The difference indicates that Bitcoin may reflect in June

Although experts and institutions continue to provide optimistic expectations for Bitcoin price in the short and long term, some point to the difference signs that may indicate an upcoming reflection.

The difference in the difference occurs when the price creates a higher increase, but the indicators or data associated weaken. This reflects the decrease in momentum. Currently, Bitcoin faces many of these differences.

Difference signs warn against a possible bitcoin correction

The first warning comes from a technical signal in the monthly time frame.

Investors often ignore larger time frameworks such as the monthly graph in favor of daily price movements. As a result, this sign may attract many investors.

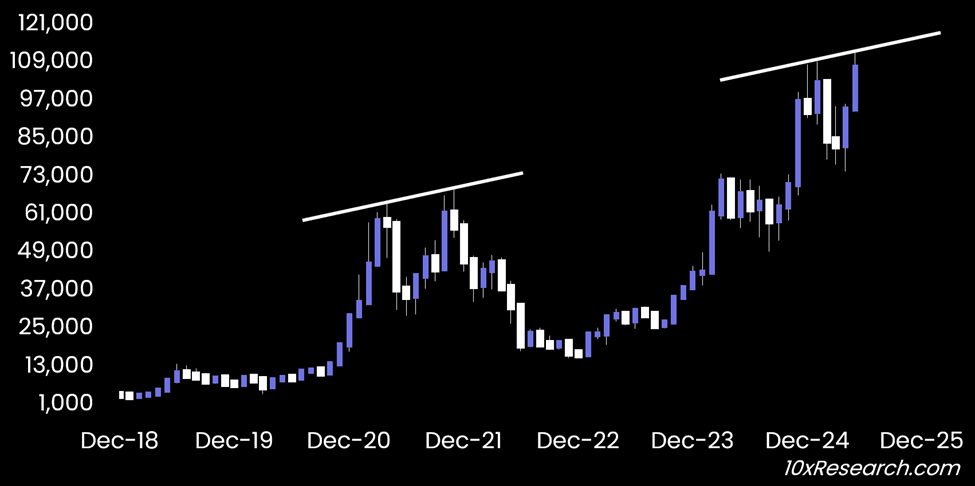

A recent report of 10xresearch warns that Bitcoin has reached resistance and that it is a similar pattern for 2021. The graph shows that in 2021, bitcoin formed two sums, and the second is higher than the first. It seems that the price style itself is now repeated in 2025.

In addition, analyst Matthew Helland Indicate A declining difference in the relative strength index on the weekly timeline. Analyst Mitch Rai also male This bitcoin confirmed a decreased contrast with the MacD-H index on the daily chart.

These multiple difference signs indicate that bitcoin may lose ascending momentum. This momentum loss can lead to a significant correction next month.

In addition to technical signals, analyst James van Stratin High Another difference – this time between the price of Microstrategy (MSTR) and Bitcoin.

The graph shows that in November 2021, MSTR decreased by about 50 % of its previous level, while Bitcoin reached the highest new level ever at $ 69,000. A similar scenario is now unveiled. MSTR has completed a 50 % decrease in its peak in the late 2024, however Bitcoin continues to obtain new levels above $ 111,000.

Although James did not provide a final conclusion, this signal once again suggests a possible correction of Bitcoin – or even reflection, as shown in the 2021-2022 session.

“Bitcoin just published another strong month, but under the surface, cracks are formed. The increasing difference between price movement, fluctuations, and retail behavior indicates that the tournament may change. The main players, such as Microstrategy, slow their purchases, and slide well. It turned,” 10xresearch I mentioned.

Despite these warning signals, Beincrypto reported a wave of bitcoin accumulation by companies outside the encryption sector, from games to health care and retail. BitWise also carries out projects that institutional capital flows can reach 426.9 billion dollars by 2026, increasing 20 % of the total offer in Bitcoin.

These new forces may represent a major difference between the 2025 market and those in 2021. They can make direct comparisons between the two misleading periods.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.