Onyxcoin (Xcn) decreases by 40 % in March, while the bears take over

ONYXCOIN (XCN) has been under great sale pressure, as it was 9.4 % corrected over the past seven days and decreased by 43 % in the past thirty days.

Leaving the Xcn declining trend to restore its foot with the continued technical indicators indicating the declining market structure. Despite the short -term attempts to recover, the original is the weight of the continuous declining momentum.

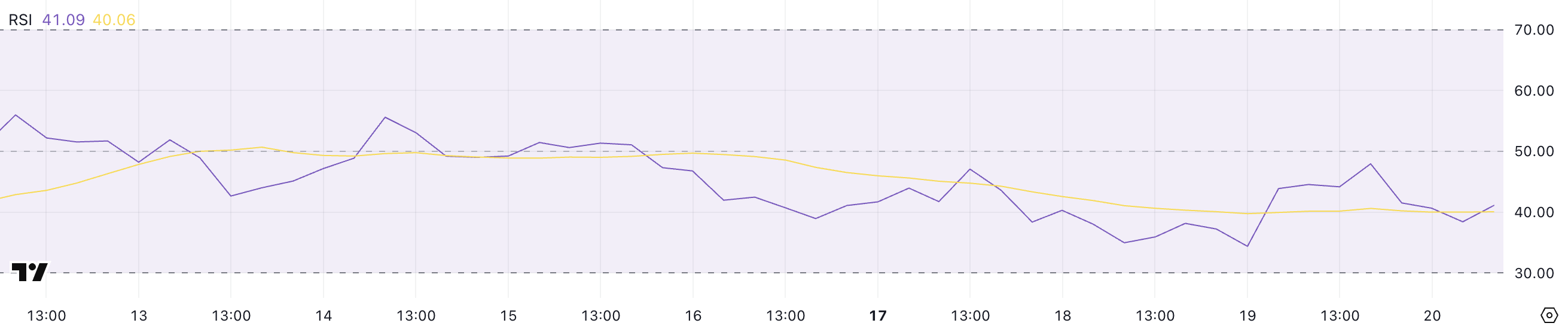

Onyxcoin Rsi was about 50 days

Onyxcoin Rsi currently sits in 41.09, which represents a decrease from yesterday’s 47.95 level. This decrease indicates that the landfill has gained land over the past 24 hours, prompting RSI away from the 50 neutral sign.

Since March 15, RSI of Xcn has been constantly lower, indicating that the original was under the pressure of constant sale.

The constant weakness of RSI indicates that the bulls are struggling to restore control, while maintaining the price in a declining or tuber stage.

The relative power index (the relative power index) is a momentum oscillator that measures the speed and size of modern changes in prices to assess excessive conditions in buying or selling.

Usually, the indicators of the relative power of more than 70 references are that the original may be above the peak peak and due to a decline, while the relative strength index indicates that less than 30 indicates that the original may be exaggerated in it and may be seen back. With RSI’s XCN at 41.09 and holds less than 50 for several days, it indicates that the market remains tied towards the homogeneous feelings.

Although it has not yet arrived in the sales lands, the continuous Sub-50 readings highlight the lack of an upward momentum and can indicate the continuation of the side movement or the descent unless the buyers intervene to reverse this trend.

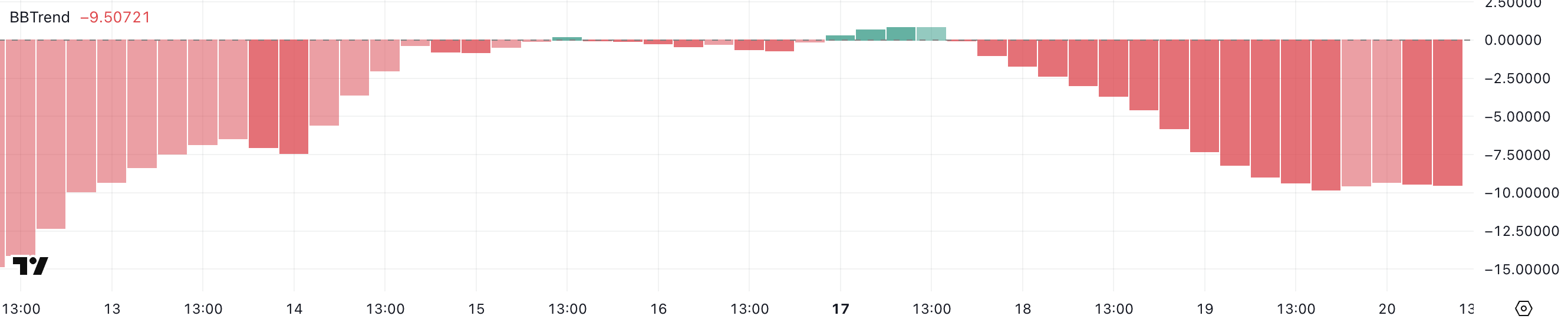

Xcn Bbtrend shows the pressure pressure is still here

Onyxcoin Bbtrend is currently in -9.5 and has remained in negative lands over the past two days, indicating a declining environment.

Earlier, on March 17, BBTRand turned into a short period of time at 0.83 but failed to maintain upward momentum, and soon returned below zero. This indicates the inability to maintain positive readings that upward attempts were weak and short -term, which enhances the idea that sellers continue to control the market.

Bbtrend’s in -depth negative value reflects the constant pressure on the XCN price, while keeping it under pressure.

The BBTREND, or Bollinger Band Trend, measures price trends based on price procedures for Bollinger.

When the BBTRand values are higher than scratch, it indicates that the price is trading over the midfield (usually the moving average in the period 20), which indicates the bullish momentum. On the contrary, negative values indicate the prices that are directed below the midfield, which indicates the declining momentum.

With XCN BBTREND in -9.5 and struggling to put positive values, it indicates that the original still lacks strong upward pressure, leaving the price vulnerable to unifying the negative or prolonged side.

Will Onyxcoin drop to less than $ 0.010 in March?

Onyxcoin EMA lines offer a decreased composition, as the short -term transmission averages were placed under the long -term lines.

This alignment indicates that the declining momentum prevails, which increases the probability of low prices. If Xcn continues in the low direction, it may decrease to less than the main support at $ 0.010, a level that has not been seen since January 17.

However, if Onyxcoin managed to restore the strong bullish momentum he showed at the end of January-when it became one of the best altcoins in the market-it can reflect this setting.

In this case, XCN may challenge resistance levels at $ 0.014 and $ 0.020, with the ability to rise to $ 0.026 if buyers enter strongly.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.