Bitcoin, XRP and Solana Test Key support with continued risk

- summary:

- The encryption prices drop more than the Bitcoin, XRP and Solana key support. The market enters the “acceptance” stage of withdrawal, as the total fear crushes feelings.

The encryption market entered a complete acceptance stage-where hope turns into realism, and traders are adhering with the weight of economic and structural pressures. Bitcoin, XRP and Solana are all deep in the correction lands, and testing critical support levels where the market participants stop his hope in a quick counterattack and start pricing in a sustainable period of fluctuations.

What started as a technical decline developed to reset feelings. From excessive euphoria to the peak to the reluctant reality, the emotional cycle of the Crypto market has turned – and the price contradictions in the type.

Acceptance stage: Cryptology wakes up to the new ordinary

The market is likely to move to the “acceptance” stage in the withdrawal cycle-a stage in which the enthusiasm of denial is replaced and retracted with sober caution and modified expectations. This transformation is now the price, its size, and the location.

The shift from greed to fear is completed. And unless the macro conditions quickly improve, the encryption may remain good in the Q2.

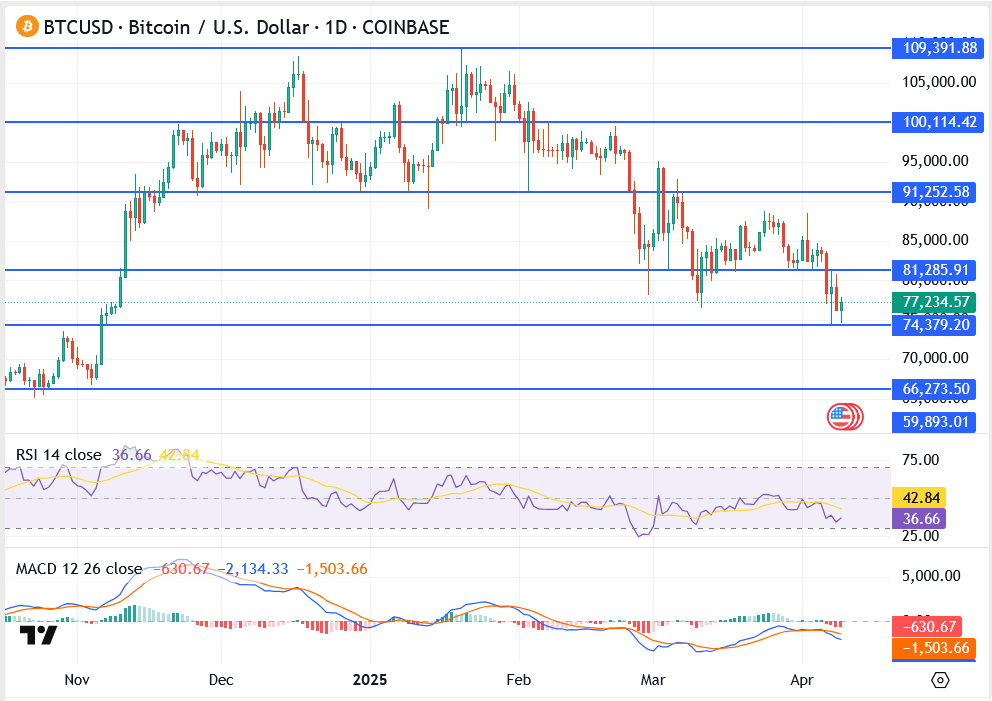

Bitcoin price expectations: BTC in Make-AR-Break 74,000 dollars

Bitcoin clings to a $ 74,000 support zone after selling last week to less than 81,000 dollars. This level has become the line in the sand for the bulls, with any other breakdown that is likely to lead to a slice towards a scale between 66,000 and 59,000 dollars.

Main technical levels

- Support: 74,379 dollars → 66,273 dollars → 59,893 dollars

- Resistance: 77234 dollars → 81,285 dollars

- RSI: 36.66 (landing but not overlooked)

- MACD: In the depths of negative lands

The market remains in waiting and vision. The broader bullish structure of the first quarter is intact, but only. If BTC closes less than 74,000 dollars over the size, the sale pressure may increase. Bulls need to restore 77 thousand dollars to restore momentum.

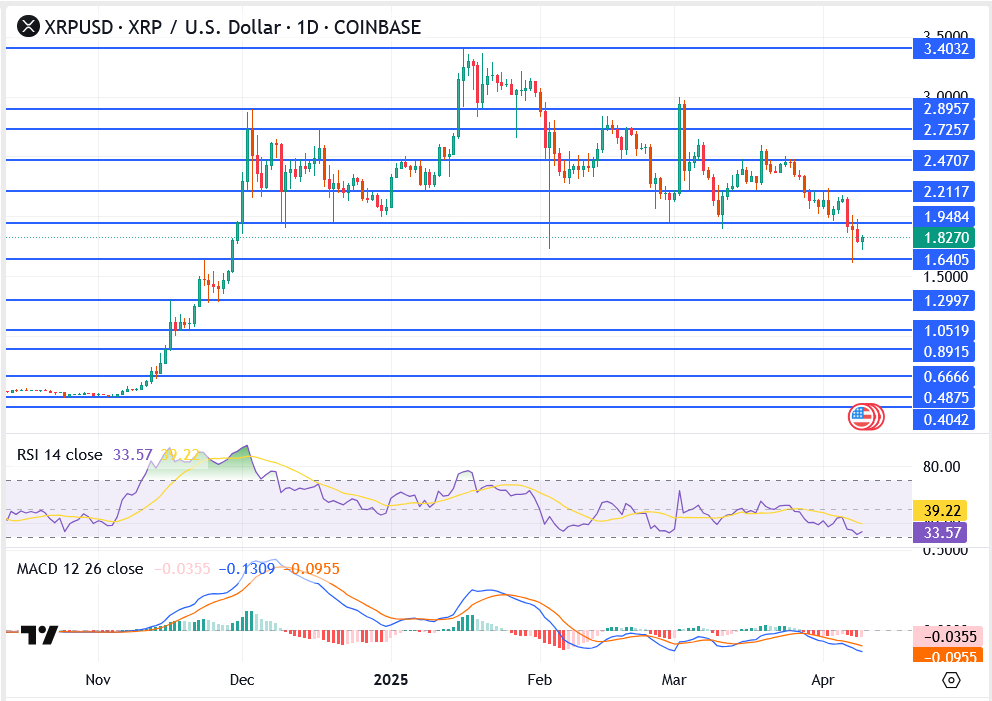

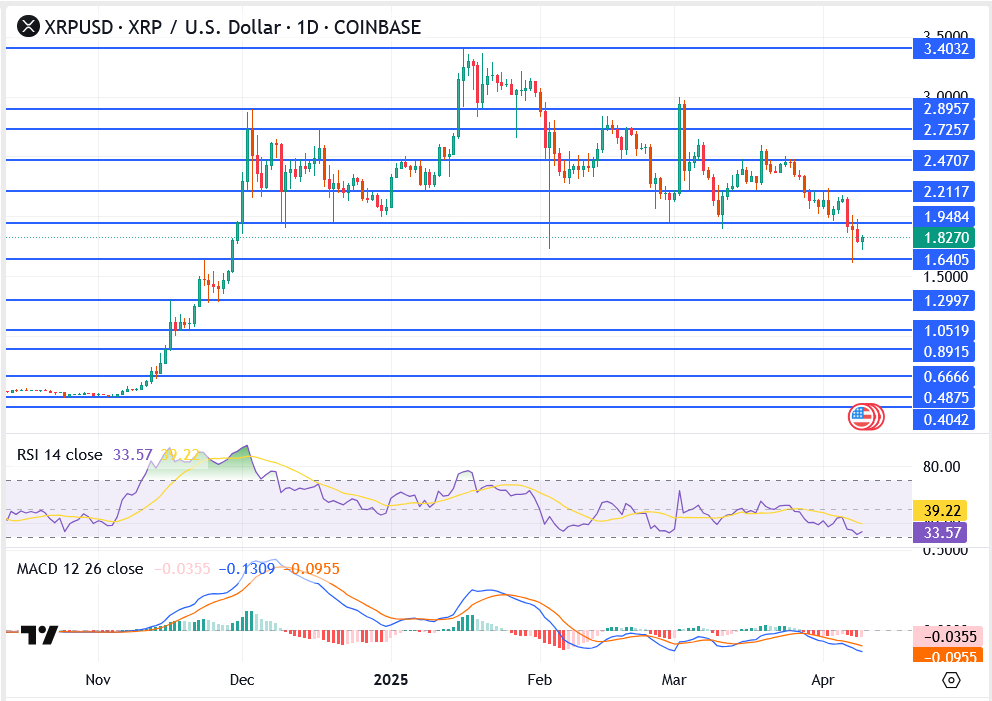

XRP Prices: $ 1.95 confirms the reflection of the direction

XRP has decisively broken its $ 1.95 support level, which is now trading about $ 1.82. The loss of this level removes a major psychological ground, which increases the possibility of re -testing $ 1.64 and $ 1.50.

Main technical levels

- Support: 1.6405 dollars → 1.50 dollars

- Resistance: 1.9484 dollars → $ 2.11

- RSI: 33.57 (near the sale)

- MACD: Carros extended calm

The XRP price structure now confirms the reflection of the direction unless the bulls can quickly recover $ 1.95. The traders of momentum are likely to remain on the margin until the lower artistic models are formed. The admission phase here can extend several sessions before buyers return.

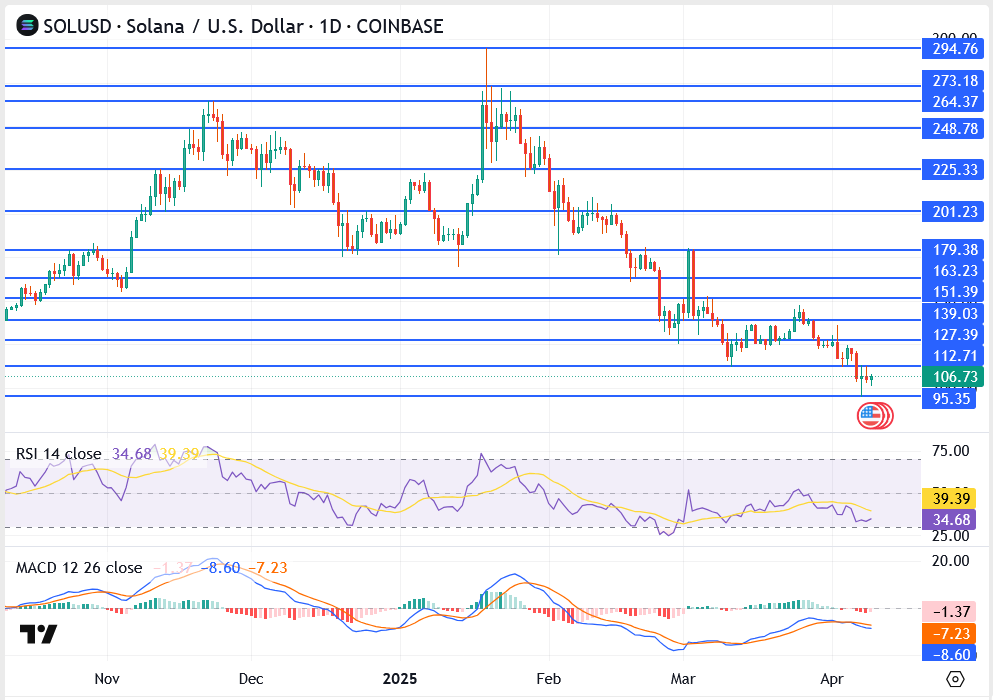

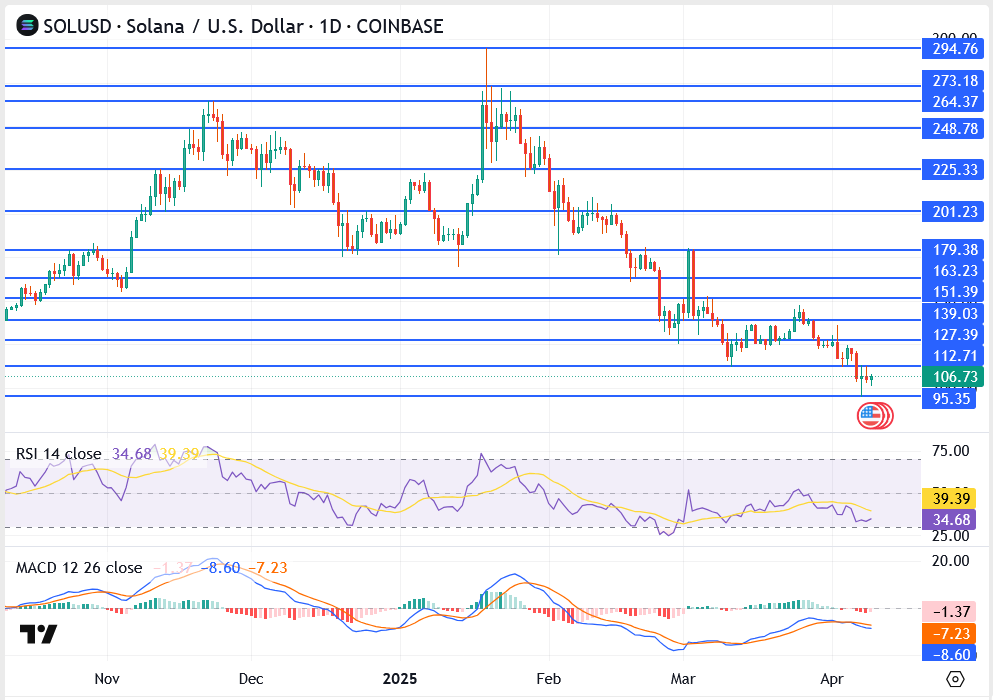

Solana price expectations: subsidies 106 dollars in focus as it is waving on the horizon surrender

Solana’s price has decreased to less than $ 112 and is currently fighting to keep the support zone of $ 106.73. This level is very important. The daily closure below this region can lead to a rapid decrease of about $ 95.35 – as the previous historical demand has appeared previously.

Main technical levels

- Support: $ 106.73 → 95.35 dollars

- Resistance: $ 112.71 → $ 127.39

- RSI: 34.68 (weak momentum)

- MACD: It is still a decrease

Solana continues weak, which reflects a wider weakness in the altcoin sector. The market appears to restore expectations and move away from heavy attitudes of risks, especially in a low lady altcoins.

It stimulates macro behind declining encryption

This is not just an encryption story. The background has changed – the area of digital assets interacts with global transformations in the flow of capital and the same investor.

1. Inflation does not budge

The basic, sticky inflation data has lifted the consensus that the Federal Reserve will start interruption in June. The market is now pricing in fewer discounts – and then.

2. Revenue reserves

The US Treasury’s return returned for 10 years near 4.5 %, and liquidity drained from risk origin. Bitcoin, which has been traded simultaneously with the Nasdak Stock Exchange, is now beaten on both sides: falling stocks and high bond returns.

3. Federal Reserve has not been developed (yet)

Federal reserve officials are still tight about the collection early. With high oil prices and global conflicts, monetary policy is in a detention style – as well as the investor condemnation.

4. Geopolitical tension adds fuel

With the risk of Chinese customs tariffs and the Middle East, risk installments are escalated. Checks feel heat.

Summary: risk morale control the encryption bar

Bitcoin at $ 74,000, XRP at $ 1.82, and Solana less than $ 112 is more than just numbers – they are reflections for the market that goes through a transition. The speculative mania of Q1 is cooled, replaced by tactical trading, cash rotation, and the fear of deeper losses.

The “acceptance” stage has reached – and with it, the realization that the upcoming satisfaction will not pay in the current overall climate.

This is the place that matters to patience, discipline and clarity.