The ongoing underwriting success reveals a shocking frustration with employees

The appearance of Sirkel General has attracted criticism from prominent investors, especially about the extent of the first employees who may miss approximately $ 3 billion of unreasonable gains.

The investment capitalist billionaire, Shamath in Ghabitia, indicated that the circle of the insiders sold 14.4 million shares at the initial public offers price (IPO) of $ 31 each, and securing nearly 446 million dollars. However, with the arrow’s circulation now over $ 240, the same shares will currently be worth about $ 3.45 billion.

The public subscription department leaves billions of dollars on the table for the first employees

The difference represents a gap of about 3 billion dollars, which Palihapitiya described as a costly fault resulting from choosing the traditional public subscription path.

He pointed out that insurance companies bought the shares from the inside and redistributed them to identify customers, leaving the original shareholders besides the limited upward trend.

In his opinion, the employees delivered billions as a basis for external investors who had no role in the success of Surkel.

“In this case, it was a gift of $ 3 billion of employees and investors from the department to people who do not know it, and they will not know and have nothing to do with their journey,” Palacetia, ” He said.

Palihapitiya has argued that the situation may have played differently if Circle chooses a special integration for the acquisition company (SPAC) or a direct list.

These methods often give alternative to more control over pricing, timing and disclosure, helping them to keep more value during the general transition.

He added that Spacs and direct menus reveal the evaluation dynamics more clearly and can be organized for both sellers and buyers.

He added: “In order to be clear, this value transfer method does not occur through a direct list or Spac – the benefits are detected in SPACS and DLS very explicitly. It can be negotiated, to a minimum, in favor of selling shareholders and buying shareholders.”

Serkel had previously planned the audience via SPAC’s integration with Concord Custom Corp, but canceled the deal in 2022. The company later continued the traditional public subscription, which appears to be, despite its success, it may have left the first stakeholders.

CRCL rises with the growth of confidence stablecoin

Despite the controversy, the performance of Surke in public markets was great.

Its shares, which are now traded under the CRCL, increased by more than 675 % since its appearance of $ 31, with a peak of $ 248 per share on June 20. This puts the market value of the company by about $ 58 billion, indicating a strong investor confidence in the company’s future.

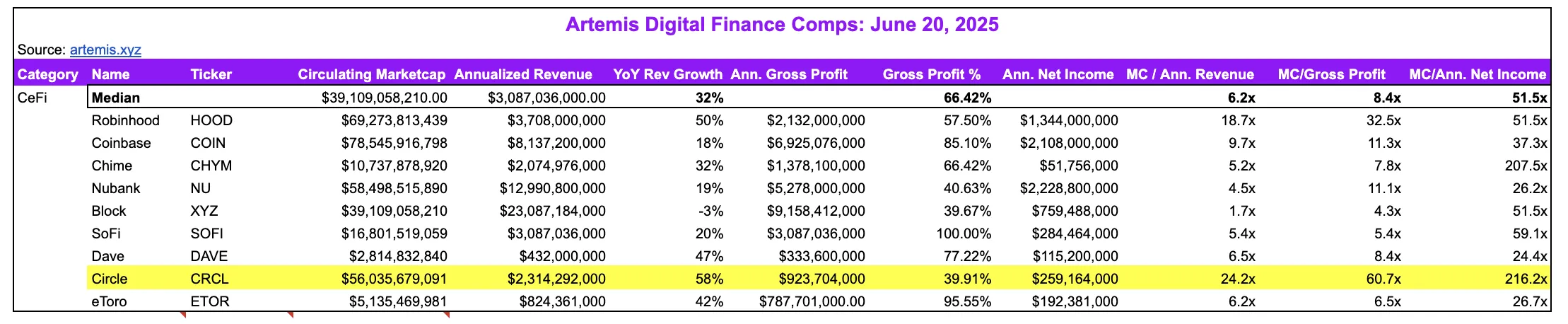

John Ma, CEO of Blockchain Artemis, noted that Circle is traded in assessing the complications of the evaluation much higher than that of Coinbase and Robinhood, although companies that have been reported higher income.

“Circle is now trading for: 24.2X [its] Q1”2 5 revenue operating rate, 60.7X Q1’25 [and] 216x Q1’25 net income operating rate, “MA Indicate.

According to him, the installment probably reflects the investor’s belief in the future growth of circles and a possible organizational advantage.

One of the main factors behind this optimism is the last traffic of the Genius Law in the Senate – a draft law from the two parties designed to bring Stablecoin to the American market. Legislation, backed by President Donald Trump, still needs approval from the House of Representatives and the final signature.

If it is passed, it may reinforce it to consolidate the regulatory pots in Circle, which enhances its hegemony in the Stablecoin sector and helping to justify the price of its high share.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.