of the direction.

ADX is a major component of the DMI movement index (DMI) and is used to measure strength – not trend – from a scale from 0 to 100.

Values that are less than 20 usually indicate that the market is weak or at all, while the above readings confirm a strong and durable direction.

With ADX now on 11, the onyxcoin momentum loses the momentum, although it remains technically in a bullish direction. This low reading indicates that the current upward stage is fragile and may lack the necessary condemnation of the continuous upward movement.

Besides the EMA lines that are starting to flatten, the weak ADX adds to the possibility of the direction that changes soon or delays.

If there is no increase in purchase of purchase to enhance the upper direction, XCN may enter a period of side movement or even a short -term reflection.

Onyxcoin at a crossroad

Xcn EMA lines are currently optimistic, as short -term averages are still higher than long -term long lines.

However, short-term EMAS began to slope down, which increases the possibility of a death cross on the horizon-a declining intersection in which the average decreases in the short term from the long-term average.

If this intersection is achieved, it will indicate a shift in the direction and can lead to a deeper decline, after a 200 % mobilization between April 9 and April 11, making it one of the best performance performance in previous weeks.

The main support levels for viewing are $ 0.016, followed by $ 0.0139 and $ 0.0123. If the landmark is accelerating, XCN may decrease to $ 0.0109, which represents a potential correction of 38 % of the current levels.

On the other hand, if Bulls managed to regain control and enhance the current upward trend, Xcn may challenge resistance at $ 0.020.

The collapse beyond this level would open the door to a possible rise of about $ 0.027, which represents a 55 % increase.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.