Onyxcoin (XCN) is close to selling after a 30 % monthly decrease

ONYXCOIN (XCN) has been subjected to a large sale pressure, as more than 11 % decreased in the past seven days and more than 30 % last month. Multiple indicators now reflect this continuous weakness, as momentum and direction signals are decisively.

RSI approaches excessive sales levels, while ADX shows that the declining direction is gaining strength. Unless buyers take soon, Xcn may face deeper losses before any meaningful recovery attempt is formed.

ONYXCOIN RSI almost up to excessive sales levels

Onyxcoin (RSI) has decreased to 31.63, a decrease from 48.72 just one day ago. This large decline makes it closer to the threshold of sale and highlights the increasing landfill.

The relative power index has now remained less than the 50 neutral mark during the past 12 days in a row, indicating that the Haboodi feelings were dominant throughout this period.

This constant weakness indicates that sellers continue to control the market, and the last decrease may indicate the deepening of the current declining direction.

RSI is a momentum that measures the speed and change of price movements on a scale from 0 to 100. Readings that exceed 70 usually suggest that the original may be overly peak and may be due to a correction, while values that are less than 30 indicate the appearance of excessive conditions that may lead to a possible recovery.

The XCN is the current relative index of 31.63 of the sales lands, which means that the bounce is possible – but away from the content. If the declining pressure persists and the relative strength index decreases less than 30, it may indicate the sale of panic or surrender.

On the other hand, the rapid recovery in RSI above 40 can hint that the pressure pressure and the early signs of the direction are faded.

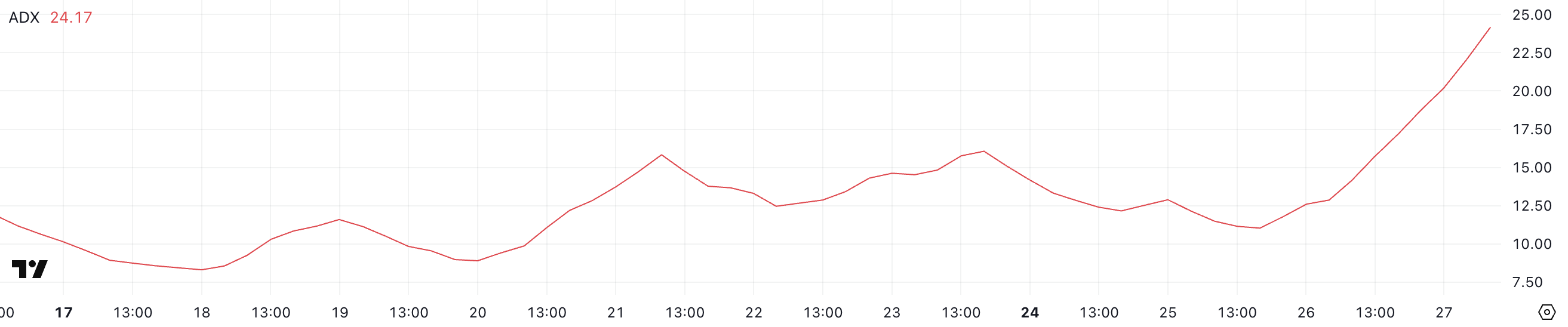

Xcn ADX shows that the downward trend is getting stronger

Onyxcoin (ADX) increased to 24.17, from 12.86 just one day ago, indicating a rapid increase in the direction strength.

ADX measures the intensity of the direction, regardless of its direction, and this sharp height indicates that the current declining direction is gaining strength.

As the XCN price is already a decrease, ADX reinforces the idea that the bears control firmly, and the downward momentum may continue in the short term.

ADX works on a scale from 0 to 100, with readings less than 20 usually indicates a weak or not present direction. The values between 20 and 25 indicate the direction that may start to build, while anything exceeding 25 indicates a strong and founding direction.

The current ADX of Xcn is on 24.17 on the edge of this critical threshold, indicating that the declining trend moves from the early stage to lands that are potentially stronger.

If ADX continues to rise above 25 while the price remains a decrease, it will confirm that the sellers are leading a more powerful step, and you may face any attempt to reflect a strong resistance ascending.

ONYXCOIN can continue

Onyxcoin EMA lines are currently aligned in a declining formation, indicating that the declining trend may continue in the short term.

If the landmark continues, Xcn can re -test the support level at $ 0.0083, a critical area that was previously working as a floor.

The collapse of this level is likely to show the distinctive symbol for more negative aspect, which may lead to a decrease to $ 0.0051, which is its lowest price since January 17.

The current EMA structure highlights poor upward pressure and increased weakness in additional sale.

However, there is still a way to recovery if Onyxcoin managed to restore the strong momentum he showed at the end of January, when one of the most talked on the market was.

Xcn reflection can re -test the resistance at $ 0.014, and a successful achievement above that would refer to renewable upward upward strength.

If buyers pay further, the price targets $ 0.020 and up to $ 0.026 will become relevant-levels that have not been seen since mid-February.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.