North Carolina state proposes bitcoin reserve bill, aimed at allocating 10 % of public funds

North Carolina states the bold move to the encrypted currency with the introduction of Bitcoin Reserve and Investment (SB327).

If passed, the draft law will allow the state to allocate up to 10 % of its public funds in Bitcoin.

New: Bitcoin North Carolina SB327 The State Fund Secretary Bill allows for up to 10 % of public funds to Bitcoin. Nursery: Multi-Sig Storage-Evidence of Reserve: Monthly Auditing Operations-Holding: Selling is limited to “severe financial crisis” in addition to strict conditions

This decision may affect other countries to take their example, indicating an increasing acceptance of digital assets as part of government reserves.

The General Fund in North Carolina has $ 9.5 billion, allowing up to $ 950 million to buy bitcoin if the bill is approved.

North Carolina leads in bitcoin reserves

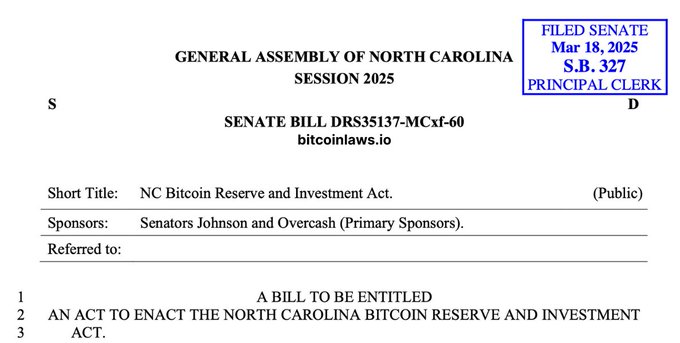

The proposed legislation, presented in March 2025, represents an attempt to diversify financial holdings in North Carolina by integrating Bitcoin.

The draft law is led by Republican Senator Todd Johnson and Brad Oversé, and is part of a larger strategy to integrate digital currencies into public investments.

This initiative is not the first attempt in North Carolina to engage with Bitcoin.

The state has already has two bachelor’s bachelor’s pending projects in the House of Representatives and the Senate, which enhances its increasing interest in taking advantage of Blockchain technology.

If it succeeds, the legislation can arise in North Carolina as a pioneer in government -backed encryption investments, which may put a precedent to follow other states.

Cold multi -signed safety storage

One of the main bill provisions is the use of cold -signed cold storage for Bitcoin.

This security measure aims to reduce the risks associated with stealing digital assets and unauthorized transactions.

Cold storage, which maintains the assets in non -communication mode, enhances the protection of penetration and electronic threats.

To maintain transparency, the state will perform monthly audits of its bitcoin reserves.

These audits will be evidence of reserves, ensuring the public’s confidence and enhancing accountability in how to manage digital assets.

Given the volatile nature of Bitcoin, these guarantees are designed to relieve risks and maintain stability in state financing.

Bitcoin sales are limited to crises

The legislation imposes strict conditions on bitcoin sales, which limits transactions to severe financial distress periods.

This measure ensures that Bitcoin is still a long -term investment instead of the volatile origin subject to frequent trading.

By creating clear guidelines for liquidation, the draft law aims to create a stable investment strategy that integrates Bitcoin into the state’s financial system from exposing public funds to unnecessary risks.

This control -subject approach seeks to balance the potential gains to invest Bitcoin with the need for financial wisdom and responsible governance.

Governmental interest grows in the encrypted currency

North Carolina’s step reflects a wider direction to increase government interest in encrypted currency.

As digital assets gain a major acceptance, countries explore ways to integrate them into financial strategies.

Bitcoin’s increasing reputation as a hedge against inflation and traditional economic shrinkage makes it an attractive choice for public funds.

However, bitcoin fluctuations and lack of comprehensive federal regulations are still major concerns.

While some view this initiative as a step towards financial innovation, others warn of the risks associated with the investment of taxpayer funds in a volatile market.

After the state of North Carolina proposes a bitcoin reserve bill, and aims to allocate 10 % of public funds first appeared on Invezz