NIFTY, Sensex recovery is a LOWS keys in focus with Frdyy Close becomes the decision

The Indian Securities Market survived a volatile week, but the bulls are far from defeat. NIFTy 50 and Sensex have reduced previous gains by mid -week, to find support at critical levels with the start of trading on Friday. This weekly closure now carries weight, not only for the short -term momentum, but how to calibrate investors before the second half of June.

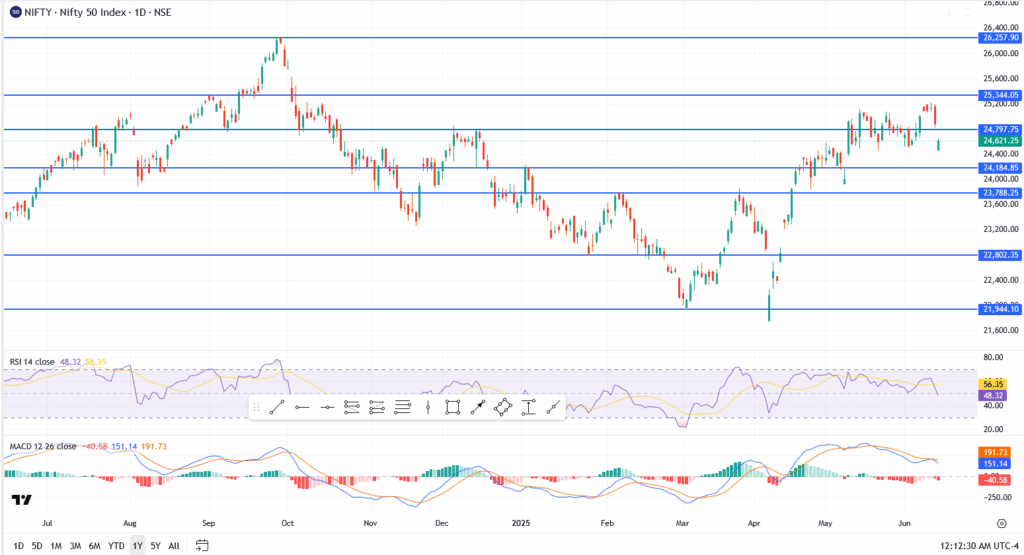

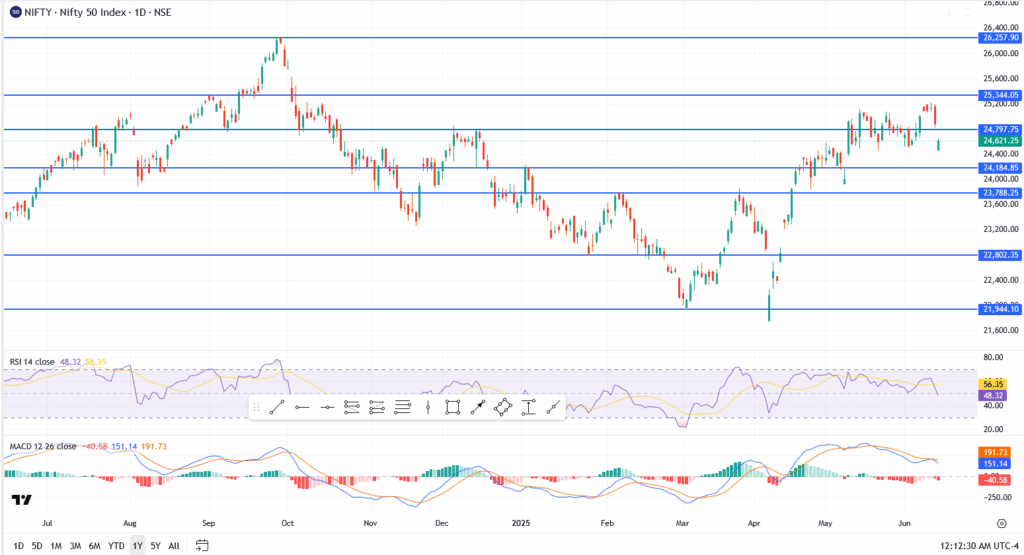

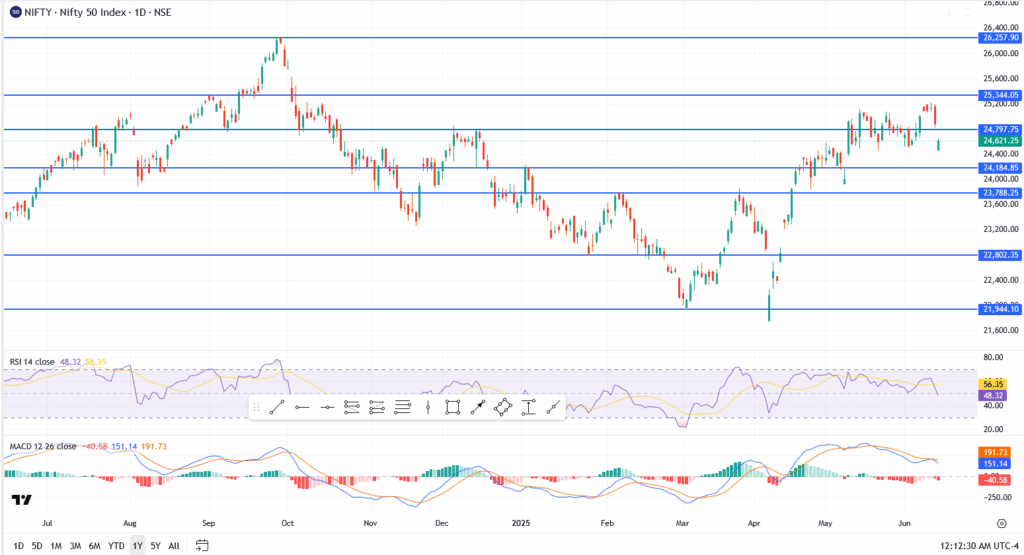

Nifty 50 penetration eyes but faces resistance in 24,800

NIFTy opened 50 weeks in full swing, pushed towards the resistance area 24,800. But by Thursday, she started working in softening, reflecting a mixture of global sermon and institutional repositioning. However, NIFTY managed to adhere to the 24600 brand, a level that still serves the line in the sand.

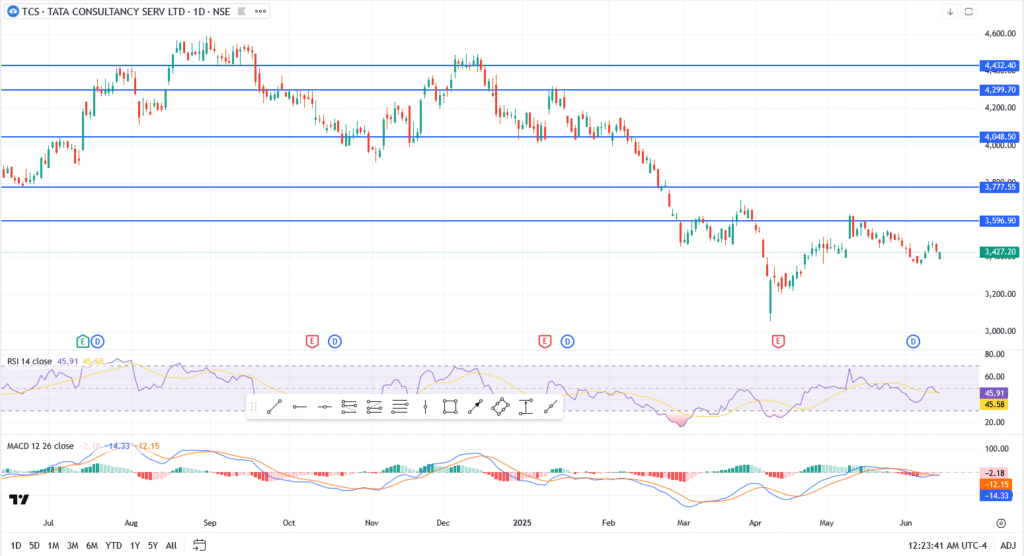

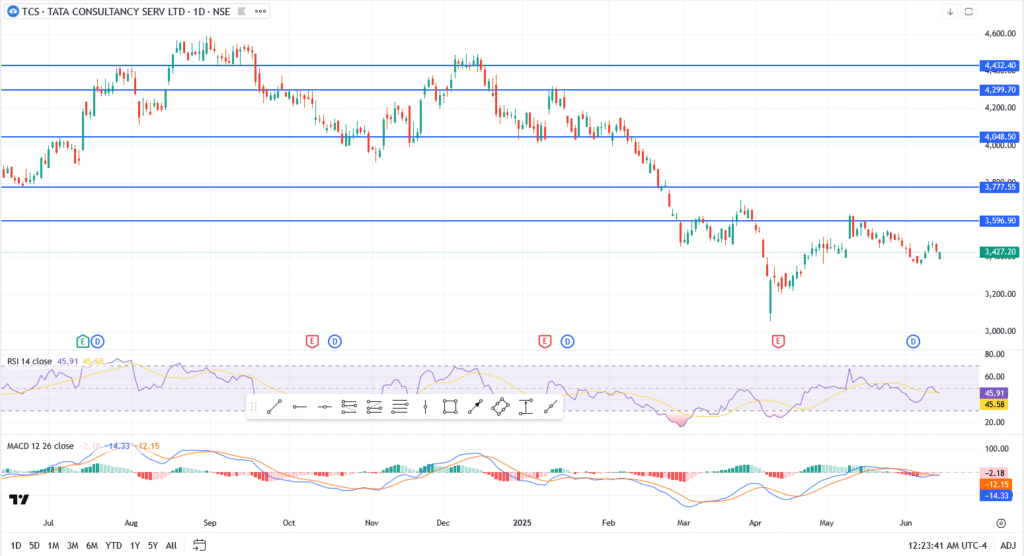

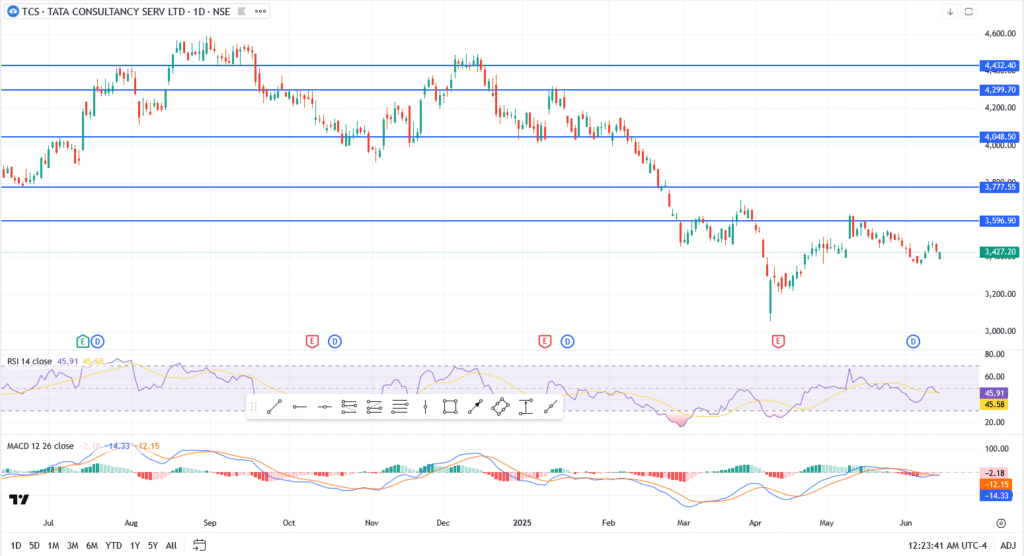

NIFTY 50 graph analysis today

- Support remains fixed at 24,184, which is the lowest level of the week, with a decrease in the DIP buyer every time the index slip to less than 24,500

- If it is 24,800 convincing breaks, the next station may extend about 25344, which is the last high major oscillation before April correction

- Less than 24,184, bears may regain control with eyes over 23788, which would violate the direction

From a technical point of view, the relative strength indicators are hovering near 48.32, not in the excessive sale area, but it is flat, hinting on the frequency. Macd shows a simple cross, although the momentum has not completely rolled yet, indicating a temporary stop, not panic.

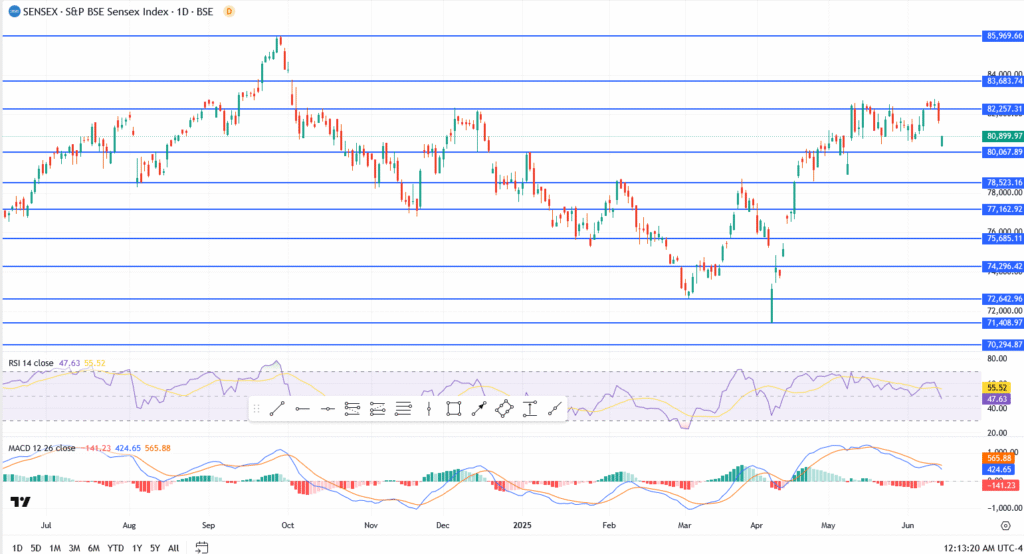

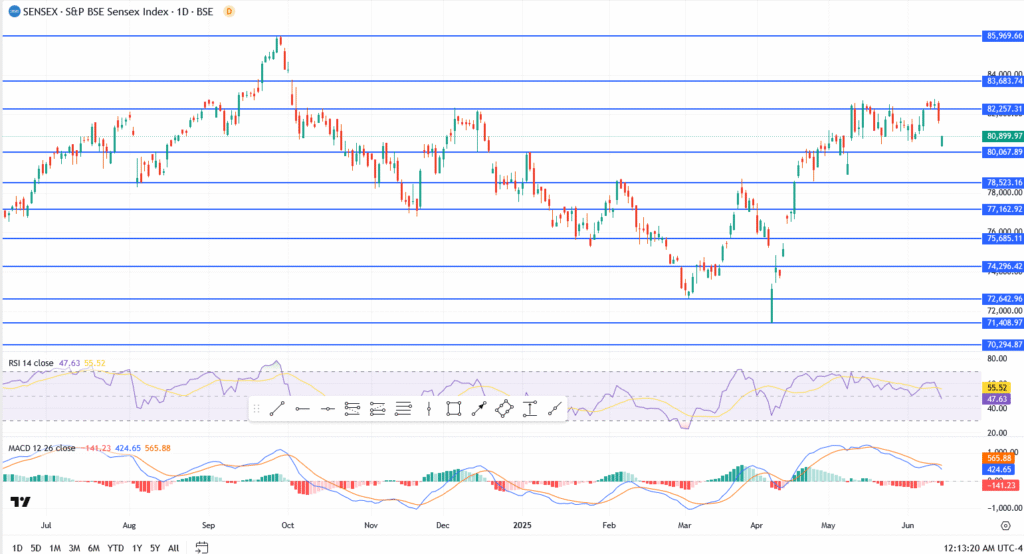

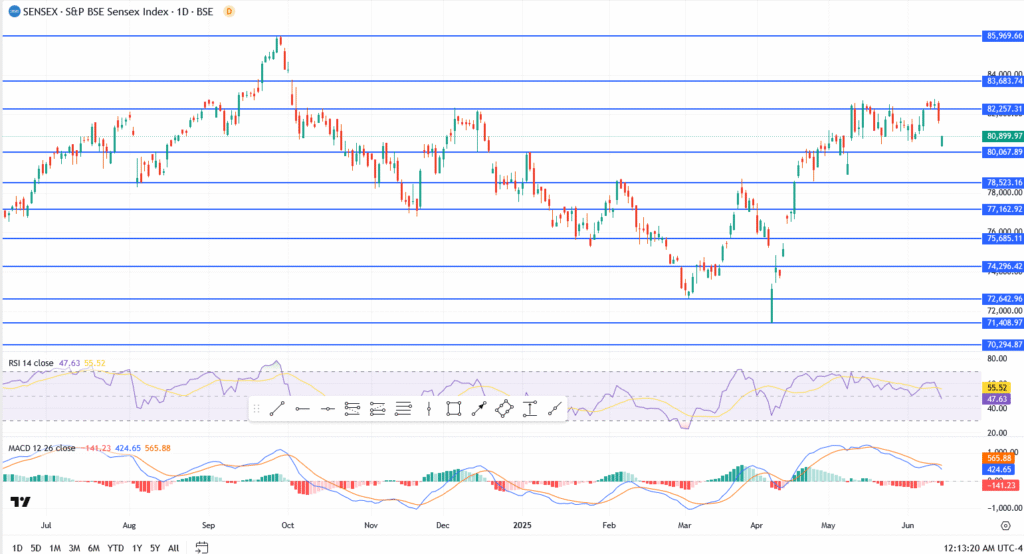

Sensex still holds 81 thousand, but the bulls need a strong Friday

Follow Sensex a similar path. After testing 82,257 early in the week, the index retreated, but it managed to stay above 80,899, which appeared as a critical rule in the near term.

The structure of the week appears:

- Sensex Bulls is scrambling for 80,067, which is the deepest support that represents the summit of April

- Any closure above 80,899 today may nourish a new move around 82,257, and then 83,683

- On the contrary, it opens near less than 80,067 the door for deeper losses, with 78,523 after the radar

RSI on the daily graph 47.63, under neutral, while MACD remains down, is an indication that despite the weak momentum, there is still room for bullish insecurity if today’s session ends.

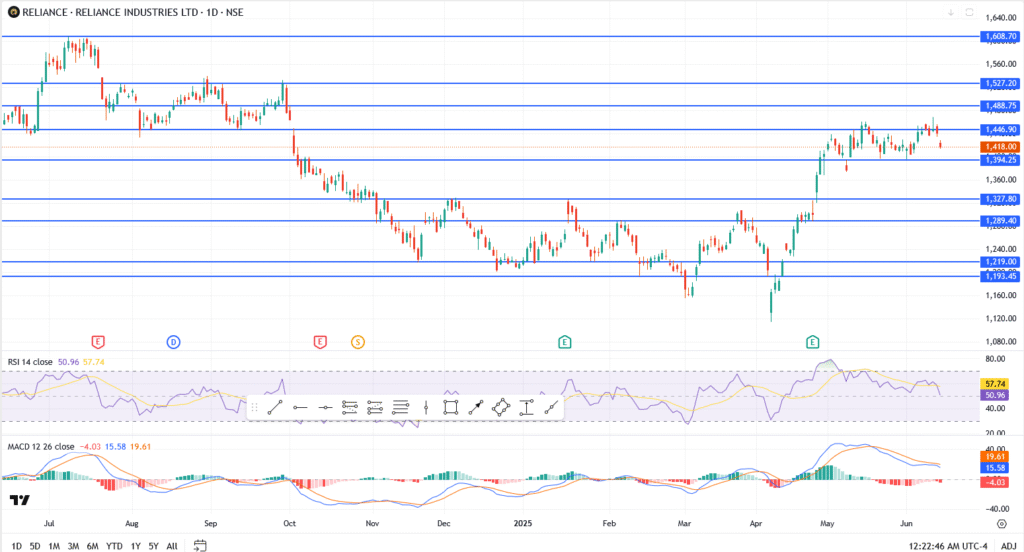

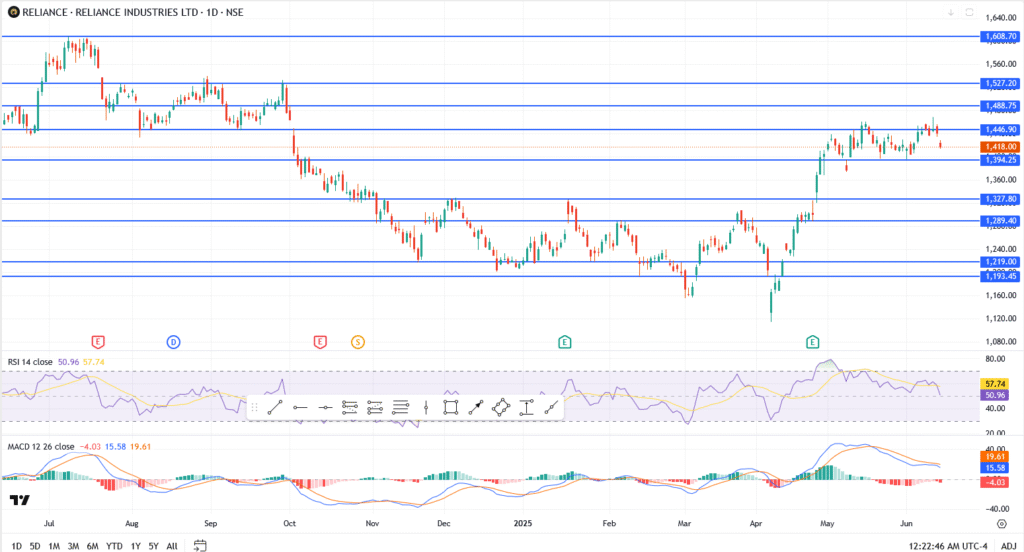

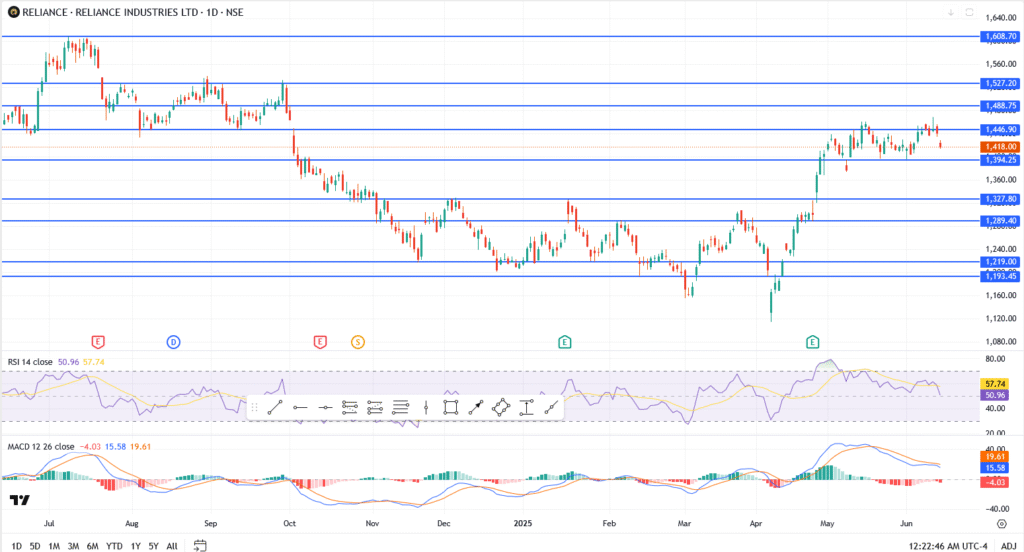

Dependence and TCS: Calm in volatility

The Rellece Industries, which is often Bellweether for NIFTY, is complicated by EMA for 50 days this week, although facing the opposite winds of global energy prices. The arrow’s ability to settle in the broader indicator stabilized. TCS also reflected the market, after testing the high levels earlier this month, slipped, but it did not divide the rising trend line.

Both stocks act as pressure valves: it does not collect, but does not collapse either. If it starts either to show strength next week, this may become Spark Nifty to break the ceiling 24,800.

Conclusion: Watch near today

This Friday’s closure may not be amazing, but it matters. If Nifty holds 24,600 and Sensex remains above 80,899, the bulls will remain in the game. The breaks below will change the tone towards cautious monotheism. But at the present time, the plans are still in favor of flexibility, not retreat.