SPX6900 cools after an equivalent rally, SPX dates back to $ 1.77?

- The price of the SPX has increased by more than 230 % from May to mid -June, as it reached its peak slightly less than its highest level at $ 1.77.

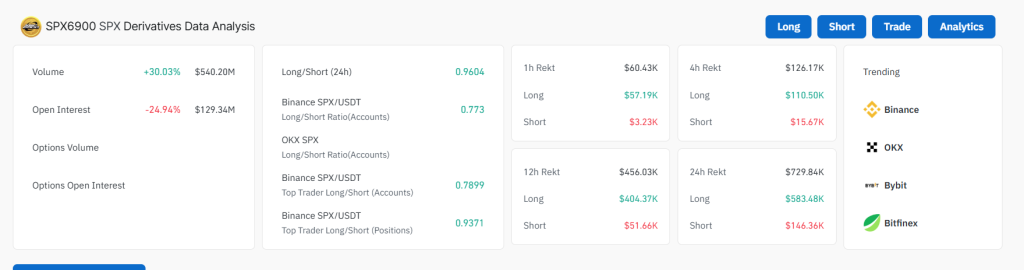

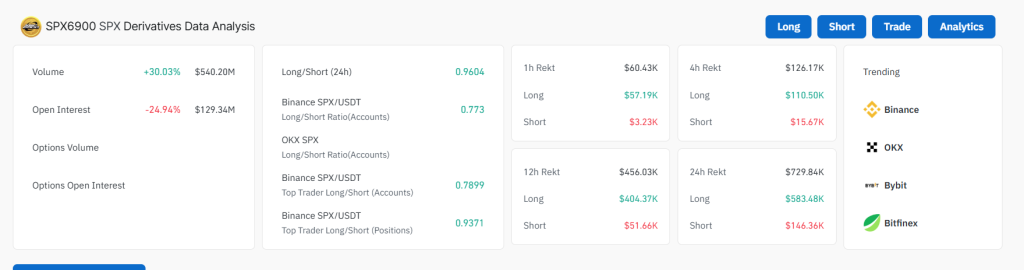

- The open interest increased to 171 million dollars before a sharp decrease of 25 %, indicating that the excessive length was wiped.

- External flows reached a spot of $ 6.4 million on June 14, indicating strategic exits

Technical Analysis SPX6900usd: Classic equivalent progress

The assembly was run by a golden cross on May 6, when EMA crossed for 50 days over EMA for 200 days-an upward signal in technical analysis.

After this intersection, the SPX accelerated through consecutive resistance areas, and began a multi -leg reward.

SPX PRICE followed a rewarding rally between May 7 and June 11, gathering from $ 0.50 to break its highest level ever at $ 1.77 in more than a month. This step was revealed in four accelerated legs, followed by a shallow decline.

This structure often refers to the top or a phase of exhaustion of the explosion, especially when the size and the feeling of the peak.

A temporary summit was formed on June 11, when the price of SPX began to fade less than $ 1.70. The correction is condensed on June 14, driven by heavy profits, and is now merged above the main support at $ 1.30.

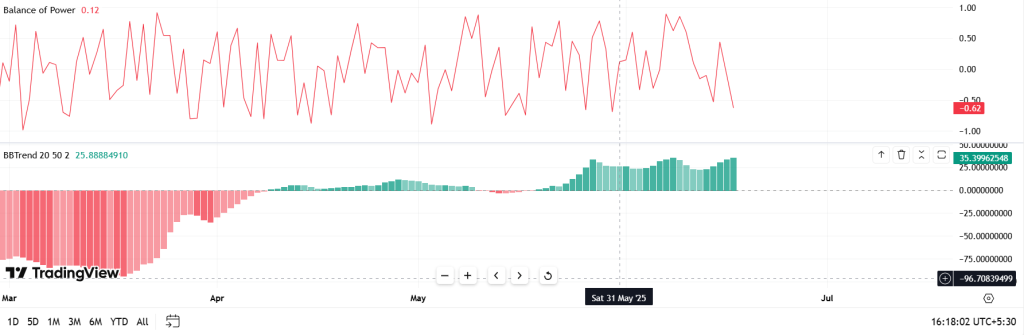

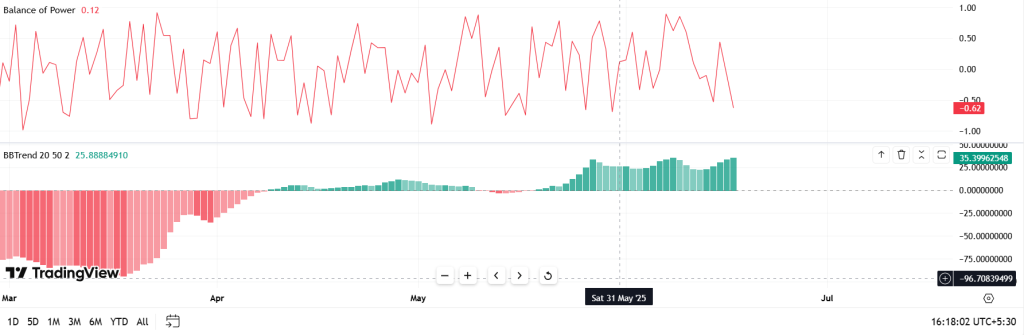

Indicators indicate cooling, not collapse

- Rsi It decreased from 75 to 40.19, cooling from the peak area.

- MACD Digoused crossover appears, confirming the delusional momentum.

- The balance of strength Smooth at 0.12, while BBTREND and BBP show the weakening of the upward energy.

The indicators are in line with the post -skipper reinstitation. The base is likely to form between $ 1.30 – $ 1.35.

Flash derivative warnings: The collapse of open attention, the feelings of feelings

The open interest to ATH reached $ 171.7 million on June 13, but it quickly decreased by 25 % with the price recovery. At the same time, the long/short proportions turned through the main stock exchanges:

- Binance L/s (accounts): 0.773

- 24h Global L/S: 0.9604

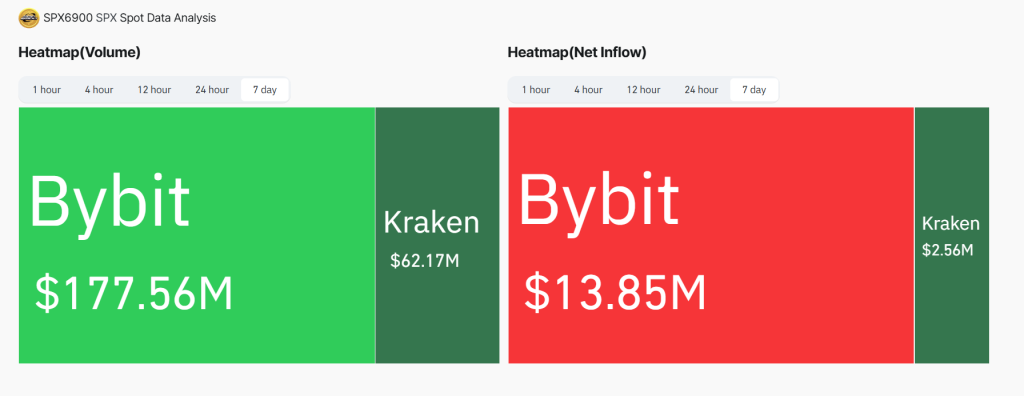

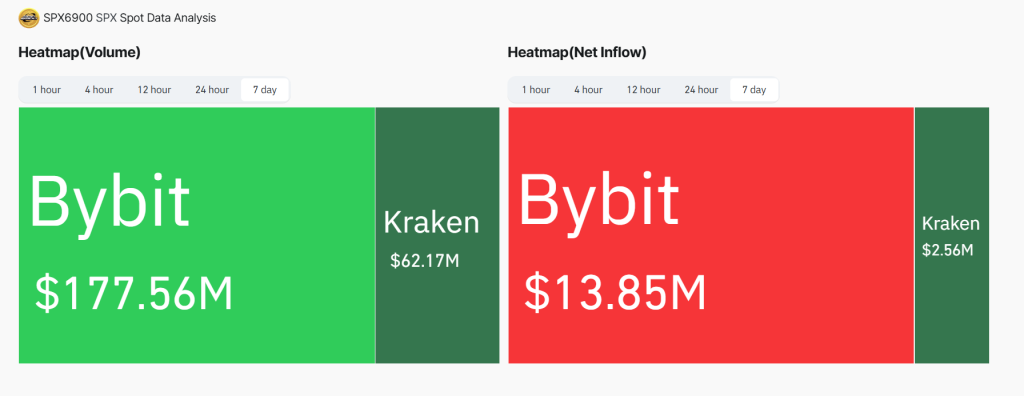

This shift indicates that merchants have begun to close long sites or open short pants as they lost the gathering momentum. Bybit, which led the trading volume of $ 177 million, has seen more than $ 13 million in net external flows.

The reflection of the immediate flow confirms the achievement of profits

The flows on the chain show more than $ 6.4 million in net external flows on June 14 alone, with an additional daily exits continuing until June 17. Coinbase has seen light flows (about 367 thousand dollars), but Kaken and OKX have recorded large net exits, confirming that this step was not accumulated on retail but strategic heritage.

Spx6900 prediction price: apostasy or collapse?

SPX was traded at $ 1.39. Support of $ 1.30 can witness the price test of $ 1.50 and may be targeted by $ 1.71 at late June. The penetration may pay about $ 2.00.

In the event of a failure of $ 1.30, the negative side targets include $ 1.18 and $ 1.05 (levels of retreat from FIB).

Currently, SPX shows stability marks. Merchants should monitor the measuring return near $ 1.50 and RSI to confirm the upcoming continuity.

SPX6900 Rally follows the technical structure, and its slowdown reflects the rotation of the health market. The collapse or collapse in the upcoming sessions will determine the leg of the next M.