Why can the law of genius provide the US dollar and the economy

After many discussions and reviews in Congress, the genius law is now about to become a law. The draft law, which aims to regulate the Stablecoin industry throughout the United States, is expected to be signed.

According to representatives of Digital Ramber, a group -based group of Blockchain, the approval of the bill is likely to come before the end of June. Such a move will increase institutional adoption and enhance the dominance of the US dollar worldwide.

When will the genius law pass?

The genius law is preparing, a prominent bill that regulates the American Stablecoin industry.

Despite the recent differences between Republican Senators and Democrats, the draft law issued a major procedural vote. Christopher Klaish, director of politics in the digital room, strongly believes in her imminent approval.

“I feel strongly that there will be no more hiccup … I think the industry has been a strong player in politics over the past two years and supportive campaigns … there is a high cost for members who may be the stick in the mud,” said Beincrypto.

According to Taylor Bar, the affairs of the Da`wah Group and PAC government, 53 amendments were made.

“The majority leader Thne is committed to the existence of what is called a fully open modification process, which means that each one modification has the full right to the debate voting and its entirely closed in each modification. So at the end of the day, this may be a three -week process for three weeks,” Bar told Beincrypto:

However, Barr explained that the operation is completely open with 53 unlikely individual discussions. These amendments are expected to be divided into three or four groups, which leads to a more efficient and brief modification process, given that many repetitions.

If Barr estimates are correct, the bill will pass before the end of this month. When this happens, the importance will be great for the major encryption industry.

Understand the effect of stablecoin

It can be said that Stablecoins are the most internationally dependent digital assets. Unlike traditional cryptocurrencies like Bitcoin or Altcoins, they provide reaching all over the world to a stable method of exchange.

According to the January Excination CEX.IO report, the total Stablecoin 27.6 trillion transactions in 2024, which exceeds the total payment volume in VISA and Mastercard by 7.7 %.

Tether and Circle dominate the market with $ 151 billion and $ 59 billion, respectively. Together, they have a market share of 89 %, according to RWA.XYZ.

Their heavy presence in global economies makes a bill like a lack of genius more important. This is especially true in the context of the exhausted US dollar.

The influence of the dollar is declining

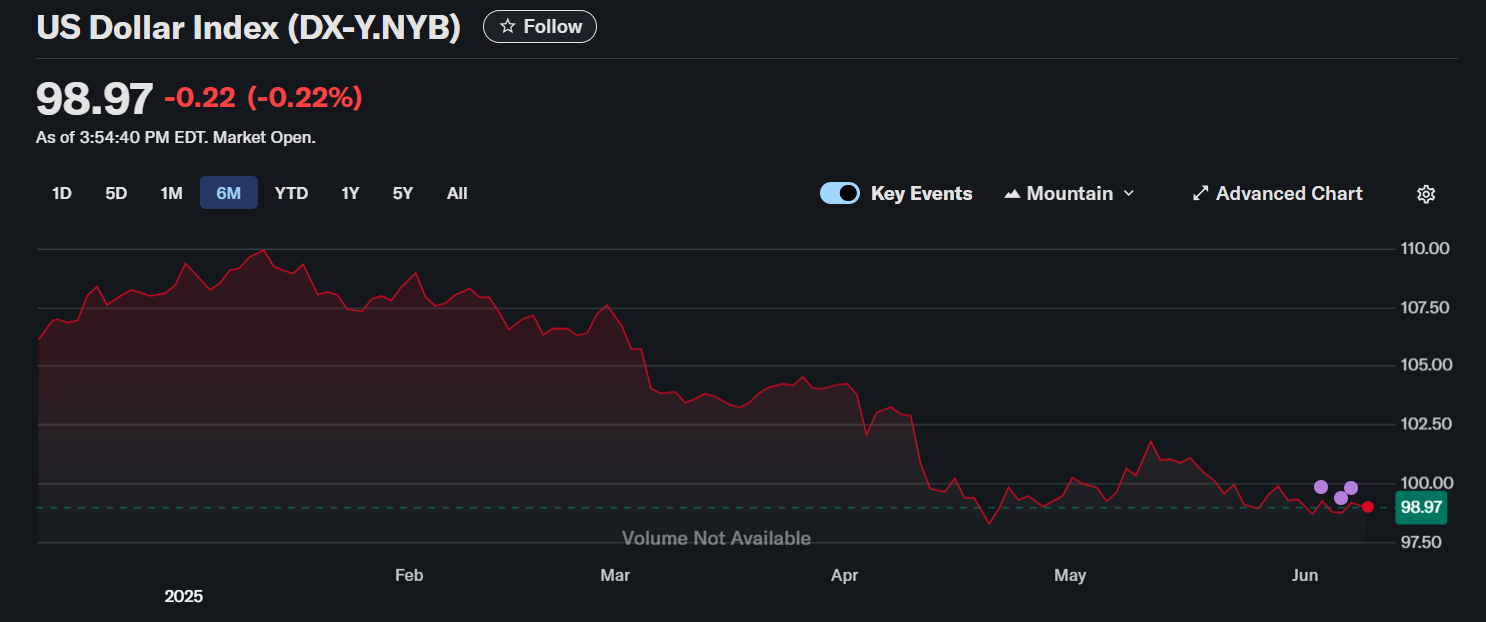

The US dollar began exceptionally weak. Two days ago, the US dollar index (DXY)-a main measure that was severely affected by the euro-was approximately 9 % to less than 99 years. The results were the weakest year of its evaluation since the mid -1980s.

In the face of these data, in addition to the ongoing commercial uncertainty and recession, investors mainly restore the role of the dollar in their portfolios.

This situation and the efforts of the wider ice removal by major US debt holders such as China and Japan increases concerns about the future of the dollar.

The data from Ark Invest shows this shift. In 2011, these three countries held 23 % of 10.1 trillion dollars in the suspended US Treasury debts.

By November 2024, although the total US Treasury debt to $ 36 trillion, their common property decreased significantly to about 6 %.

This significant decline in holdings by the main foreign creditors highlights increasing concerns about the long -term stability of the dollar and the ability of the United States to re -financing its huge debt.

“The dollars are the global reserve currency. Demand for the dollar has declined at the sovereign level. Over the course of recent years, the cabinet buyer reduces the cabinet holdings. This is not a good situation for the United States while trying to refinance.”

Klish added that legislation, such as the law of genius, is very important:

“In my opinion, there is a little more important than the Stablecoin invoice that is passed from the total economy perspective … If the demand for dollars is dwindling at the sovereign level, structurally, if it is or can be replaced by the demand for a individual level of retail, then this represents a huge goal for the American government.”

The data behind Klaich’s comments appears to support his analysis.

What role will Stablecoins play in the demand for US debt in the future?

Stablecoin market is preparing for great growth. According to the April report from Citigroup, the total Stablecoin supplies can reach $ 1.6 trillion by 2030. This growth can create a demand for American debt similar to the historical levels supported by sovereign countries.

The genius law can facilitate this transition.

“We hope, when it passes, the demand for stablecoins will explode because there are many companies and banks that are planning to provide Stablecoins that will provide them with bars to work at the consumer and commercial level. Thus, competencies and individuals will help to pay this,” explained Klash.

By serving the regions and people who have been neglected or undermined by traditional banking systems, Stablecoins can also help balance the global disappearance movement.

“It allows anyone in the world to reach US dollars. What gives the United States from the point of view of the economic war is important.”

With the risks of continuous inflation, the federal reserve is unlikely to buy large sums of the American treasury. Therefore, encouraging the use of Stablecoin allows this market to replace the ineffective financial mechanisms currently effectively.

Amendments to the bill

If the genius law is implemented correctly, the Stablecoin industry may become a valuable financial tool for the US government to ensure long -term support to the US dollar.

The draft law underwent a difficult review. According to Bar, the process was boring and political difficult.

“If you look at all the progress we made, we have worked on this for three conferences now. We have worked on this [through] Various multiple leaders – minority, majority division. So we are very close. We have made all this progress so that we can see the finish line. “We will get there,” he said.

However, multiple reviews were a prerequisite for passing it to ensure that the bill was responsible for consumer protection, national security and market safety.

Klish noted that these decisive concerns have been treated fairly in the legislative process. He stressed that modern publications of the draft law have effectively incorporated these reviews.

He said: “None of these existential issues has been negotiated in the latest version of the draft law that is being considered at the present time. I think the changes made are reasonable and acceptable.”

The future will reveal whether the draft law passes and achieves its required impact in helping the United States to overcome its complex economic reality.

Disintegration

With the guidance of the confidence project, this article displays the views and views of industry or individuals experts. Beincrypto is devoted to transparent reports, but the opinions expressed in this article do not necessarily reflect the views of Beincrypto or their employees. Readers must independently verify information and consult with a professional before making decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.