More than $ 1 in open interest signals

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

XRP price Raed to $ 2.61 In the past 24 hours, it was able to maintain a fixed pace, and register a 22 % profit During the past seven days. Traders accumulate in futures contracts.

The prominent performance was in the open benefits section, which jumped by more than 40 %.

Related reading

High future activity

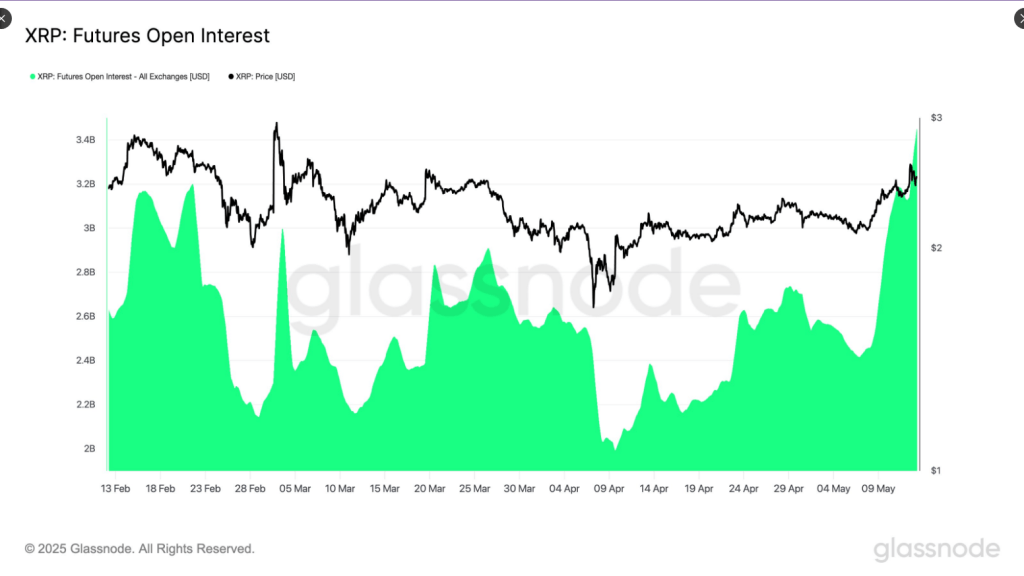

according to Glassnode data Posted on May 13, the future interest on XRP increased from $ 2.42 billion to $ 3.42 billion in only one week. This $ 1 billion increase represents an almost 42 % increase in active contracts.

When both the price and the open benefits, it usually means new money comes and merchants expect more upward trend.

$ Xrp The open future interest rate increased by more than $ 1 billion in the past week, increasing from $ 2.42 billion to $ 3.42 billion (+41.6 %). This sharp increase in the leverage coincides with the price increased from $ 2.14 to $ 2.48, indicating the increase in the increasingly directed speculation and conviction, pic.twitter.com/qbsaom9Oxe

– Glassnode (Glassnode) May 13, 2025

The price is for market gains

Based on reports, XRP profit for one week The broader cryptocurrency market, which increased by 12 % during the same period. A jump of approximately 20 % is not a small work when most major metal currencies rise in low double numbers.

XRP traders see as one of the most powerful performance artists at the present time, and they are betting accordingly.

Momentum indicators indicate

XRP is trading higher than its mobile averages 10‑, 50 and 200 days. This indicates short -term and long -term trends both for buyers. The relative strength index in 68, which is less than the peak area.

There is still space to continue gathering before reaching the ceiling. The average spacing of moving rapprochement also exceeded, indicating the continuation of the bullish momentum.

Institutional demand grows

Meanwhile, I painted ETF XXRP Flow For five consecutive weeks. Last week, it added $ 14 million of new money, an increase of $ 10 million in the previous week. The fund now has approximately $ 100 million in assets.

Even with an annual fee of 1.80 % – twice that still has some investment funds in Bitcoin – investors still see value in a product associated with XRP.

Difficulties and projections

Based on market platforms like polymarket, there 79 % opportunity The US Securities and Stock Exchange Committee will agree Xrp etfs almost.

According to JPMorgan analysts, these traded investment funds can attract $ 8 billion in the first year – more than he saw ETHEREUM money after its launch in September 2024. This type of demand can crawl higher XRP.

Related reading

Expectations and risks

The work collects, increasing open attention, and fixed ETF flows make a state of difficulty. Quick gains can fade easily if traders are locking profits; Average 50 -day decrease will be a warning signal. Organizational delays or wider encryption sale can also hinder the assembly.

Currently, XRP sits on top of its main average and sees fresh capital. However, anyone should participate in technical levels and monitor news about the resulting ETF approvals.

If these pieces fall in place, XRP can be set for another leg. But if the markets stop or stop the organizers, running may stop.

Distinctive image from Gemini Imagen, the tradingvief chart