The analyst warns of a 40 % decrease

Este artículo también está disponible en estñol.

Dogecoin (DOGE) was put on alert by the Ali Martinez (@ali_charts), who participated on Monday, highlighting a noteing technical preparation. According to Martinez, the percentage of the market value to the achieved value (MVRV) was just formed a “death cross” with a moving average for 200 days (MA)-an event previously linked to the decrease in the main prices.

Dogecoin mvrv death warning

Martinez scheme, obtained from Santiment, draws three main data points: DOGE/USD price (black line), MVRV Doge (orange) and MVRV ratio of 200 days (red line). he Stuck: “Doug just witnessed an intersection between MVRV and MA for 200 days. In the last time this happened, prices fell by 26 % and 44 %.”

The newly printed “Cross Death Cross” is caused by the 200 -day MVRV ratio below the 200 -day red line. Historically, the analyst notes that the price of Doug witnessed two important corrections after this intersection itself: a 26 % decrease between September and late October 2023 and 44 % from mid -June to late September 2024.

Related reading

Both declines appear in shaded areas on the graph, called accordingly. After each of these clouds, the price of the Dogecoin frequently recovered, but only after reaching the low price levels significantly. If we look closely at the graph, the DOGECOIN price is offered to trade about $ 0.268. The MVRV ratio increased (orange) near 91 %, while the 200 -day MVRV ratio (the red line) hovers about 78.36 %.

The MVRV ratio compares the current market value of Dogecoin with its achieved value (the basis of the assembled cost of DOGE is transferred to the chain). MVRV indicates 91 % that the market participants, on average, can significantly rise to the purchase price – if the percentage remains above 1. Increased gains between the holders.

Related reading

MVRV MA for 200 days is the simple moving average of MVRV over the past 200 days. It provides a long -term essential line to measure the extent on which the current MVRV stands in topcoin or below its historical direction. The “death cross” appears in this context when the short -term MVRV ratio (orange) moves under the 200 -day MVRV ratio (red line), which often indicates a potential transformation of morale or imminent sales pressure.

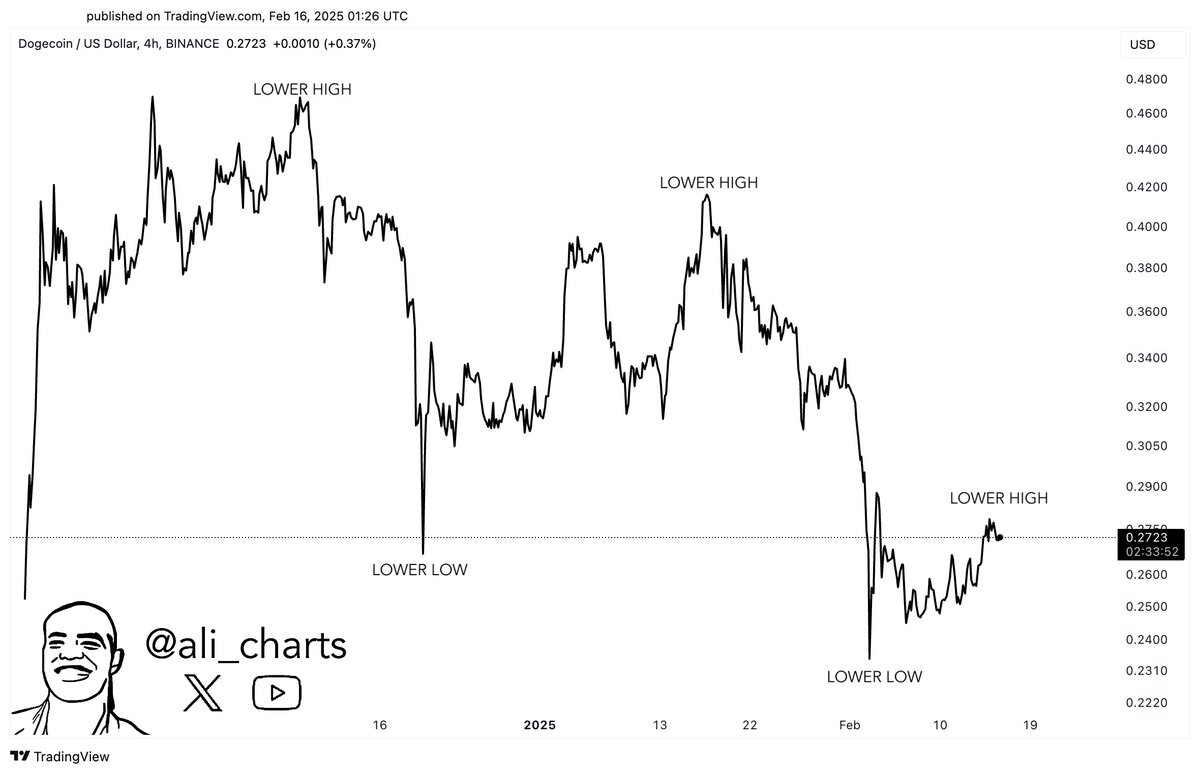

It is worth noting that the price of Dogecoin has some weakness over the past two weeks. Since the height of December 8 at 0.4834 dollars, Doge has been constantly writing its highest level and lower lower, which is a very declining scheme. Martinez shared the graph below and I mentioned: “Doug remains in a declining direction, a lower decrease and higher levels. A higher outbreak is needed than the main resistance to change the momentum!”

In order for this to happen, you will need to break more than $ 0.44. However, Doge Bulls can expect significant resistance at $ 0.31 (0.382 Fibonacci re -imitation level), $ 0.342 (0.5 FIB) and $ 0.375 (0.618 FIB). At the time of the press, Dog was traded at $ 0.26.

Distinctive image created with Dall.e, Chart from TradingView.com