Tesla Cybletructs has been disrupted by approximately 40 % with trade opening

While Tesla Stock (NYSE: TSLA) has jumped sharply over the past month and most of its losses in YTD, the company still faces the huge opposite winds. The company recently opened the trade to receive Cybertruck, which indicates consumption rates of up to 45 % for the model, although the deliveries began in late 2023.

The owners of the multi -prices Tesla Cybletruck have shared the low -price low prices offered by the company on the trade that was previously. It seems another challenge for Tesla, whose share price increased during the past month despite sales and profitability.

Tesla quotes Tesla Cybletruck shows a huge decrease

The accelerated consumption of electronic nonsense is destroyed by both Tesla and its owners. For example, Business Insider Talk to two Cybertruck owners. One owner got a $ 63,100 price offer for AWD, which lasted for a distance of 19,623 miles, a 37 % decrease. The second owner has bought Cyberbeast from the best line for $ 127,000 in September 2024, and transferred its price from only 78,200 dollars. While electric vehicles (EVS) generally decrease faster than ICE, a decrease in value of 38 % in 8 months is incredibly high even through these standards.

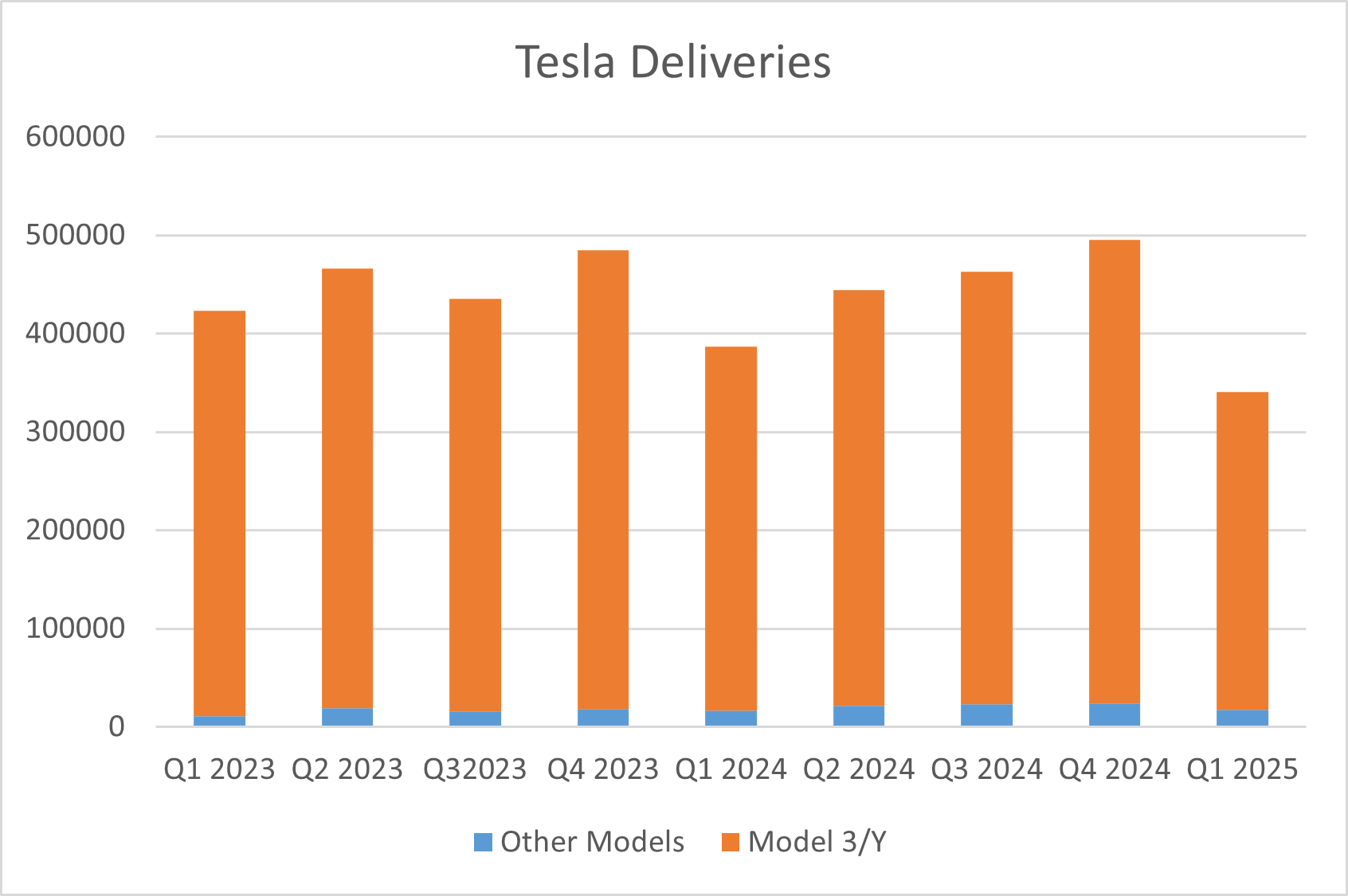

Higher consumption is the other opposite wind of Cybertruck, which has never started sales. Although the company does not break the Cybertruck sales in the quarterly delivery numbers, it is part of the “other models”. Along with Cyberrtruck, this X SUV and a model model include. Although the latter was one day the basic pillar of Tesla sales, they have long been overlooked through the 3 cheapest price and model Y. Model Y is now the best -selling Tesla model, and last year, the highest -selling model was in the world, not only Ice but also.

Source: Tesla

Last year, Tesla reported that only 85,133 was delivered for its “other vehicles”, a small part of the total delivery of 1.77 million. Cybertruck has a completely unique design, like most Tesla things, stable. Since the model is easy to determine, the anti -happy protests have become, and many electronic inflorescences were damaged by those who protest against the musk policy, especially because of its association with the Ministry of Governmental efficiency (DOGE) to which it is directed.

Musk admits a “reaction” because of its political activities

Musk political activities affect Tesla sales and MUSK admitted itself as a problem. During the q1 2025 profit call last month, the billionaire acknowledged that there was a “reaction to the time I spent in the government.”

Musk said: “The natural mediocrity from that is those who were receiving wasted dollars and the unfortunate dollar will try to attack me, the Dog team and anything related to me.”

However, he said he chose to do the “correct” thing and called the protests “to pay.” According to Musk, the demonstrators were either receiving fraudulent money or that they were moving in waste. “There is no evidence that supports these allegations. Bill Gates claimed His discounts will kill millions of people.

Tesla delivery last year

Perhaps not surprisingly, Tesla last year informed the first annual decrease ever in delivery operations. The delivery of the company increased even in 2020 and 2021, when the global auto industry was fighting the severe supply chain crisis.

Tesla sales continued in the first quarter of 2025, and its shipments decreased by 13 % to 336,381 units, which were the lowest in nearly three years. The company attributed the lukewarm sales to the long -awaited Y, but modern data indicates that although the opposite winds related to update in the back vision, Tesla sales are not completely prosperous, and are increasingly intense competition, especially in the world.

Last year, the Chinese giant EV Tesla exceeded revenue and sold more electric cars for the battery more than the American giant in the first quarter. BYD Tesla excelled in Europe last month despite entering the market about two years ago. To return to it, the maximum BYD market is less than 15 % of Tesla, despite its prosperous sales and strong general expectations. Moreover, Tesla also faces a tariff in the European Union, although it produces some vehicles on the continent that is not subject to it.

Musk’s embrace of extremist right -wing politicians has reduced its sales in Europe in particular, as sales have decreased by about half in April, and the continuation of the trend we have seen over the past few months. A A modern survey of 100,000 Germans It was even found that 94 % said they would not buy a Tesla car.

Return to spending 24/7 at work and sleeping in the conference rooms/server/factory.

I must focus superior to 𝕏/Xai and Tesla (as well as the launch of Starship next week), where we have important technologies.

It is also clear from the issues of readiness this week, the main operations …

Elon Musk (@elonmusk) May 24, 2025

Musk to focus more on Tesla

Despite many major problems facing Tesla and Musk, retail investors seem to have a pink vision of the stock. This is partly due to the MUSK’s last declaration during the call of the first quarter profits, saying that he is due to his political activities. “Therefore, I think I will continue to spend a day or two a week in government matters as long as the president wants to do so, and as long as that is useful,” Musk stressed during the profit call.

He has since repeated such opinions about more than one occasion, and in a recent tweet, he said: “Return to spending 24/7 at work and sleeping in the conference/servant/factory rooms.

While the basics of Tesla Motors have deteriorated during the past few months, and if not for organizational credits, it will have recorded a net loss in the first quarter, Musk’s comments on defining Tesla’s priorities helped because of his political activities stimulating a march.

However, some analysts doubt whether Musk spends more time in Tesla, it will be a lot of help given the serious opposite winds facing the company’s basic company’s business.

Tesla to launch the Robotaxi service in June

There is also optimism about the launch of the Robotaxi service in Austin, which Musk said on the right way to start before the end of June. The company will compete with Waymo supported by Alphabet, which already provides Robotaxi service in partnership with Uber.

Musk said that horseback riding will not have a safety driver, but it will be monitored by remotely by Tesla employees. However, reports indicate that everything is not fine with launch. In its message to Tesla earlier this month, the National Road Traffic Safety Administration (NHTSA) The company asked how vehicles perform in bad weather. The letter added: “The agency would like to collect additional information on the development of Tesla technologies for use in” Robotaxi “vehicles to understand how Tesla plans to evaluate its cars and automated operating technologies to drive on public roads.”

Robotaxi’s launch will be another test of independent driving capabilities in Tesla. Musk has promised to countless dates for complete self -power, and yet, none of them came.